Yield Farming NFTs - The Next Big Thing

Written by Parag Bhattacharya

“Just out of reach, behind a digital curtain, exists a galaxy of activity. A new economic frontier that may be the answer to the generational wealth gap.” – Virtual Economy

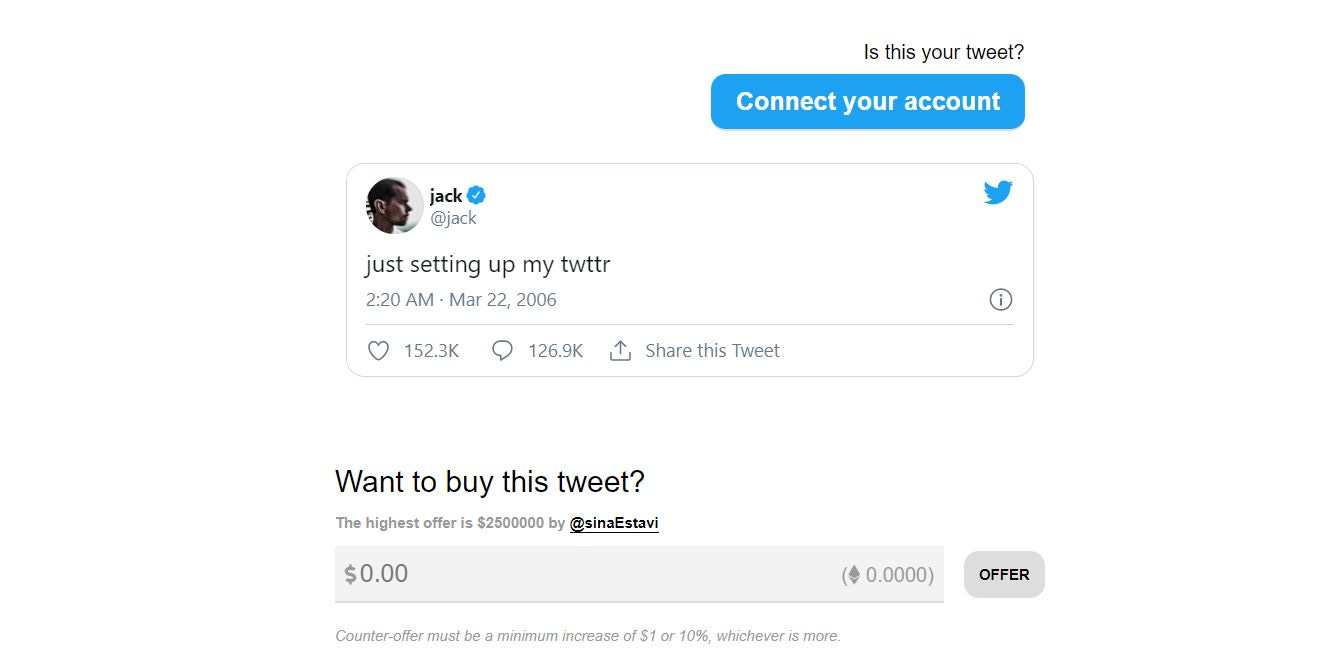

Twitter CEO Jack Dorsey offered to sell his first tweet as NFT or Non-Fungible Token on a platform called ‘Valuables’ some days back. On 22nd March 2006, Jack posted his first tweet on Twitter saying “just setting up my twttr” and the tweet’s historical value is undeniable. ‘Valuables’ is a platform that offers the trading of tweets autographed by their original creators as NFTs and it is gaining traction for its innovative offering very quickly. Jack’s sell offer is getting astronomical bids on the platform and Sina Estavi, CEO of Bridge Oracle, has offered $2.5 million till now as the highest bid. Jack’s tweet is not sold yet. Will it sell for billions?

Jack’s tweet on sale - fromValuables

NFTs are different from normal tokens. The word ‘fungibility’ is a keyword! Bitcoin or Ethereum is fungible i.e., 1 unit is always interchangeable with another but NFTs are unique tokens that exist on a blockchain. You can create NFT from a piece of art. An in-game asset can be NFT too. CryptoPunks, launched in June 2017, paved the way for digital art on the blockchain. These punks were the primitive NFTs created on the Ethereum blockchain. Since then, we have seen a lot of experimental NFTs. CryptoKitties, an Ethereum based game, rocked the gaming market by allowing the players to collect digital cats and breed them to generate new generation cats with different properties. NFT is a form of the digital certificate of ownership if we try to explain in a simplified manner. Digital art can be copied and distributed very easily but NFT creates a verifiable ownership mechanism and produces scarcity. The NFT market is really growing at an exponential rate. Numerous NFT trading platforms are doing rocking business. The boom of NFTs is also attracting the mainstream music industry nowadays. The artists are definitely enjoying a better economic opportunity as they can reach the customers without any middleman.

The craze for rare NFTs is visible. Some people collect them for passion and some people collect them for selling at a high price in the near future. Is it possible to earn ROI from NFTs without selling them? The advancement of DeFi or decentralized finance has shown that people desire liquidity from their idle assets. Can they expect the same from NFTs?

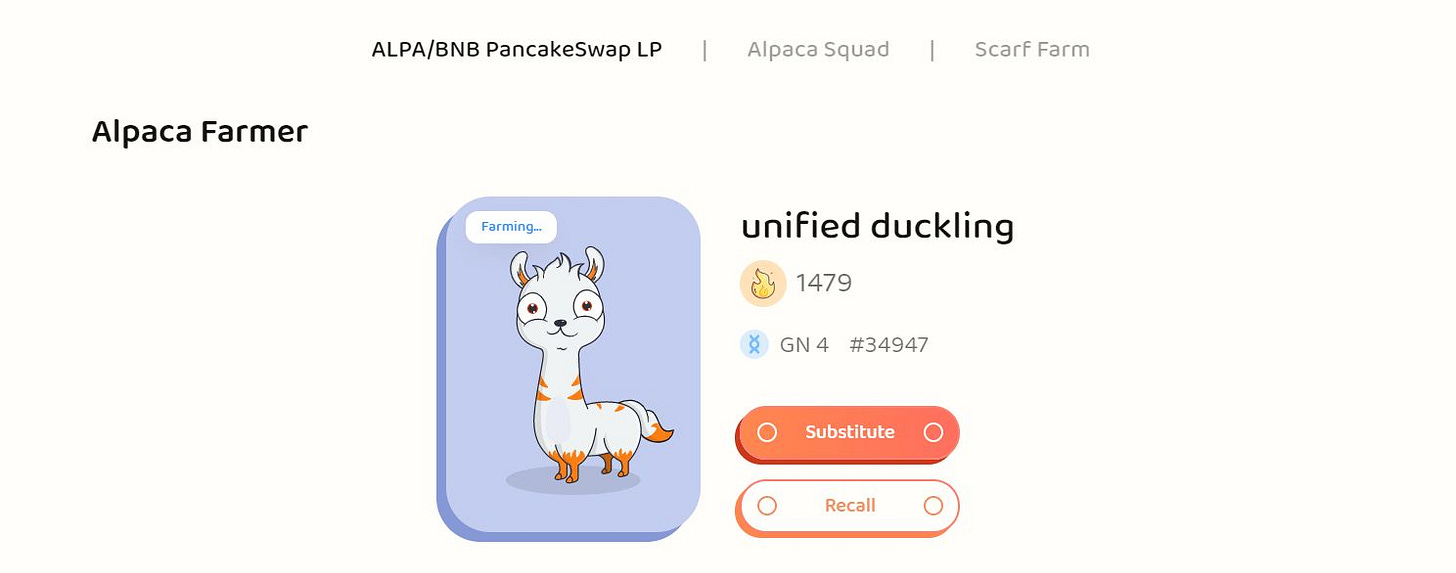

Alpaca City – Yield farming NFTs on Binance Smart Chain

Several projects are already offering ROI opportunities if you hold NFTs. NFTX, a community-owned protocol for NFT index funds on Ethereum, provides ERC20 tokens which are backed by NFTs. NFTX helps you to create fungible tokens from your CryptoPunks or CryptoKitties using a DEX with a single click. If you deposit a Punk, you get an ERC20 Punk. You can always redeem the ERC20 Punk for a random same category Punk. The ERC20 tokens are tradeable on Balancer pool PUNK- CORE. If you provide liquidity to the pool, you earn fees. So, NFTX enables you to get instant liquidity from your NFTs without selling. Charged Particles is a project which turns your NFT into a basket holding any token. You can fuse an interest-bearing token like ‘aDai’ with your scarce NFT; configure principal and program interest. The platform is absolutely NFT agnostic, so you decide what will be your charged particle. If you want, you can also combine more than one NFTs and create a new NFT collection set on the platform. Alpaca City has gained immense popularity recently due to its yield farming NFTs. The platform works with both Ethereum and Binance Smart Chain. Yes, you can use the NFTs as farmers there to do yield farming. Every NFT has a different farming capability and thus produces a different yield.

Yield multiplier ‘Leptons’ from Charged Particles

Many new DeFi protocols are coming with a focus on NFT. The creativity possibility is really unbounded. NFTs are crypto-assets and so they are strikingly different from traditional assets. The decentralized anonymous trading is only the beginning. We can soon see a high-level lending-borrowing activity involving NFTs. The scope of fractionation and amalgamation through different means opens up a plethora of opportunities and the implementation of game theory can provide an innovative and magnetic asset mobilization concept. Imagine earning ROI from your drawing room wall hanging portrait while displaying it to the visitors. The game is on!

This post is published for Cryptowriter in association with Voice.

Very interesting article, most importantly your comment about earning ROI for displaying your art to visitors. What I imagine when you said that is my virtual room in a virtual house in a VR game. Someone paying an entrance fee to see my collection of art which is in fact an NFTs. I have recently seen people buying land, houses and such in VR but never thought of art fairs and such. I can see either a collection of collectors doing something together or a single big collector of NFTs. Very interesting to imagine the possibilities!

Loving the platform and the direction this project is heading! I can't wait to see how close we (Finney supporters) get to the moon! If you haven't already got yourself a HARD COPY of the Cryptowriter Volume 1, you're missing out! 🔥🚀🌕 Thank you to Sean, Kenny and everybody @ Cryptowriter! 😁