Bitcoin — A New Regulatory Threat?

Is the new global business tax rate agreement a shot across the bow for Bitcoin?

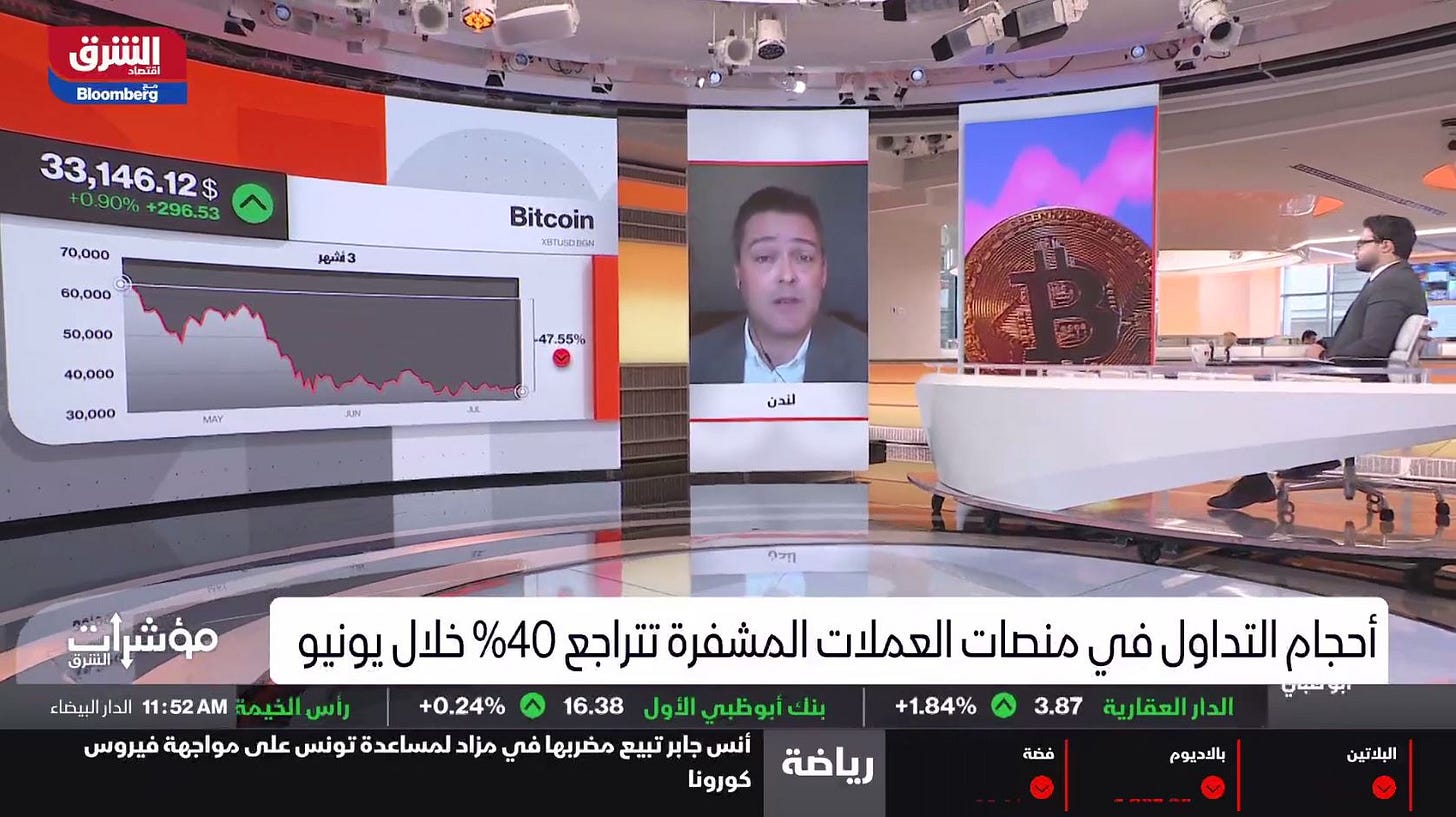

This morning, at short notice, I was asked to appear on Asharq Business, Bloomberg’s Dubai broadcasting division, to “discuss Bitcoin” on their flagship business program.

To be honest, I always get a little nervous before a live TV interview. It’s one thing to make a gaff when explaining something to colleagues or at an event, it’s another to do it on live TV on a clip that can be re-run ad infinitum. It’s not happened yet, thank goodness.

Well, at least as far as I know anyway.

The added complication with foreign media, of course, is live interpretation. My Arabic is non-existent so resident interpreter Hassam stepped in to provide live two-way translation in my ear. It is a skill I am in total awe of.

As the countdown to live broadcast came through my earpiece and I adopted the obligatory “sit upright and stare straight at camera” position (always slightly uncomfortable because of the producer’s insistence you sit at a certain height and angle for lighting and on screen graphics), I realized I still didn’t know what we were going to be talking about.

I had been opposite this anchor before on previous interviews and he could be a little insistent on certain points. My brain inevitably starting imagining scenarios of a Jeremy Paxman style grilling, so I had to have a quiet word with myself.

In the event, we were talking about Bitcoin on a macro level, an area I am totally comfortable with. During that discussion, the question of regulation came up, as it so often does. They are always variations of “can government regulations stop Bitcoin?”

My stock answer is well documented, but TL;DR version is essentially “no, they can’t”. Governments can, of course, attempt to remove themselves from the Bitcoin network — Nigeria and China are trying to do this right now for very different reasons — but they can’t actually stop it at any level.

In fact, the only sure way to do it would be to switch off the internet and all satellite, radio and cell phone connectivity in the jurisdiction concerned. Even then, there are still no cast iron guarantees and there are almost certainly no territories that would risk sending their economy back to the stone age anyway.

Switching off all on and off ramps via the banking sector is another option, but easily circumvented through other jurisdictions, VPNs and all manner of other work arounds.

So, if it can’t be done because of the tech, the only other angle available to central authorities is regulation. That is, if you make holding, buying, using or selling any cryptocurrency such a serious offence that no-one would risk it, you might have a shot.

Assuming, that is, your citizens would accept that en masse, something that would be extraordinarily difficult in democratic societies.

But then the news anchor pulled out his killer question:

With the global agreement on corporation tax do we now have a precedent that shows it might actually be possible to stop Bitcoin with regulation?

A global agreement? Seriously?

In case you’re not aware, a large whole group of countries, including the planet’s wealthiest, did something almost unprecedented recently. They actually agreed on something at a global level.

This, of course, is usually impossible. We’re still arguing over climate change, whether pumping toxic stuff into the atmosphere is really that bad for us as a species and disagreeing over poverty, world hunger and all manner of other literal life and death decisions of billions of people.

But tax, well, that’s different.

Everyone knows that large corporates pay far too little tax by employing legal — but morally questionable — accounting practices and each time a loop hole is closed in one location, they simply move (at least on paper) to another more welcoming jurisdiction.

It’s been happening for decades and discussions at some level over the matter have been going on almost as long. The answer is to create a united front and block all possible exits at the same time, assuming, of course, everyone agrees.

It’s also an easy win for all concerned. Corporates, in this context, are the enemy of both the people, who see preferable tax rates as grossly unfair, and governments, who want to make sure they get their cut of the profits. You can have the most powerful lobby in the world, but if those two parties are united against you, you’re going to have it tough.

So, earlier this year a provisional agreement to create a global corporate tax rate of 15% was put in place and recently progressed further at the Paris talks hosted by the Organization for Economic Cooperation and Development. It’s quite the achievement, with 130 countries (representing around 90% of global GDP) broadly agreeing the terms.

Even China, who had reportedly been hard to bring the negotiating table, have agreed with no special caveats or exemptions. Others of note include the “go to” tax friendly favorites such as Bermuda, the British Virgin Islands and the Caymans.

So, since the loopholes of tax avoidance are finally and permanently closing for those multi-national companies that have traditionally enjoyed them, does it set a precedent as an angle of attack for Bitcoin?

This was precisely the question the anchor posed and was being translated in real time as I stared down the barrel of the camera.

It was a great question and, quite incredibly in retrospect, it was one I hadn’t actually been asked before. However, I wasn’t concerned so much about whether I knew the answer (I did) but how I was going to deliver a soundbite in less than 60 seconds with an answer using words that an interpreter would quickly and easily be able to move to Arabic without creating any ambiguity.

This, after all, is not as straightforward as it seems.

Watertight … or leaky sieve?

International agreements are notoriously complicated to agree and even harder to enforce, especially when it comes to a mixture of human nature and money.

But “agreement” is the key point. It’s hard to say how long it took to even get to this point, but it is, for the moment, no more than a general agreement in principal. Final details are expected to be shaped by October this year with a view to being in place sometime in 2023, another two years from now.

Things don’t move quickly on an international level.

Things also rarely go smoothly. To gain acceptance in the EU area, for example, a new law will need to be passed that all member states must agree to. However, at least three member states (Ireland, Estonia and Hungary) currently oppose the idea and won’t ratify it in its current form, although it’s worth noting that all three have said they will continue to support the discussion.

At the same time Peru, Saint Vincent, Barbados, Sri Lanka, Nigeria, Kenya and the Grenadines are also opposed. What happens even if the law does get passed everywhere else? What’s to stop companies funneling their sales through those territories?

In reality, there will probably be practical reasons as to why this is difficult and international pressure to boot, but even so, the best that can be hoped for is making tax avoidance harder to achieve.

But if there’s one thing I’ve learned over the years, it’s that large corporate coffers and creative accountants are incredibly persistent when it comes to exploring all possibilities. The benefits are just way too high.

So, with combined obstacles of true global agreement, time and individual desire to achieve the goal, how much of an actual precedent is it?

The hard truth

As alluded to above, this agreement will probably be one of the easiest the international community ever has to agree on.

More or less all parties agree that corporate tax avoidance has gotten out of hand, all stand to benefit in some way (except, notably the lower tax rate countries that are currently opposed) and all know they have extremely high levels of support from the citizens they represent. It’s about as easy as it gets.

Except that it’s not really, for the reasons we’ve seen.

So, just how realistic is it for the global community to come together and agree a blanket Bitcoin ban?

The first problem with Bitcoin is, of course, the fact that is entirely geographically independent, and far more so than any corporate structure which has to be based somewhere. The practical implication of this is that as long as there is at least one territory on the planet who views Bitcoin as positive, ANY ban, even in every other country on the planet, will not work.

Put simply, all mining activity, all exchanges and all activity will switch to the friendly jurisdiction, quickly and easily. Worse for global regulators, there’s actually quite a few countries who view Bitcoin this way, including those who are actively exploring making it part of their currency mix such as El Salvador, Paraguay, Malta, Panama, Mexico, Brazil, Nicaragua and a handful of others. They represent many tens of millions of people and a small, but significant, portion of global GDP.

This approach, therefore, cannot work unless it carries very stiff sanctions against dissenting states, something that would be very difficult to achieve given the complexities of the international economic relationships concerned.

The next issue is time. Even if total agreement was reached today, it would take years to shape and put into place. Bitcoin may well reach a billion users within the next four years which will represent around 12.5% of the global population. Would any legislation realistically be able to overcome that network effect at that point?

Finally, even assuming the legislation was agreed today and implemented very quickly, would the citizens of the world respect it? It might be possible to enforce through fear in controlled economies, but in fully free democratic societies it would be close to impossible to stop any activity.

It’s also quite likely that the will to enforce by a central authority may wane over time as certain economic advantages are achieved through Bitcoin — or at the very least — certain economic disadvantages are avoided.

The few states that have tried to ban Bitcoin to some degree —topically, China and Nigeria — have seen adverse effects including capital flight as citizens simply move their Bitcoin to neighboring jurisdictions and the eradication of hundreds of millions of dollars of industry via mining and the manufacture of related equipment.

Although no figures have ever been published, almost certainly there has been additional loss of employment, closure of related businesses and the migration of development skills related to this growing industry moving elsewhere. The most likely outcome is that that the use of Bitcoin will move to being entirely “off the government books”. That is, never touching any official channels with people transacting only in Bitcoin itself via the closed network and their own custodial wallets.

In other words, this could actually actually drive the direct use of Bitcoin in the jurisdiction which bans it, further reducing government influence on spending habits, taxation and monetary policy. Of course, law makers may then hit back with very severe prison sentences and other penalties for anyone caught doing it, but, aside from taking yet more time to implement and more money to enforce, would these societies accept that?

Conversely, the six million strong country of El Salvador which is pioneering state level adoption is, at least on paper, likely to see an immediate increase in the country’s GDP for reasons explained here, whilst also potentially solving the problem of 70% of its citizens being unbanked. This is something than can only be beneficial in the long term by any measure.

It’s early for both points of view — that is those countries supporting and those dissenting — but over time these theoretical effects will become real world effects and create a divergence in outcome. That divergence may well be the deciding factor.

The question remains a very valid and interesting one, but the reality is that this is not a precedent on any level.

So, did I manage to squeeze all of that in a 60 second sound bite?

Not exactly, but at least it sounded good in playback.

At least I think so.

It was, after all, only recorded in Arabic.

Want articles and to minute analysis and opinion in your inbox? Why not subscribe to the ‘Bitcoin and Global Finance’ newsletter? Receive special offers and insider info. Unsubscribe at any time.

Disclosure: The author of this opinion piece has been heavily involved with bitcoin for several years and holds a substantial cryptocurrency portfolio, including bitcoin. He also has a mining operation running the SHA-256 algorithm based in Siberia and is a published author on the subject of promoting the understanding of cryptocurrency. Jason is an analyst at Quantum Economics and consultant to Luno.

Disclaimer: Investing in any asset class is risky. The above should not be taken as financial advice, nor construed as so. Always do your own research before investing or consult with a professional financial planner.

Reading this article sounded better than the idea of watching the broadcast itself. I felt the excitement, and the topic you were trying to explain was very clear.

Actually restrictions have controversial impact on people. If you ban anything or tell them it is not allowed to do something, it will hit back. I will give a simple example: througout these 1.5 years I preferred to stay at home to avoid the virus. I handled the situation well, but once the government announced that there will be a curfew for several weeks, I felt desperate. I was already staying at home by my own will, but to be restricted by a power made me feel like that.

So if you ban something, people will always tend to act its opposite. The example I gave was for the benefit of society, therefore we can exclude it (I gave this example to prove that our mind is always against restrictions, its in our nature). If you try to ban or regulate something against society and restrict their economical freedom, society would fight back. Thereby, if you ban something, know that people will always tend to surpass your ban and it is almost impossible to avoid it.

Moreover, the description you gave for international agreements was very proper. It is not possible for houndreds of different cultures and governments to agree on something, as you mentioned it does not even happen in humanistical level. Even if they do, it would take too much time to setup the order.

I enjoyed reading the article, and I think you did a great job explaining it both here and on TV. Thanks!

It was a very different article, I still couldn't get over it. I felt really informed, I'm waiting for the continuation of these articles, Jason