A Familiar Story: How New Crypto Regulation Reminds of Turbulent Air Transportation

Elon Musk, Coinbase CEO Brian Armstrong, and Congressmen Tom Emmer, Darren Soto, David Schweikert, and Bill Foster all disapprove...

I maintain that travel and aviation are as much a driving force behind blockchain as anything else. Conventional ledger systems are simply incapable of navigating the many nuances of modern trade logistics and cross-national regulations. Additionally, the Internet’s profound advancement of education and the widespread sharing of independent thought screams for a more decentralized economy.

At the Heart of Crypto

Maybe it’s the fear of unknown outcomes caused by an overwhelming amount of new ideas. Trust in humanity to stand against terror and the ills that historically plague society is by no means trivial. Still, innovation, especially widespread across small business ventures, demonstrates a knack for solving challenging problems. This is at the heart of crypto.

Overview of the Infrastructure Bill’s Crypto Section (80603)

With the above in mind, consider the U.S. Senate’s recent approval of an infrastructure bill. Draw your attention to how a single vote determines the fate of both road investment as well as a heavy taxation of finance conducive for aviation, i.e. crypto.

If you’re unfamiliar with the history of aviation, the Next Generation Air Transportation System, and the struggle to keep General Aviation alive, know that the United States is all but alone in encouraging civilian pilots and small aircraft.

My first thought on SEC. 80603. INFORMATION REPORTING FOR BROKERS AND DIGITAL ASSETS was:

If that's how it reads then…

Imagine if your boss found you misappropriating funds or operating with such inefficient financial constructs that it became virtually impossible to keep pace with innovation.

Tech billionaires exert a strong global influence. They alone can keep US lawmakers on their toes and away from straying down a path toward another Dark Age.

Insight from Crypo Influencers: Elon Musk and Brian Armstrong

In Senate Debates Crypto Provision That Opponents Say Would Harm Industry in US, the Morning Brew’s Neal Freyman quotes Coinbase CEO Brian Armstrong as saying:

[the provision] makes no sense

Armstrong goes on to discuss how the US would chase away innovation. Elon Musk offered further insight essentially asking why the:

hasty legislation

While there’s certainly not a wide consensus among Senators, the importance of the matter seems to have yet fully permeated this continuous body.

Key Points

The primary purpose of the proposed regulation is to redefine the term “broker”. If you have yet to read 80603, hopefully my briefing of key points will help get up to speed:

SEC. 80603. INFORMATION REPORTING FOR BROKERS AND DIGITAL ASSETS

CLARIFICATION OF DEFINITION OF BROKER— on behalf of another person, any service ‘effectuating’ regular digital asset transfers

DEFINITION OF DIGITAL ASSET— as determined by the Secretary, ‘digital asset’ to mean “any digital representation of value”

RETURN REQUIREMENT FOR CERTAIN TRANS-FERS OF DIGITAL ASSETS NOT OTHERWISE SUBJECT TO REPORTING— returns pertaining to unsold transfers and accounts of unknown parties

REPORTING PENALTIES— pertaining to returns of digital assets

TREATMENT AS CASH FOR PURPOSES OF SECTION 6050I—inserting “any digital asset” to prior text

EFFECTIVE DATE—December 31, 2023.

RULE OF CONSTRUCTION— regarding to interference of this section upon actual implementation

You can read the drafted text released by the Senate (via National Law Review) as a Google Doc here or at epw.senate.gov. The National Law Review shared the following perspective:

... if enacted in its current form, would amend the Internal Revenue Code (Code) to extend certain reporting requirements for ... digital assets,... is intended to address a “tax gap” resulting from the underreporting of cryptocurrency transactions.

Beyond the Infrastructure Bill

Stating Bluntly

At this stage, we must expect more from lawmakers than trying to hit the broadside of a barn, especially due to “hasty” legislation. Let the voices of those knowledgeable about crypto and blockchain be heard the loudest. Furthermore, if local use cases across the globe are not enough to earn respect, then regulators must explain why their actions would inhibit progress in line with:

Venezuela

El Salvador

Wyoming

Malta

People who call these regions home are organized and taking a strong stance towards modernizing financial instruments.

Business Sentiment

A growing number of investors are as well. Investopedia recognizes the value of pairing crypto with innovation. The battle will continue!

Bringing the Fight to the House. No wonder why Rakesh Sharma chose the subheader “Crypto advocates are suiting up for a battle in the House of Representatives” in Senate Fails to Pass Amendment to Crypto Tax Provision. Financial professionals in the know understand the need for clearer regulations. Section 80603 as it stands now only serves to cloud, and hence cause hesitation, among innovators.

CONCLUDING REMARKS

Outside of those intimately tied to traditional financial systems there are few agressive efforts to curtail the spread of crypto. Informed investors overwhelmingly support various aspects of blockchain technology, including NFTs. The public’s conscience needs to be awakened to these matters. Information must be made available for individuals to more easily investigate for themselves. Individuals must decide if they wish to pass on the advantages that crypto has to offer.

Blockchain will live on. That’s as sure as the human need for real money. The world is at the precipice of change. Any number of respected sources will reiterate this. Here are a few more:

Fortune: Dante Disparte on covering Sen. Cynthia Lummis (R-Wy.)... Sen. Pat Toomey (R-Pa.) speaking about the cryptocurrency amendment:

‘Harnessing blockchain and the crypto industry should be a cornerstone of U.S. economic competitiveness and industrial policy,’ writes Dante Disparte.

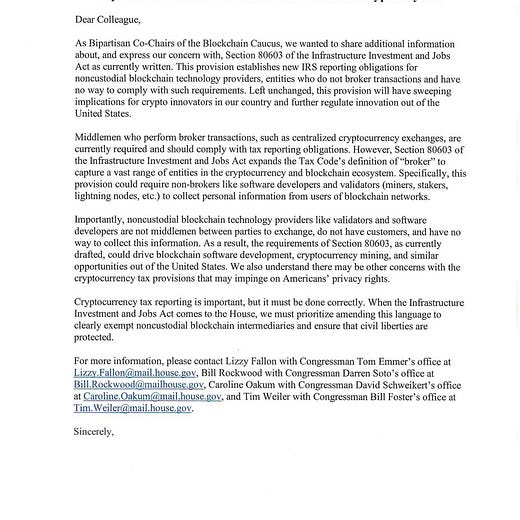

Minnesota Congressman Tom Emmer, Rep. Darren Soto, Rep. David Schweikert, and Rep. Bill Foster sent the following letter to:

every single Representative in the House

in their quest to raise concerns about the crypto industry paying for the Senate infrastructure bill:

Funny, the Congressman’s words sound awfully familiar to a recurring complaint launched by General Aviation towards the Airline Industry.

This is the thing what they have been trying to do since popularity of crypto has emerged and reached users all around the world. Amount of the users in USA cannot be ignored, and this law-making undermines one of the remarkable feature of crypto currencies which promises economical freedom for people. Overall, if this law gets approved it will not only have impact on US citizens but other users from the world.

Lawmakers are obligated to do what is best for the individuals and moreover society. Is this law-making beneficial for the people and whatsoever institutions which are operating in crypto space? They are making those in the purpose of whatever is promotional for their fiat oriented intentions.

I agree with you. Blockchain is a great technology, especially in places where records are stored. There's a lot of good about it. Everything is being recorded. No fear of losing. But people still don't get used to it. Because of this, we have a long way to go.

Thank you for the article.

Have a nice day.