Back in June 2020 I wrote an article looking at the latest research (at the time) at how fast Bitcoin adoption was happening.

The article gained tens of thousands of views and is still regularly picked up a full 12 months later, presumably because the title fits nicely into a very commonly phrased question that many put to Google.

I should point out this this was entirely by accident rather than by design, but, in my defense, it was also one that I had typed myself at that time in an attempt to find a straightforward answer to what, surely, is a simple question.

Of course, it isn’t that straightforward, as my own research confirmed.

There are complexities over on and off chain transactions, the fact that users can have multiple wallets and addresses and the very definition of “user” in the first place.

For example, does someone who once owned bitcoin but doesn’t any more count as a “user” if they are no longer active but still have a wallet address? What about if they bought some in 2015 and lost the private key? What if all their bitcoin is used or stored on “half-way house” systems like Paypal? All good questions — and there are many more — with no firmly agreed answers.

So, my attempt at the time was to make some sense of this and compare various sources to see if we could get anywhere close to a useful number. My conclusions (for Bitcoin), based on the reports at the time and looking at some on-chain data, were as follows:

In all of 2018, 10,377,248 new wallets were created, at the rate of 28,509 per day on average, or just over 20 per minute.

In 2019, that figure rose to 12,804,514, providing an increased rate of 35,177 a day or 24 per minute, roughly 23% faster than 2018.

As always, because of the limitations listed above, we can’t take these numbers as anything more than indicative, but it would be interesting to know where we are now and on a comparative basis if possible.

Of course, this task remains difficult. It’s why companies, analysts and research groups spend large sums of money trying to work it out. However, by looking at a mix of the latest reports, analytical opinion and on-chain data, we should be able to come up with some sort of decent idea.

So let’s give it a go.

Report Absolutes?

There are two key reports that are worth referring to here. The first was the Third Global Benchmarking study by Cambridge University in September 2020 which concluded there were around 101 million cryptocurrency users (in total) by May 2020 when the data was collected.

The second was the “Measuring Global Crypto Users” report by Crypto.com which concluded that there were 221 million crypto users by June 2021.

Assuming these numbers are anywhere close to correct, we can assume that 120 million people — or roughly 1.5% of the global population — started using Bitcoin (and other cryptocurrencies) between those dates.

It is roughly 395 days between those benchmarks, so we can calculate that around 303,797 people joined the cryptocurrency space each and every day. That’s 112,658 an hour or 211 each and every minute.

It also means that around 2.81% of the world’s population is now using it to some degree. For someone who has been in the industry for some years now, and has been used to talking about 0.18% to 0.23% back then, these numbers seem enormous.

Interestingly, Crypto.com’s report appears to create a discrepancy between Cambridge's numbers of 101 million users in May 2020, concluding that only 106 million users existed in January 2021. That means, in eight months, only 5 million users entered the crypto space, or only 20,548 people a day. This seems far too low, especially since Bitcoin made major moves in the latter half of 2020 that attracted a lot of attention.

Yet, by June 2021, total number of users had more than doubled in just five months, representing the fastest expansion of the space since, well, ever. Anecdotally, this is supported by the issues that exchanges visibly faced— almost all were overwhelmed by outage and support issues as new users flooded in during the early part of 2021.

Reports use different methodology of course, but the one take away that we can really be sure of is that the rate of growth in general cryptocurrency usage terms increased dramatically in 2021.

What about Bitcoin?

There have been many numbers offered up as the current number of Bitcoin users, but they all face the same limitations. All sources, however, seem to be in roughly the same ball park.

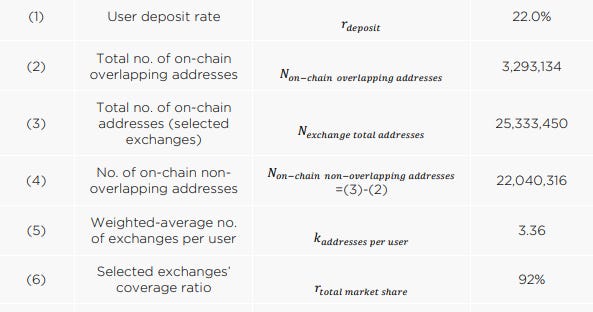

Crypto.com’s report explains the methodology it uses to calculate Bitcoin owners in some detail and applying solid logic behind each number, ultimately ending up with the following formula:

Of course, we need to know the breakdown of each attribute, so here it is:

Even better, Crypto.com’s report attempts to calculate user numbers by month for the first half of 2021 based on that formula, and the results are interesting.

The bottom line is that the “Bitcoin Population” increased from 71,000,000 to 114,000,000 in that 181 day period. Applying the same approach as we did before, we can conclude that the updated figures come out as follows:

In the first six months of 2021, the Bitcoin population has risen by approximately 43,000,000, giving a daily average increase of 237,569 or just under 165 a minute.

This is a 587% increase on 2019’s rate and a 725% increase on 2018’s rate. In other words, not only has the total number of users grown significantly, the rate of increase has also accelerated noticeably.

And that is important.

The Network Effect

Bitcoin is almost certainly now experiencing the “network effect”, an economic theory that states a good or service becomes more valuable when more people use it.

To put it another way, the more people use it, the more other people want to use it. Think Facebook, the internet, telephone or any other service that derives its value from mass adoption.

If you’re the only one using any of these then there is no value at all — the more people you add, the more you can do with it, increasing its appeal and the cycle continues on an ever increasing basis. With Bitcoin, wider acceptance means wider appeal and, in theory, a higher value placed on using it.

Network effects are extraordinarily difficult to reverse and, in the case of Bitcoin, the options for doing so are very limited at this point. It would either have to be a sudden adoption of sound monetary policy by global governments removing Bitcoin’s need to exist, or some sort of self inflicted wound in the Bitcoin protocol, such as an error being introduced through an upgrade.

Both are probably about as likely as each other, that is, not technically impossible, but very unlikely.

What’s next?

Of course, this means we have some fun with the numbers and look at what might be coming next.

For example, if we assume that the current adoption rate stays the same, we can say with a reasonable level of confidence that another 430,000,000 people will start using Bitcoin in the next five years, bring the total to well over half a billion by 2026. That’s still only around 6-7% of the planet, allowing for population growth at the current rate.

If the adoption rate actually continues along the same trajectory as it is at the moment, then the math gets much more complicated, but we could reasonably expect to see that number reach a billion in the same time period, perhaps as high as 12% of the population.

To put it into context, although it has taken some 30 years for the internet itself to reach 4.66 billion users (that’s just under 60% of the planet according to the latest data from Statista.com), Bitcoin’s current growth rate is actually higher than the internet’s was at a comparable stage in its lifecycle.

This was superbly summarized by the respected analyst WillyWoo earlier this year in this (now famous) tweet, published even before the recent acceleration in cryptocurrency use.

The bottom line

As an analyst I am always aware of the limitations on certain numbers, especially when having to make assumptions or calculated guesses on some of the inputs. It is entirely possible there is a margin of error on the total number of users but, at the same time, qualitative data, on-chain analytics and even anecdotal input seem to strongly support the case.

For me at least, they are viable.

However, even if we ignore the absolutes, we can be reasonably certain that the Bitcoin’s adoption rate is increasing. And it is increasing fast.

To demonstrate the point, think about this: the article you’re looking at is probably around a five minute read. That means that in the time it took you to go through it, around 825 people have joined the Bitcoin network globally.

That figure would have been only 120 less than two years ago. How many will we be looking at in 2023? 2025? or 2030?

No-one knows for sure, but at this point the only thing we can say for certain is that another of these articles is all but inevitable in the future.

And, for the record, I don’t mind having to do that at all.

Looking to start your own Bitcoin journey? How about a £10’s worth of Bitcoin to get you started!? If you are over 18, live in the UK and are new to Luno, download and set up the app now and use code BPJDEANE to instantly credit £10 in Bitcoin to your account.

Want articles and to minute analysis and opinion in your inbox? Why not subscribe to the ‘Bitcoin and Global Finance’ newsletter? Receive special offers and insider info. Unsubscribe at any time.

Disclosure:

The author of this opinion piece has been heavily involved with bitcoin for several years and holds a substantial cryptocurrency portfolio, including bitcoin. He also has a mining operation running the SHA-256 algorithm based in Siberia and is a published author on the subject of promoting the understanding of cryptocurrency. Jason is an analyst at Quantum Economics and consultant to Luno.

Disclaimer:

This content is for educational purposes only. It does not constitute trading advice. Past performance does not indicate future results. Do not invest more than you can afford to lose. The author of this article may hold assets mentioned in the piece.

If you found this content engaging, and have an interest in commissioning content of your own, check out Quantum Economics’ Analysis on Demand service.

Bitcoin usage and popularity is always on the rise. We are growing even more with the development of newly educated people and new investors entering the market.

But we are still at the beginning and we have a lot to learn.

After getting over these, we can now see the use of bitcoin in every field.

While those days are not near, they are not far away.

People in the Z generation should be trained and informed about this technology. It is difficult to change the mentality of older people, but young people are always open to new ideas and trends.

Thanks for the topics, data and analysis you mentioned in the article. Good day

Bitcoin still has not reached its potential. People know what BTC is, but they have doubts about investing. It is normal for the number of users to increase day by day.

What we really need to talk about is the positive and negative aspects of this situation.

As you all know, someone should lose in the stock market, and someone else win. New users often make mistakes because they are inexperienced and lose, on the other hand, the volume of btc increases, in this case it affects alt coins.

The bad side is that the number of fraudsters is increasing day by day and the name of btc is tarnished.

If you ask me, the increase in the number of users is good because the number of people participating in a btc revolutionary event and revolution is increasing.