Afraid of a Big Financial Crash? Bill Miller Says Bitcoin Is Your Insurance Against Such a Catastrophe.

Bitcoin represents between 50% and 60% of Bill Miller's portfolio now.

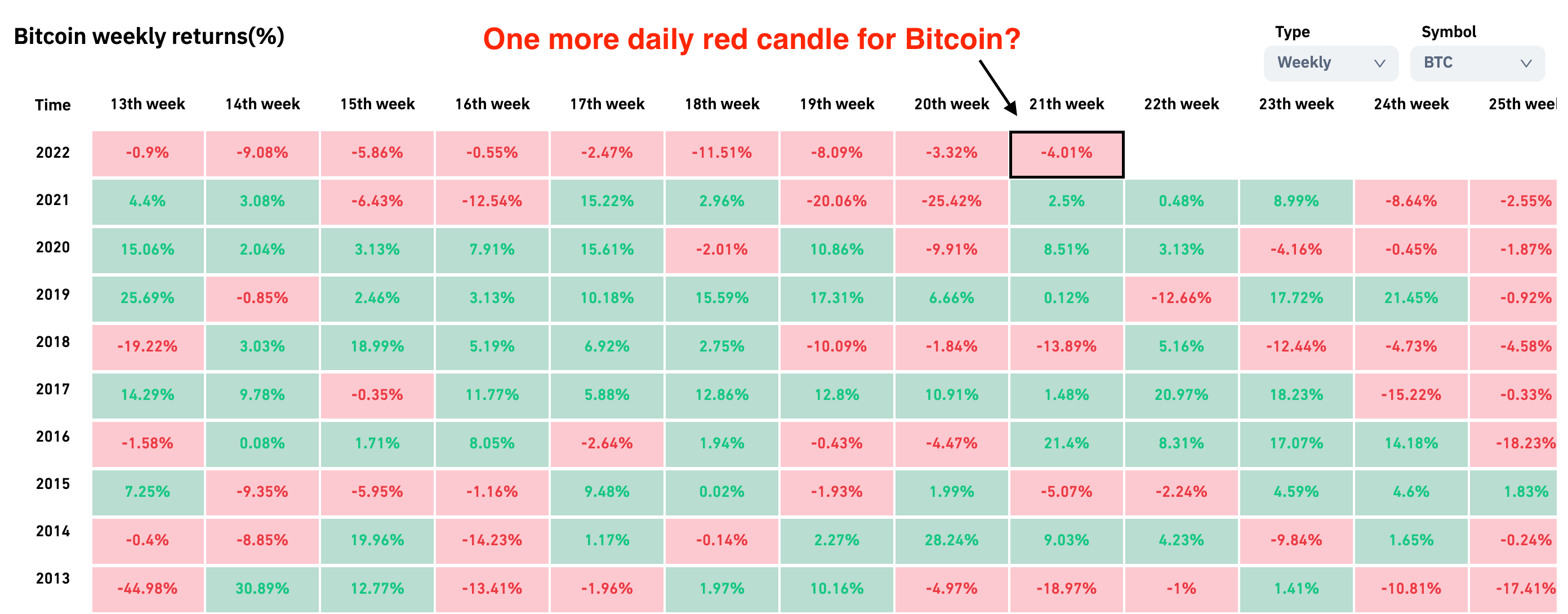

The weeks are going on and on for the Bitcoin market. Bitcoin will now record its 9th weekly red candle. Last week we were already talking about an extremely rare situation for the 8th weekly red candle. How would you describe this 9th weekly red candle?

I leave it to you to propose your ideas in the comments.

Anyway, we can see that extreme fear is dominating the market now. This fear is linked to the uncertainty of the situation for the months to come. More inflation? Recession? Stagflation? Both? No one knows what lies ahead, which complicates the work of central bankers and therefore the vision of investors in the financial markets:

Thus, the fear that prevails in the Bitcoin market is also noticeable in all financial markets. Even gold is not taking off, which is surprising to many given the current uncertainty. It has to be said that gold is starting to tire. Why? Many are simply fed up with its manipulated market. Of course, gold remains an established reserve value for centuries, but individuals want something more relevant to their times.

That's where Bitcoin comes in. Digital gold on steroids, because it allows for so much more.

Bitcoin's current price does not change its fundamentals

So of course, all of this is not materializing on the price of Bitcoin which is around $29K as I write this. Retail investors are absent from all liquid markets and prefer to wait wisely. This can be seen in the very low trading volumes.

Yet, despite the fear that Terra's collapse has added to the market, the opportunity with Bitcoin is now. While a major financial crash could occur, Bitcoin will be your lifeline.

It's hard for some to see that in a market dominated by fear, and where Bitcoin's opponents are having a field day. Christine Lagarde has just assured once again that Bitcoin and cryptocurrencies have no intrinsic value. Perhaps she feels obliged to repeat this constantly to convince herself ...

Bill Gates, the founder of Microsoft who considered the Internet to be “a passing fad” in the late 90s, also assures you that Bitcoin has no value. And therefore no future. Just hearing him talk about Bitcoin like that makes me even more bullish than before, I must say.

Between these naysayers who are taking advantage of the current uncertainty, some investors are taking the high road. When they're billion-dollar investors, that's something that speaks to you more than when I tell you that the opportunity with Bitcoin is now.

Bill Miller strengthens his position in BTC, as he sees Bitcoin as insurance against financial catastrophe

This is especially true of Bill Miller, a famous investor, and fund manager. The man built his fortune by founding the investment firm Miller Value Partners. I already told you about him at the beginning of 2022 when I said that the secret for this year would be to focus on the number of BTC you HODL, not the price of Bitcoin at the moment T:

Well, Bill Miller has more confidence than ever in Bitcoin, which he sees as the best possible hedge against the potential big financial crash ahead. What makes him so confident in Bitcoin is that it cannot be controlled by the powerful in the current system:

“When the U.S. pulled out of Afghanistan, Western Union stopped sending remittances there or taking them from Afghanistan, but if you had Bitcoin, you were fine. Your Bitcoin is there. You can send it to anyone in the world if you have a phone.”

What is happening with the war in Ukraine also confirms this. Bitcoin is helping all those who cannot rely on the current monetary and financial system daily. There are more and more of them.

For Bill Miller, “Bitcoin is an insurance policy”, because “Bitcoin works without the intervention of central banks or governments”. The investor took the opportunity to make fun of Mike Novogratz, who had the logo of Luna, the cryptocurrency that recently crashed, tattooed on his arm: “maybe you should have had a Bitcoin on your arm, it would be a bit more durable than this one”.

Indeed, as far as durability is concerned, it's better to have the Bitcoin logo tattooed on your arm than a Sh*tcoin. Anyway, everyone does what they want with their body. It'll be a souvenir for Mike Novogratz.

Putting his money where his mouth is, Bill Miller invested half of his funds in Bitcoin:

“This time I went back to buying it at $30,000, when it had dropped from $69,000. The idea was this: there are a lot more people using it, there's a lot of money coming in from the venture capital world. Bitcoin can provide insurance against financial catastrophe that no other asset can. And its value can increase ten or fifty times.”

Final Thoughts

Bill Miller is not the only billionaire investor who fundamentally believes in Bitcoin. There are more and more of them, and I already told you about them at the very beginning of 2022 here:

What I want you to understand here is that this is not the time to panic. Uncertainty obstructs the vision of most market participants, but you have to make the effort to look past it. If you do, then you will understand why Bill Miller is so Bullish on Bitcoin.

You will do the same as I and all other Bitcoiners: you will be patient in continuing to learn about Bitcoin during this moment of consolidation with the price of Bitcoin seemingly stuck below $30K. This is reminiscent of what we experienced in the summer of 2020 when the price of Bitcoin seemed to be stuck between $9k and $10K. The rest is history.

So be patient.

Twitter

In Bitcoin We Trust

Comment & Earn!

Share your thoughts and opinions on the topics covered within this blog in the comments below for your chance to win yourself an NFT. Click here for more information on our engagement rewards.

Bitcoin will always remain an opportunity and an advantage. Thanks for the article.