You probably won’t want to read this episode…

If you do choose to read it, you’ll inevitably be sad about what you just took in by the time you finish. I’m sorry, ahead of time, for that feeling. But alas, my job is to inform my followers of what is going on in the market. When ‘what is going on in the market’ isn’t pretty or exciting, it’s time to be just as real and transparent as during a bull market, and bring the truth anyway. There are lessons here, and I will not make any foolish guessing game out of them. I’ll spell them out for you as I always have. This is going to be one hell of an episode… emphasis on the hell.

Let’s jump in.

TLDR: Sell everything. If nothing else, sell DOT. Maybe buy ENJ, ANKR, and my end-of-episode trade idea UNO.

TOTAL MC - 4H chart - click to view

“We’ve broken a CRUCIAL support level to the down-side, then re-tested the underside of it as new resistance in the form of a bear-flag.”

If I were to add to the TLDR above, it would be this quote. This is EVERY chart… We’re going much lower, once these Bear Flags break short. There is no V-recovery from here. I know on-chain metrics are all pointing toward accumulation by the big boys, and blah blah blah. As much as that might be the case, I trust TA. And the TA tells me that, across the board almost ENTIRELY, we’re looking incredibly bearish. It is our current reality, regardless of bull cases you may read on CT.

BTCUSD - 4H chart - click to view

As I said in the episode “Final Opportunity”, BTC completed the rounded-top pattern I had outlined there, and has now re-tested the underneath of it as new resistance. It’s not re-testING… It’s re-testED… PAST tense. This is going to break short very soon.

Read that episode here, published on May 7th.

https://crypto.writer.io/p/aotc-final-opportunity

LTCUSD - 4H chart - click to view

LTC, against ALL ODDS, sliced through some INSANE levels of support like they were butter. Multi-year USTL (upward-sloping trendline) x3, its parabolic curve, previous-highs, 0.618 Fib Retracement, and more (circled in yellow). We’re now, just as with literally every other chart market-wide (almost), forming a Bear Flag re-testing critical now-broken zones as new resistance. Bearish.

RUNEUSD - 4H chart - click to view

RUNE… my baby… Looking demolished like the rest. We have a Head & Shoulders pattern, and in the right shoulder, which just formed, we have another smaller H&S pattern. RUNE’s wings were clipped before it could show the world its true potential, and that makes me sad. But alas, as cliché as it sounds, it does allow us more time to accumulate this beauty. DeFi is getting hit hard, because TVL is dropping and any platforms that allow loans / margin to be used on-platform have some unforeseen knock-on effects that are bringing them down with the rest of the market. TLDR: ALL Cryptos are INSANELY correlated still… Unprecedented levels of correlation, in fact. And when the overall crypto market-cap drops, everything drops no matter what. If your coin is an outlier, trust me, it will return to the mean eventually. Sorry… If you’re telling yourself, “but my coin hasn’t dropped as much as the rest yet…” Good… You still have time to sell it and get your $$ out before it does.

LUNAUSD - 4H chart - click to view

LUNA has caused me a good bit of pain. This chart drives me nuts, because the TA hardly ever works out. Bull Flags, larger and clearer than any other, break the opposite way. The biggest buy or sell signals on the planet just dwindle into sideways PA that becomes some new evolution of market structure that then takes what seems like decades to break, just like the last one, and probably the opposite way you expected. If you want to HODL LUNA, don’t look at the chart. Just hold the thing. If you want to actively trade a chart, LUNA looks attractive because the patterns are so clear, but I’d advise against it as they provide contradictory signals left and right. Or should I say up and down…

Anyway, price looking - you guessed it - bearish. Looking like we’ll get a re-test of the lower HTF (higher timeframe) flag boundary or at least a double-bottom near the previous local-low (about $4).

GRTUSD - 4H chart - click to view

My other baby… GRT. Bear Flag. It’s about to break through support from the high way back in 12/2020, and that won’t be good at all.

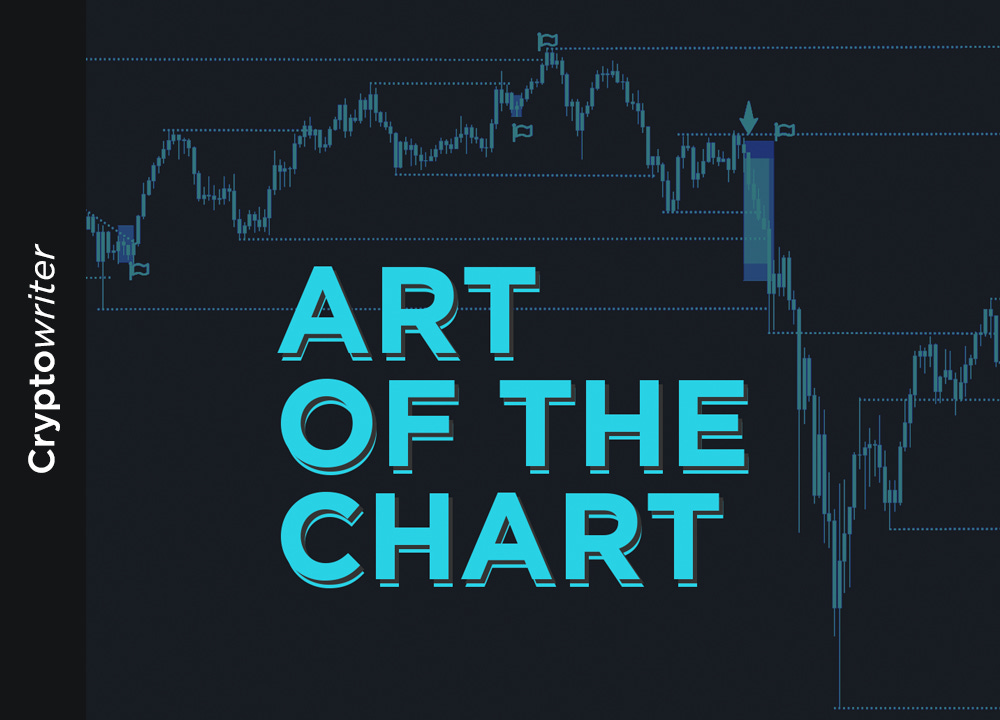

ANKRUSD - 4H chart - click to view

ANKR actually looks *somewhat* decent right now. It’s STILL within overall structure (which is, in fact, a MASSIVE Bull Flag), but within that Bull Flag, we’re in a Bear Flag just like everything else. I think a decent short-term trade would be buying a bounce off the bottom boundary of this flag, depending on HOW we re-test it…. If we correct / chop down to it, that will be bullish and I’d buy the second it touches the boundary. If we impulse straight down to it, that would be bearish, and I wouldn’t want to buy until I saw some strength, as I’ve drawn in green (buy first flag break).

MATICUSD - 4H chart - click to view

I’m afraid for MATIC. I just sold mine about an hour ago. This chart has yet to “return to the market mean”, as I mentioned above, and that is why it’s scary. I think this could pull back fairly heavily when the other flags market-wide break short causing more blood and fear. I would sell this and look to see how it moves in the coming week or two. IF it continues to show strength, it might be a good one to consolidate some of your other coins into, as it’s obviously getting bought up fairly heavily and said buyers aren’t letting it dip as much as the rest. But if that buying interest dwindles, this will fly down to meet the rest in the doldrums.

dol·drums

/ˈdōldrəmz,ˈdäldrəmz/

noun

a state or period of inactivity, stagnation, or depression.

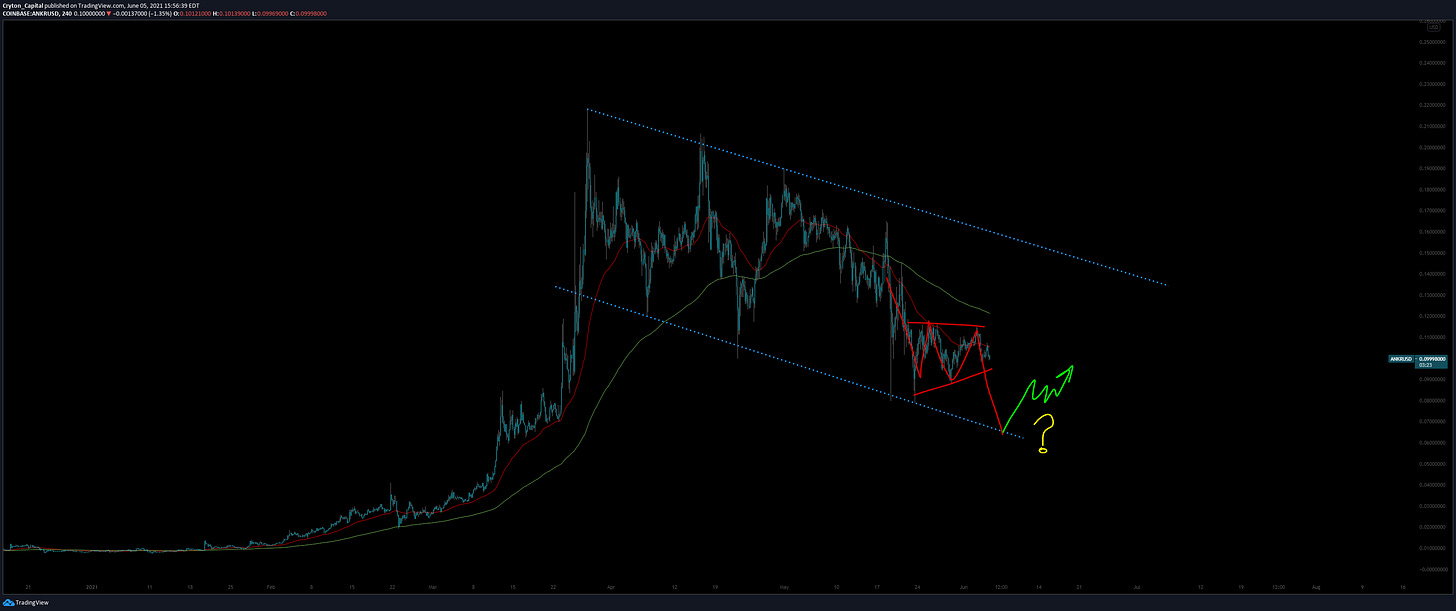

ADAUSD - 4H chart - click to view

ADA is just like the rest. Lower-high + Bear Flag. Strong support at $1.05. Wake me up when we get there.

VETUSD - 4H chart - click to view

Bear Flag. Retesting 200EMA and support-turned-resistance. Not good.

NANOUSD - 4H chart - click to view

Bear Flag. Looks like next resistance is about $4.08.

DOTUSD - 4H chart - click to view

Pardon my French, but DOT is fucked. Rounded-Top, STRONG support-turned-resistance, Bear Flag, 200EMA. This is a “sell it” on every possible level. If you do, you will get the opportunity to buy more with the same $, and that is as close to a guarantee as I can provide on this service.

LINKUSD - 4H chart - click to view

Bear Flag. Re-test of 200EMA. Now going down.

ENJUSD - 4H chart - click to view

ENJ is similar to ANKR, if not a little better even. Looks like a double-bottom might form, and if we break this DSTL (downward-sloping trendline), that’s a trade I’d take with a small allotment and, of course, a Stop to protect against a false-breakout. But of all the charts I’m covering today, ENJ is looking like one of the best.

XTZUSD - 4H chart - click to view

Similarly as screwed as DOT, although no EMA re-test yet. Might go slightly higher to do that, before breaking down. Either way, wouldn’t risk it. As with EVERY COIN thus far, I’d sell here to be safe. When these break, those that have leveraged back up after Black Weds on the premise of “look at all these bargains! Can’t go much lower”, will bring the market to its knees. If not them, Elon will.

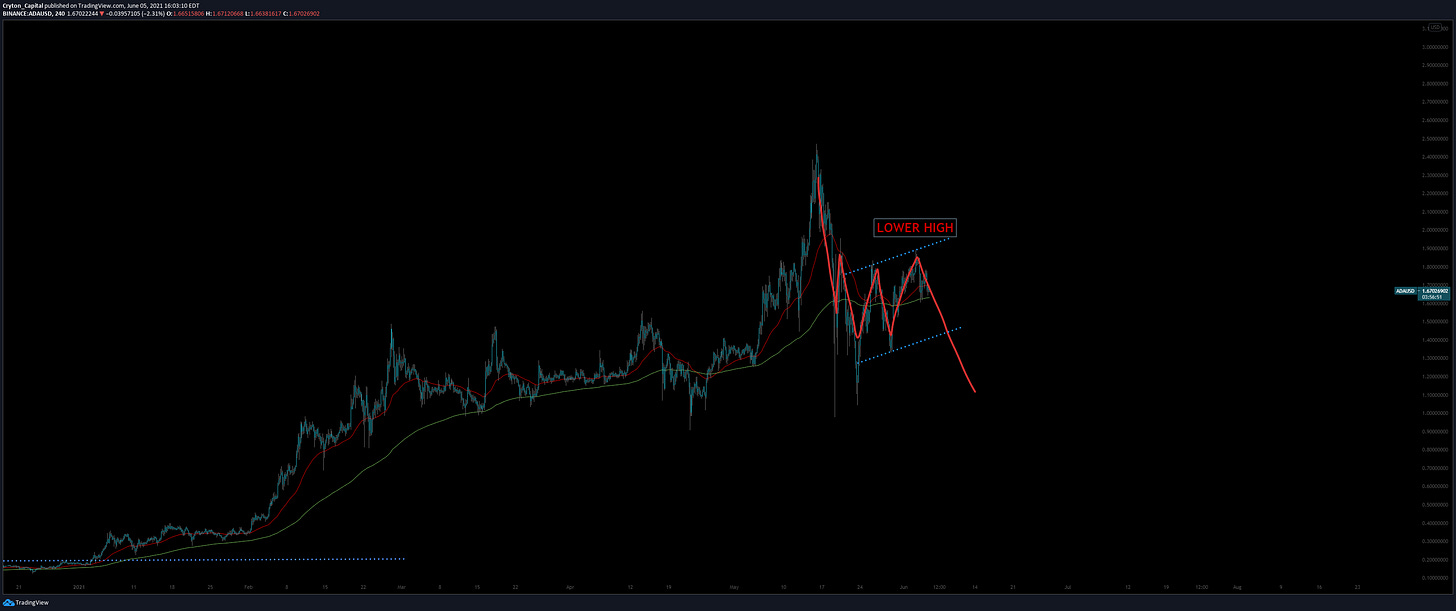

SIAUSD - 4H chart - click to view

I’m seeing my red line, in my haste to be done delivering bad news to my readers, is slightly aggressive in the screenshot above for SIA. It probably won’t dip that much, but, as with the rest, bearish.

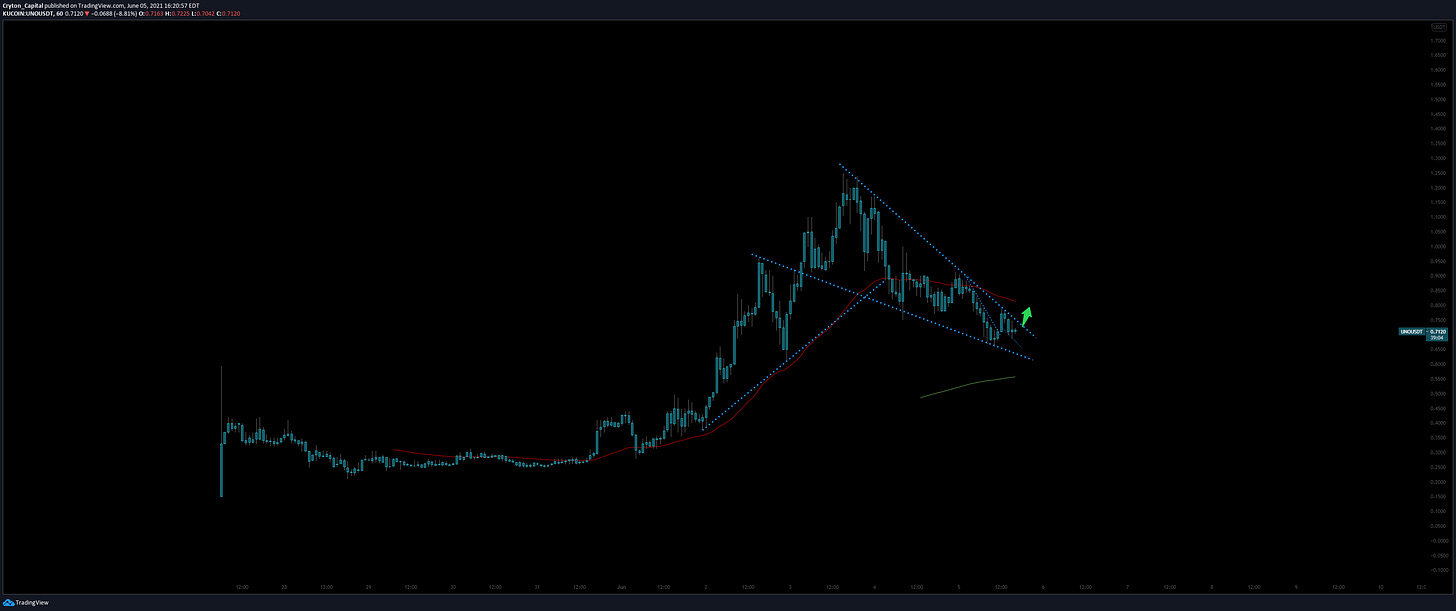

Trade idea: UNOUSD - 1H chart - click to view

Here we have a low-cap gem I recently found called UNO Re. It’s a blockchain insurance platform that allows the trading of risk between parties. I’ve fairly thoroughly vetted it, and I bought a little this morning. I see this as a Bull Flag, and it seems to be displaying more strength than the vast majority of other pairs, but I could be very wrong, so please don’t go crazy on this trying to dig yourself out of losses. My stop is below previous low at about $0.59. It’s available on KuCoin exchange.

Summary:

This is already bloody, and about to get bloodier. There are some lower-risk buys here and there, like on ENJ and UNO, but for the most part, I have moved almost completely to USDT.

Lessons:

(1) Buy strength. Don’t buy value.

Right now is NOT the time to be buying value. There is value across the board. You’re not buying value or selling value, you’re buying other trader’s opinions of that value, and selling other people’s opinions of that value. Other people are rekt. Therefore their opinions are emotion and skewed. Avoid getting rekt and buy strength only. There are literally no Bull Flags right now, except maybe UNO, ENJ, and ANKR. Wait for the market to start showing some strength.

(2) Keep yourself safe.

This year I made a lot - new personal net worth high - then lost a lot because I didn’t follow my own advice. My previous episode linked above, “Final Opportunity”, outlined a bear case for the market. It was not looking good then, and that was May 7th. That was the market peak, pretty much. If I’d followed my own advice then… well… you know the rest. Bring your actions in line with your vision. You give other people advice based on your vision, but it’s so hard to bring your actions in line as well. Advice can be given all day, and it might be damn good, but if it’s executed poorly on a “but I’ll wait and see” basis, it’s shit. Only when your level of pain meets your level of awareness will you realize that:

(3) Having money on the side is something you need to fall in love with.

We can get SO caught up in having a live trade. It just feels good… regardless of pain or gain, to know in the back of your mind “right now, I might be making money” is an addiction. That is an addiction that MUST be broken. It absolutely MUST be broken. I made $24k this week on little tiny-cap plays ONLY because I had money on the side already. I would have never gotten involved in those trades if I was already live in other trades, because they weren’t interesting enough to have to sell other positions. But to be able to jump in with dry powder not only removes hesitation that might lead to lost value on the new entry, but also completely cuts out the fact that having to cut other positions at a potential loss is something that will keep you from capturing new opportunities. Granted, some of you may not jump around that much. You might be happy HODLing through this entire bear market. And that’s PERFECTLY fine… I have zero problem with that, as I did it twice before. But in the last 2 years I’ve become much more active in the markets as I realized I (1) can absolutely see value and have developed a good instinct, (2) can capitalize on that value, or cut positions and buy back more of them later with the same $$, and (3), neither of those two points even matter if I don’t have capital with which to execute.

So, my crypto fam, I love you guys & gals, LOVE your support in the comments of my posts, and really enjoy reading your thoughts on everything as I move forward with this project. I’m posting these episodes for free, as I want to get better at my craft, get better at writing and sharing, feel that adding value doesn’t necessarily demand reciprocation, and know people are hurting and I can help them out.

I really want you all to be successful. I am sharing my inner-most advice, and if you take it, I feel you’ll be doing even better than I am (which, granted, lately isn’t tremendous, but that’s only due to not taking my own advice). And that is why I share.

Until next time guys…

Oh, and P.S., sorry for the reduced comments under each chart… I mean… what can I really do with this market? It boils down to these two things: (1) it is clear we’re looking bearish right now across the board, and (2) as always, I need to see new structure form once this structure breaks before I can re-analyze and give additional guidance. That’s all there is to it…

Peace

Disclaimer:

Cryton Capital is not a registered investment advisor, legal advisor, tax advisor, or broker/dealer. All investment / financial opinions expressed in any-and-all posts on this page, including screenshots & captions, are from the personal research and experience of the owner, and are intended to be interpreted as educational material only. Although best efforts are made to ensure that all financial charts and commentary are as up-to-date as possible, there may be times where price moves beyond key levels before the chart can be posted. Alas, this is part of the fast-paced financial sector and cannot be avoided. Also, occasionally unintended errors and/or misprints may occur.

Learn how to earn…

Become part of our community.

Follow our socials.

Subscribe to our podcast.

Subscribe to this publication.

It’s free (for now)

Thanks for putting us all on suicide watch

Looks like my UNO call was exquisite... Up near 100% since posting this!