Quite a turn of events.

Last month, YouTube told me about all these altcoins ready to boom in May and Twitter said the supercycle was about to begin.

Now YouTube says the market peaked in April and Twitter says we’re in a bear market.

Seems a little excessive to me.

I have never bought crypto during a bull market

According to expert analysts, crypto has spent 34 of the last 44 months in a bear market. we just finished a five-month bull market. Now it’s dead again.

How do I know this?

Because I entered the crypto market 44 months ago and I can count.

For almost my entire crypto journey, I have known only destruction and folly.

How did I persist through those many months of hardship, waiting endlessly for bitcoin’s price to get back to its all-time high until finally, in December 2020, it poked its head above $20,000 for only a brief, beautiful moment?

I didn’t. For most of that “bear market,” bitcoin’s price went up.

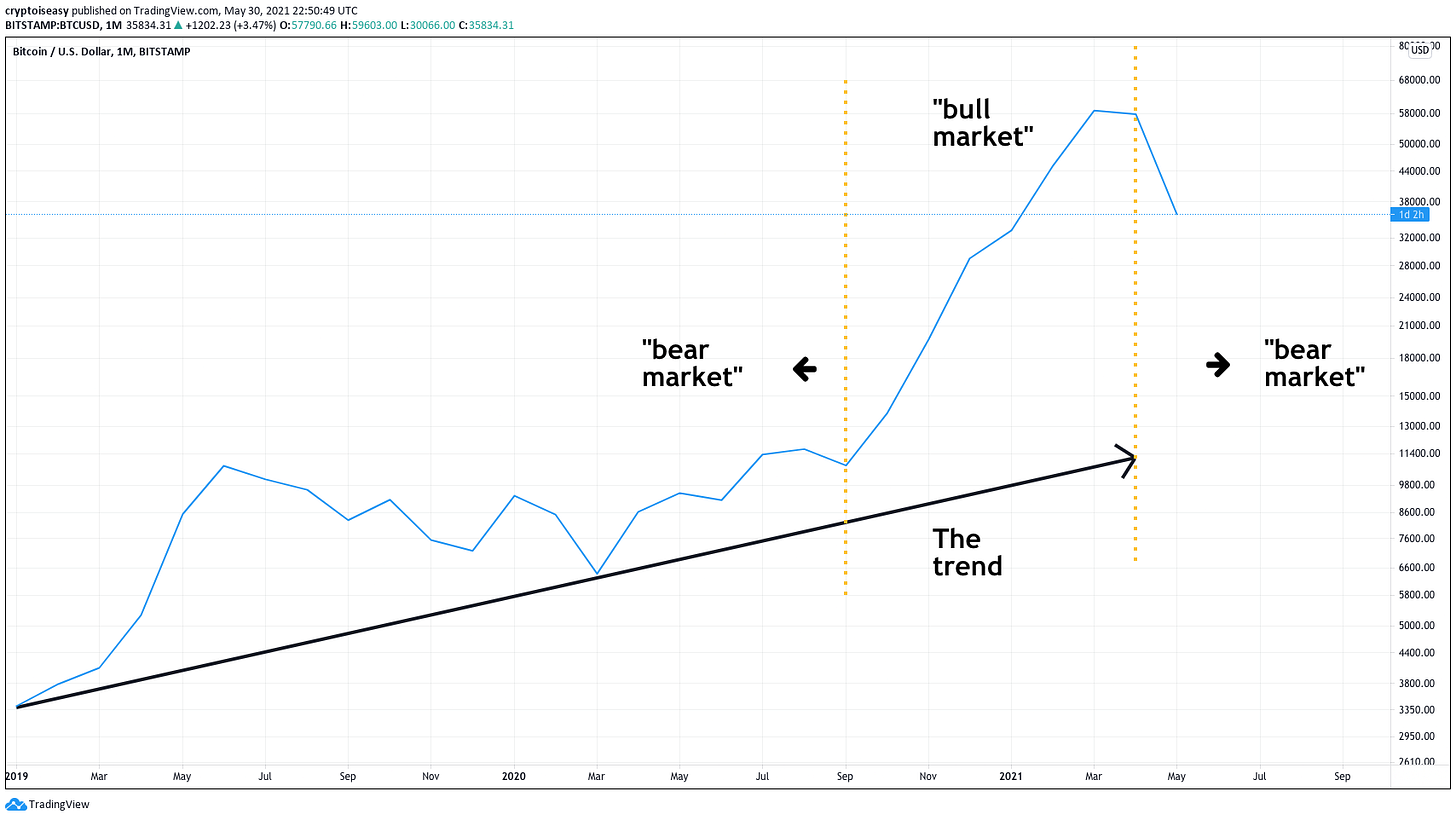

Look at what bitcoin’s price has done since the beginning of 2019. I use the expert’s definitions of “bull” and “bear” markets to denote the epochs.

Yes, I skipped 2018. That was actually a true bear market, the long downfall from a true market cycle peak in December 2017.

We also saw true bear markets in 2011 and from 2014-2015.

In 2019, bitcoin’s price started the year at about $3,100 and ended the year at about $7,160—more than double where it started.

Is that a bear market? To be honest, I don’t know, I can’t keep it straight. Are you using the 200 DMA? Or the 50/200 death cross? Something about the 21 EMA? Slope of the price line?

Consolidations are the norm

Bear markets come at the end of market cycles, not in the middle of them.

Sometimes, bitcoin just goes up really fast. Too fast. After zooming, it takes a long time to settle before taking off again.

In fact, we’ve seen that happen more often than bear markets. Look at these bull market consolidations after big moves up:

In January 2012, bitcoin’s price fell 50% and took six months to get back to its previous price.

In August 2012, bitcoin’s price fell 56% and took five months to get back to its previous price.

In April 2013, bitcoin’s price fell 83% and took seven months to get back to its previous price.

In November 2015, bitcoin’s price fell 41% and took seven months to get back to its previous price.

From June to August 2016, bitcoin’s price fell 41% and took six months to get back to its previous price.

In June to December 2019, bitcoin’s price fell 54% and took two years to get back to its previous price. (Don’t @ me with your “that’s a bear market” business, read above.)

In February to March 2020, bitcoin’s price fell 64% and took four months to get back to its previous price.

While the experts would call all of these examples of bear markets, when you look at a price chart, they don’t look like it:

Ok, admittedly that 2020 drop looks brutal, but that’s a legit black swan event, even the S&P 500 looks like shit from February to July 2020. If you take that out, these consolidations look totally normal.

I am a scam

This month, I bought bitcoin for the first time since September 2020.

Why didn’t I buy bitcoin from October 2020 to April 2021?

Because I follow my plan for bitcoin’s bull market, and the plan didn’t give me an opportunity to buy until just a few weeks ago.

Do you see the irony of that? The shame and deceit I’ve carried for over a year, since March 2020 when I created my plan for bitcoin’s bull market? How I’ve let down my readers and subscribers?

No?

Here it is:

I HAVE NEVER BOUGHT BITCOIN DURING A BULL MARKET!

My plan is false advertising. There is no bull market!

That is, if the experts are right.

It does seem odd to have a portfolio that’s 6x higher than my initial investment, seeing as I’ve never bought crypto during a bull market. Is this crypto thing supposed to work that way?

Opportunity abounds

All kidding aside, bitcoin’s price went up for six straight months. That’s insane. Even bull markets need to take a break now and then. A few months of consolidation can do wonders for the overall health of the market.

We’ve seen consolidations of up to seven months in 2012, 2013, 2015, 2016, and 2019. Each time, all of those consolidations happened within a larger uptrend, though experts call some of those consolidations “bear markets.”

Anybody who bought during those times came out way ahead—at least 67% and up to 460% gains during the bear market, plus all the gains that came after it.

Opportunity abounds, but it's hard to get that from chasing parabolas or "treating" yourself to some bitcoin at each all-time high.

If this is another one of those bear markets that ends with bitcoin’s price higher than where it started, I’m ok with that.

At least, I will be after I finish figuring out why these “bear markets” are such bad things in the first place.

Mark Helfman publishes the Crypto is Easy newsletter. He is also the author of three books and a top bitcoin writer on Medium and Hacker Noon. Learn more about him in his bio.

Buy low; sell high. We need to set up a Cryptowriter Capital Fund with you and @chriscooper making decisions for us.

You are spot on! There’s so much FUD designed to control retail investors and persuade them to sell cheap so whales can scoop up the dips. Listen to what the media are saying… Then do the opposite.

As someone who started buying Bitcoin at sub $4,000 in 2019, it’s win-win all the way for me. Am I sad that I didn’t sell all my Bitcoin at $60,000…??

No. Zoom out to the macro level and HODL.💎