Written by Jason Deane

How the African continent is poised take the lead in the use of next generation currency - and why it may not get there.

We’re totally spoiled in the West and we don’t even realize it half the time.

Not only do we take basics like food, water, housing, education and even electricity for granted, we also think of our banking facilities, as imperfect as they often are, as something that’s just always there when we need it.

Want to order a pizza for delivery? No problem. In fact, you can use your saved credit card details to do it more quickly. Pay a bill on line? Send money over to your mates for that weekend away? All easy and all, incidentally, only available in the last couple of decades, even though it’s already completely entrenched in our modern lives.

In Africa, however, things are different. Only around 43% of the sub-Saharan population have access to any sort of electricity (source: Brookings), and only 34% have access to banking facilities (source: The World Bank).

In short, most people have neither. The figures are not much better for internet access, with only 39.3% having it, and seven of Africa’s countries have access numbers of less than 10%. (source: internetworldstats.com)

Yet, even with these two apparent extremes juxtaposed against each other, there are many economic analysts and commentators, including myself, who see Africa as the “next big thing” in finance. How, then, can this be the case?

Africa — Land of Danger and Beauty

Africa, as a continent, is very much a caricature of human nature as a whole. It contains both the very best and the very worst of us, indifferently split across race and class, in a way that doesn’t quite exist anywhere else.

Wealth, abject poverty and everything in between are found within its borders, while beauty coexists with corruption, death and a constant war for resources.

And those resources are abundant. Aside from having a substantial population, Africa is thought to hold around 30% of the world’s known mineral reserves including cobalt, uranium, diamonds and gold, as well as significant oil and gas reserves. By rights, Africa should be one of the richest nations on the planet.

But it isn’t, and the reasons are largely due to political and historical problems that span centuries both within and outside the continent. There is little doubt, however, that Africa as a whole carries the potential to be a global power player, should that pathway ever be cleared.

And, for the first time, that just might be possible.

The Leapfrog

The concept of “leapfrogging” is well known among economists. The term is usually applied when a culture or entire country skips parts of a technical development process and jumps in a later stage, thereby avoiding the growing pains associated with early adoption.

Those who successfully leapfrog usually benefit from a newer and more future proofed system.

It has happened many times in many guises in many countries, but always in areas involving technology. In fact, it has already happened in Africa itself.

For example, Ethiopia was able to jump directly to hydroelectric power rather than going through the traditional coal burning route first, and the continent as a whole was able to jump directly to mobile phone use without implementing landlines first.

Since the latter is already becoming obsolete in many Western countries, this jump stopped the nation from building a low-power hardwired network that is difficult to repurpose and allowed it to focus on an alternative, more modern system.

Africa even adopted the 3G standard before most Western countries did, as a result of that action.

Now, the same thing is happening with money and cryptocurrency, and it’s entirely possible that Africa, whether by accident or design, is laying the groundwork for the biggest leapfrog in financial history.

The Mobile Money Boom

Africa, however, does not have a good track record with money. A seemingly endless supply of corrupt or incompetent governments has ensured that it is either repurposed for military or even personal use, spent on unnecessary projects or simply printed to the point of hyperinflation.

Low banking penetration meant that many of its citizens were reliant on cash or barter for survival, and this was the way it was done for many years. In the last decade, however, things have changed.

It’s so typical of Africa that there are parts of it where you can’t get running water, but you can stream a movie on your mobile device. Despite the lack of consistent infrastructure, mobile phone penetration is surprisingly high with some countries — such as Nigeria and South Africa — having subscription levels as high as 9 in 10 people.

In other words, in these places, mobile devices are as common as they are in Europe or the U.S.

This created a classic leapfrogging scenario, where Africa’s adoption of Mobile Money Operators (MMOs) was as fast as it was ubiquitous. These mobile services, supplied by operators such as Ecocash, M-Pesa, OneMoney, Telecash and MyCash, allow citizens direct access to electronic money.

For the first time, swathes of unbanked people could send money to each other by pressing a few buttons on their phones. It seemed to be a perfect solution.

However, recently, in true African style, Ecocash’s services were suspended in Zimbabwe when it transpired that the system, owned by the monopolistic Econet Wireless company, was allegedly conducting a huge raft of illegal activities on a set of charges so long that writing them out would fill several sheets of A4 paper.

Since Ecocash handled more than 94% of the payment traffic, the impact of this would have been devastating to the ordinary citizen had it not been for the Reserve Bank of Zimbabwe (RBZs)’s intervention, making sure that peer-to-peer and merchant payments remained operational.

However, if you were a user of this service, you’d have to be concerned about what would happen next.

While you may have been completely happy with the speed, ease and security of an electronic payment system over cash, especially if you have no access to traditional banking facilities, it’s suddenly clear to everyone that you’re still not in control of your money.

So, where do you go from here?

The Bitcoin Solution

Africa, generally speaking, has part of the problem solved already. Jumping straight to widespread mobile use over landlines and very high adoption rates of MMOs mean that the foundations of future monetary systems are already in place.

After all, this is unlikely to happen in a fully established culture where numerous alternatives coexist with a general apathy toward many of them. Why bother using a different service when the one you have works fine?

No, the problem is that this proliferation of use has occurred in a continent where there is unstable monetary policy, corrupt governments and companies with far too much power and little regulation.

This means, for the ordinary man on the street, you have a service you can technically use quite easily, but you do so at your own risk. There are simply no guarantees, but also little alternative, so the demand still remains high despite this.

And, even if you do manage to stay in control of your money through the collective benevolence of the service providers, there’s the constant pressure of devaluation, and the never-ending search for hard currency to preserve wealth.

What is required is a digital system that uses a hard, universally accepted currency, but also ones that lies outside of existing corrupt systems. What is needed is a system that gives peace of mind and total control back to those who use it, a system where confiscation or devaluation is out of the hands of those in power.

What is needed is Bitcoin.

And many parts of Africa have already realized it.

The Future is Bright?

Bitcoin use in Africa, as in the world generally, is increasing.

More than 14% of LocalBitcoins’ and Paxful’s global weekly trading volumes now come from Africa, with activity focused in Kenya, Nigeria and South Africa. These volumes have seen significant growth this year, surpassing $10 million in weekly volume across the two platforms.

South Africa has arguably better pathways to Bitcoin than anywhere else across the country, and it is no coincidence that several exchanges and crypto orientated projects are based there. In fact, more have announced their intention to either open offices or increase their presence in the country.

The growing awareness of Bitcoin among the population is also borne out elsewhere. Google Trends data indicates that Uganda, Nigeria, South Africa, Kenya and Ghana all rank in the top 10 on the topic of cryptocurrency.

South Africa actually ranked third-highest worldwide at 13%, with Nigeria ranking 5th (11%) in a survey about crypto ownership.

However, Coinshares data shows that only 0.2% of the world’s Bitcoin nodes are located across the entire continent, and there is no meaningful mining activity at all.

For most Africans, therefore, their primary use case for Bitcoin is also Bitcoin’s primary use case — that of a medium of exchange. Speculative or production activities such as supporting the network are clearly secondary or, may be more accurately described as “irrelevant” to most users.

The trends all seem to point perfectly to the obvious conclusion — that growth in Bitcoin use and awareness as a real, safe alternative to the tainted existing systems will continue, and Africa will find itself, by accident if not by design, at the forefront of the next financial revolution.

Unless, of course, it doesn’t.

The future may not be bright

There are several main problems with this vision of the future, even in a continent as well placed as Africa, of being the first truly crypto-friendly location on earth.

Despite the proliferation of mobile technology, access to electricity and the internet remains sporadic and network improvements are coming very slowly. A recent UN report suggested that $100 billion would need to be spent over a decade to get national coverage to an acceptable level, money that is not currently available.

However, companies like SpaceX, Amazon, Viasat and OneWeb are building low-orbit satellite mega constellations that aim to provide high-speed internet across the globe, and companies like Blockstream and goTenna are pioneering Bitcoin transactions without internet via its mesh network.

These activities may be enough to fill the gaps in the short-term, especially if demand continues to grow.

But even if the infrastructure problems can be overcome sufficiently, there are still many questions on how Bitcoin adoption would unfold.

Governments face the same issues as their western counterparts — that is, how do you work with something that is not directly under your control? How do you tax it? How do you manage monetary policy?

If anything, these questions are far more relevant in an environment where many governments can’t offer a solid alternative to their people, such as a stable fiat currency. The result? An increased propensity to be hostile to it.

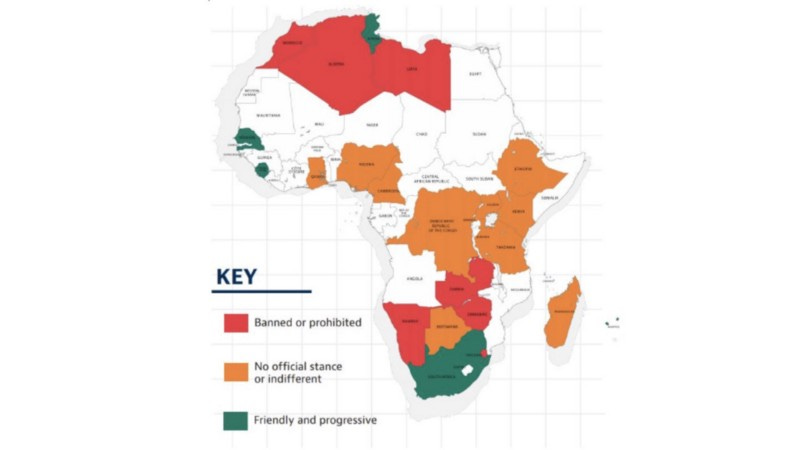

In fact, as shown in the regulatory status map above, Libya, Algeria, Morocco, Zambia, Zimbabwe and Namibia have already banned the use of cryptocurrencies, and while all other areas have no official stance as yet, several advise “caution” when using them. Only South Africa, Tunisia, Sierra Leone and Senegal are actively positive in their approach.

Its’s feasible, then, that Africa’s biggest obstacle to its own success in this regard could actually be its own regulatory structure. And if that's the case, that could be as devastating as it is frustrating for the continent.

Instead, let’s hope Ban Ki-moon, the former UN secretary-general, was right when he said “the next century belongs to Africa”.

Learn how to earn…

Become part of our community.

Follow our socials.

Subscribe to our podcast.

Subscribe to this publication.

It’s free (for now)