Hey all,

Welcome back to Art of the Chart!

We have much to review. Most of all, however, I want to express the seriousness of the potential of this cycle’s final leg. I know I’ve expressed it before; I stand by what I’ve said previously, and I am going to reiterate the main themes once again to hopefully speak to anyone who hasn’t heard it yet: (1) We are not through the bull mkt, but the end is rapidly drawing nearer, (2) this final leg up will be absolutely insane, with charts moving up so hard your heart will be pounding out of your chest while you watch, and (3), there WILL be another crypto bear market that pulls back just as violently as the previous iterations.

But today, I also bring a different message that I’d like to give a little PSA about, and it might empower you more than the final leg of this bull mkt ever could:

Money reduces apt consideration of resourcefulness.

What can be done with more, can be done with less. Doing more with less is the definition of resourcefulness. What you think you need $150k to do, there is a way to do with $85k. What you think you need to retire, there is a way to retire with half that. What you think requires “the most”, can be done with “some”.

We as humans have a natural defense against new paradigms that might cause mental instability, and that mechanism is called acclimation.

When you’re sick, it’s hell at first, but you rapidly acclimate to being sick and so easily forget what feeling “well” was even like, and it’s not as bad.

When you get a new job and it’s super hard - so hard you’re not sure you can even handle it, or that you’re capable enough - you learn the ropes, then you hardly remember what it was like before you knew it all.

When you don’t have much money, you are forced to live with less, such as when you just graduate or just get married. But eventually, you don’t even remember what it was like when you were fresh out of college, or just married, because now you’re making a good salary or income, and acclimation removes both the need to remember, as well as the reason to remember.

The examples of acclimation could fill a book (and I plan on writing one specifically about it), but this natural defense mechanism can also cause just as much damage as it alleviates. So to circle back to my quote, “Money reduces apt consideration of resourcefulness”, my point is: I hope you stay vigilant on innovating new ways to achieve your goals. If you wait for a particular number in your bank account, the chances of (1) it never getting there, or (2) you moving the bar higher when it does, are so bloody high, you’ll completely loose sight of the fact that you just might have enough right now to accomplish your goals, when sprinkling in a bit more of the innovation you had when you were broke. AKA, the need for more may simply be driven by the lens you’re looking at your account through. The lens of greed, “I deserve”, “this is finally my big break!”, and “just a little more and I can (buy/get/pay/build) xyz too!”, etc. These are the truest enemies of progress…

Moving on.

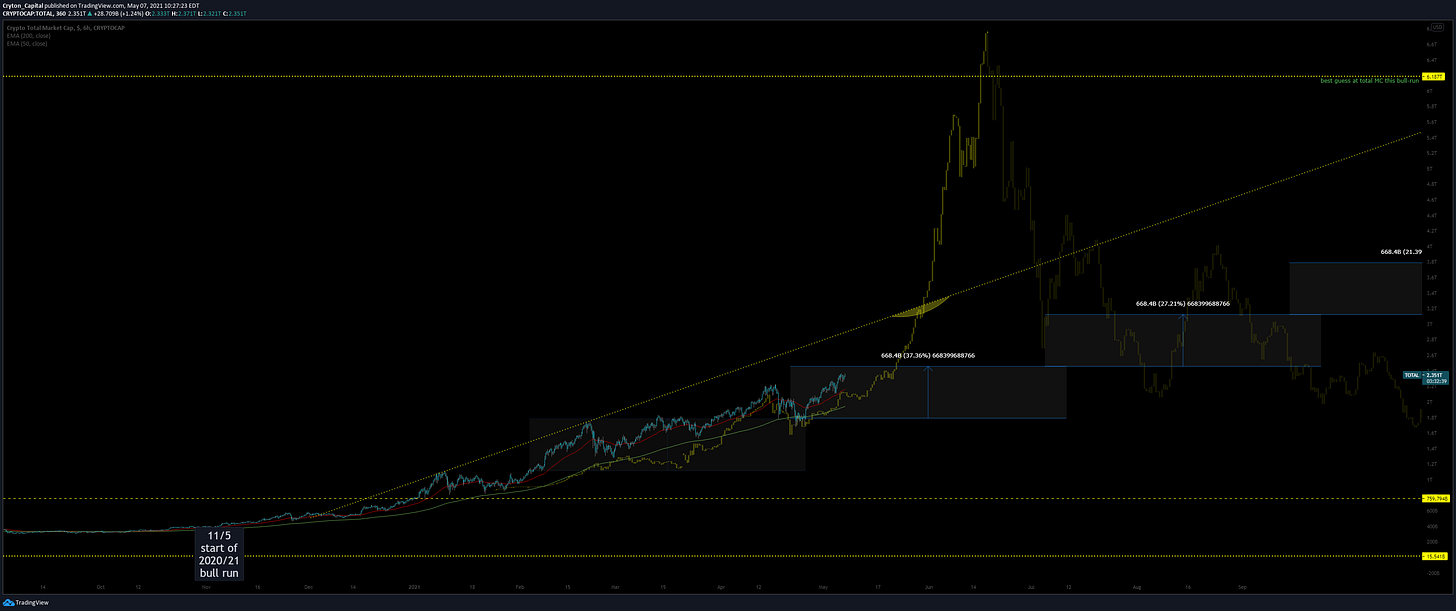

Crypto Total Market Cap - 6H chart - click to view

I still believe we’re going to 6T this bull cycle, and I think we’re very…VERY…close to going vertical. Going vertical is the only way we’ll get to 6T. It won’t be a slow rise to it. It will happen in the span of 1-2 weeks, and then the fall back to current levels will be hard and fast after that. Timing is everything. Stay vigilant.

BTCUSD - 1M

I am taking a contrarian view. I feel BTC has pumped, and topped, for this cycle. This is counter to what we’re hearing so much these days. I think it’s more likely that we see another bull cycle sooner than another 4 years than it is that we’ll keep going up. When looking at the chart above, I think “we’ve arrived”. I think those swapping their alts back over to BTC now, perhaps hoping that BTC will see a new leg up & suck the alt mkt dry again, will just get burned, as the alt szn run hasn’t seen it’s final volatile topping run up yet. You’re trading alt szn 4-10x legs for a potential sub-1x leg. We are 110% within alt szn as we speak. It’s undeniable and no longer a question. BTC hasn’t historically “kept going” after alt szn begins; BTC Dom falls like crazy, and alts power up harder than ever. That’s what we’re seeing.

Of course I could be very wrong. But this series is about my views, and this is my view as it currently stands. When I see that I am wrong, I will correct it and pivot, then fill you all in on the fly.

BTCUSD - 6H - click to view

I know this chart is very “busy”, but I’m seeing a Rounded-Top pattern here overall. Google it.

I think we are forming a large Bear Flag within (outlined in red), and we may see a re-test of the upper boundary of this flag, completing the Rounded-Top before falling. Once the “neckline” of this Rounded-Top gets taken out, it’s bye-bye bull mkt BTC, and hello bear mkt BTC.

AltCoin Index Chart - 1W

Here we may see a little resistance, as we’re re-testing the bottom of the previous consolidative period. This will act as a catalyst that could slow the rise of alts vs BTC. But this could just as easily get broken within 24h, then get correctively re-tested as new support… Be ready for either scenario. I think the latter is more likely, considering the multiple-week Bull Flag forming on most altcoins.

LTCUSD - 1W - click to view

This is my LTCUSD trade thesis, zoomed out. I have extremely high confidence that we’ll see $900 LTC. I have somewhat high confidence we’ll see $1100 LTC. Read my upper-most yellow lines on the above chart - this is my management method. I will be taking 25% of my LTC longs off the table as each yellow line is crossed. If price goes half-way to the next yellow line but doesn’t fully make it, the re-traces to and re-crosses the previous yellow line, I am liquidating all positions. Why? During the final 10% of the bull cycle, charts defy gravity in ways you can’t even imagine. There are limited pullbacks. When there is a pullback, it has a high likelihood of meaning the run on that coin is over. This mgmt method protects against this, and ensures I capture profit at key areas.

How did I arrive at those key areas, you might ask?

LTCUSD - 6H - click to view

I spent about 2 full hours putting this chart together for you guys (and myself).

Explained:

• Every dark-red rectangle is corrective PA after a new high is formed.

• Every light-green rectangle is price discovery after a single-candle-close beyond previous local highs (previous local highs marked in brighter-red S/R zones).

• Note how quickly price discovery occurs after the previous highs have been broken…

• The yellow numbers are how much higher the price discovery phase brought LTCUSD, in percentage-terms. Below that, the amount of time it took for it to occur.

I was wrong. I no longer feel that it’s wise to take profit in this area. If you did, you can still get back in while slightly gaining ground. But we’ve just broken a previous local high, and that means we’re in a new price-discovery green-zone. When it breaks both local high AND all-time-high, we’ll be in completely new territory. There are too many that know this, and too much new money flowing in. I no longer feel we’ll see a pullback to $275.

Strap in.

ETHUSD - 1D - click to view

ETH is fully parabolic. The only tool in a TA-trader’s toolbelt at this point is Fib Extension levels. The 1.272 Fib Ext level is the most commonly re-tested level in history. We’ve just broken beyond it. Here, you may wish to employ my yellow-line mgmt method I outlined above on LTCUSD, except with the Fib Ext levels: if a 1D ETHUSD candle closes back below 1.272, sell 50% of your bag, etc.. Otherwise, use the two upcoming Fib Ext levels (1.75 and 2.0) in the same way.

EOSBTC - 1D - click to view

We just broke a long-term descending segment of price structure on EOSBTC. I see us re-testing the EMAs (50 & 200) before going higher. Also, watch for a Golden Cross soon (50EMA crossing 200EMA on 1D chart). This is bullish.

EOSUSD - 1D - click to view

We had a Head & Shoulders pattern play out perfectly on EOSUSD and it broke down just as I said it would. But after the neckline was taken out impulsively, the momentum that the Bull Mkt is stirring up caused the pattern to ultimately be overwhelmed, and now we’re headed higher. We just re-tested a minor level on this chart - $11.60 - and will likely form some kind of small corrective flag here. Next up is $15.60 and then ATH of $23.05.

Lets zoom in:

EOSUSD - 4H - click to view

Here I feel we’ll see some form of flag, as outlined in green. I don’t think it’ll have time to become a complete flag (2-touches on one boundary, 3-touches on the other), due to the time we have left. I think EOS was late to the party due to the constant drama surrounding this chain, but now it’s playing catch-up with no fks given to the drama as new market participants are buying what seems undervalued vs. previous bull-runs. They see EOS as being capable of previous highs, and will send it there. Any form of bullish pennant or flag here will signal the next leg to $15.60. Keep in mind, it might happen on the intraday only.

RUNEUSD - 6H

We just formed a lovely bull-flag on RUNEUSD. It looks like we’ll probably re-test the upper-boundary of this flag as new support, then launch from there. We’re not parabolic on RUNEUSD yet… the curve is just now becoming visible. I believe RUNEUSD will reach $40+ this bull cycle, and that’s being conservative. And we’re hardly listed on any exchanges yet… Plan accordingly. RUNE may be the best buy of the whole cycle, even at this price.

LUNAUSD - 6H - click to view

Here we can see an Inverse Head & Shoulders pattern. The right shoulder is forming now. I think this is a good entry point, and as this is one of the largest overall Bull Flag patterns on any intraday alt-coin chart across the board. I feel this coin especially has plenty more in the tank this cycle. This price action is strange though, I will admit... I haven’t fully grasped what’s causing the prolonged corrective period, but it’s likely due to the complex tokenomics of LUNA. Either way, I see it as more bullish than bearish, as it’s allowed additional time to gather steam vs. some of the other alts that haven’t taken a breath lately. I bought more last night.

WAXUSD - 6H

We see one of the cleanest Bull Flags in all of crypto right here. Textbook. We’re in a little mini-flag within, re-testing EMAs, and will likely break & briefly re-test the top of the overall flag before heading to the 1.272 Fib Extension level of $0.465.

Summary:

I hope you enjoyed this episode, and that it’s helped you to realize where we are in the cycle. As many terms can be made up and thrown around CryptoTwitter, the charts remain the charts, and they tell a story. Learn to read them and you’ll never have to rely on “hot tips” from unreliable resources again. Empower yourself day-by-day. I’m still learning a decade later… It never ends, but it’s the journey that makes us who we are.

See you all at the top!

Oh, and I will do an AMA on CryptoWriter’s Telegram channel on Monday of next week. Please reply below with the best time for you, in EST. 9AM, 1PM, or 4PM. The most requested timeslot will win, and I will do the opposite for AMA #2 to ensure everyone gets to participate. These will be a good quick way to communicate thesis-changes and pivots as we near the most volatile leg of this cycle.

Disclaimer:

Cryton Capital is not a registered investment advisor, legal advisor, tax advisor, or broker/dealer. All investment / financial opinions expressed in any-and-all posts on this page, including screenshots & captions, are from the personal research and experience of the owner, and are intended to be interpreted as educational material only. Although best efforts are made to ensure that all financial charts and commentary are as up-to-date as possible, there may be times where price moves beyond key levels before the chart can be posted. Alas, this is part of the fast-paced financial sector and cannot be avoided. Also, occasionally unintended errors and/or misprints may occur.

Learn how to earn…

Become part of our community.

Follow our socials.

Subscribe to our podcast.

Subscribe to this publication.

It’s free (for now)

Thanks for your insight! I am going to hold my wax a bit longer...

The introduction of this piece is what made me confident in your analysis of everything. It made me trust your plan and I’m following it verbatim.

Thank you , Chris.