Bitcoin Price Evolution When the Fed Rates Hike – The Past Shows Us That There Is No Reason To Panic

History Doesn't Repeat Itself, but It Often Rhymes.

That's it!

After several months of waiting and procrastination, the Fed has finally taken action by raising the key rates. If I say finally, it's because, just like me, you must have had the feeling that Jerome Powell was constantly taking precautions since the summer of 2021 saying that it was going to happen soon.

The soon will have lasted a little over 6 months in the end. This will have allowed investors in the financial markets to prepare for the news. When this happens, there is a feeling that the market has already moved on.

It must be said that the war between Ukraine and Russia has totally diverted attention from the main risks identified at the end of 2021: the COVID-19 and potential new waves, but also inflation which now reaches 7.9% in America in February 2022. Between risk and uncertainty, the central bankers of the world's major economic powers were faced with a dilemma.

The Fed, therefore, decided to go sparingly. Rates are rising by only 0.25% for the moment. Six more hikes are announced for 2022, but Jerome Powell says the Fed will adapt to the situation in real-time. At the end of the FOMC meeting, Jerome Powell took the opportunity to specify that the Fed will also start reducing its balance sheet. Probably starting in May, but nothing definitive yet.

A balance sheet that has reached almost $9T and that has increased parabolically since March 2020:

The reduction of the Fed's balance sheet will be done in the same way as between 2017 and 2019, according to Jerome Powell. The Fed will be careful not to move too fast or it will completely freeze the US economy.

Bitcoin price evolution when the Fed raises rates

Many investors are wondering what the impact of the Fed's change in monetary policy will be with the start of a tightening cycle in mid-2022. Some are even imagining the worst, talking about a Bear Market for Bitcoin, and a crash for the stock market.

So I looked at the recent past to see what might be in store for us. After all, as Mark Twain said, if history does not repeat itself, it often rimes. So analyzing past market responses to this type of monetary policy event is an interesting thing.

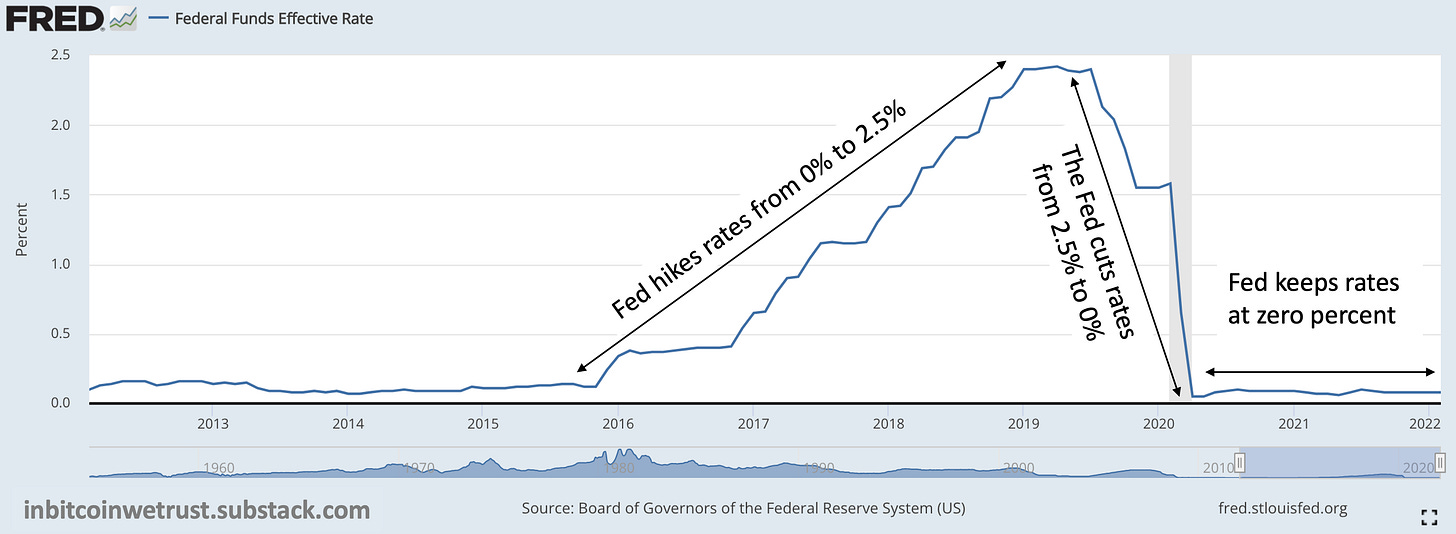

The last time the Fed inflected its monetary policy by raising its key rates was in November 2015 with implementation in December 2015:

Between November 2015 and January 2019, the Fed had thus increased its key rates from 0% to 2.5%. This is the first period that I want to highlight here. The second one is the one consisting of the fall of the Fed's key rates from July 2019 to April 2020: from 2.5% to 0%. Finally, the third one is the one that ends with the Fed keeping its key rates at 0% from April 2020 to March 2020.

The last time the Fed started to raise rates again, Bitcoin was priced below $500:

This was followed by a phenomenal rise in the price of Bitcoin culminating in the $20K almost reached at the end of 2017. An increase in the order of +4,000% for the price of Bitcoin compared to the beginning of the Fed's rate hike cycle. The Bitcoin price then experienced a Bear Market throughout 2018 as the Fed continued its key rate hikes. At the peak of this rise, the price of Bitcoin was +963% in January 2019.

So we can see that rising policy rates did not stop the price of Bitcoin from soaring to all-time highs.

In the following period, as the Fed lowered the key interest rates from 2.5% to 0%, the price of Bitcoin fell by -61%. A cut in interest rates does not mean the beginning of the party in the Bitcoin market as some people seem to think. Then the Fed kept rates at zero from April 2020 until March 2022, and we saw a phenomenal increase in the price of Bitcoin of +458%. But other elements came into play with the third Halving of Bitcoin and a massive injection of liquidity into the markets from the Fed.

The direct correlation between the Fed's key rates that will increase the borrowing rates for the everyday life of Americans (from credit card bills and mortgage payments to auto loans) is therefore not conclusive. We always come back to the Bitcoin Halvings which play a crucial role in the market cycles of its price.

There is no need to panic as the Fed starts a new rate hike cycle from now on.

S&P 500 evolution when the Fed raises rates

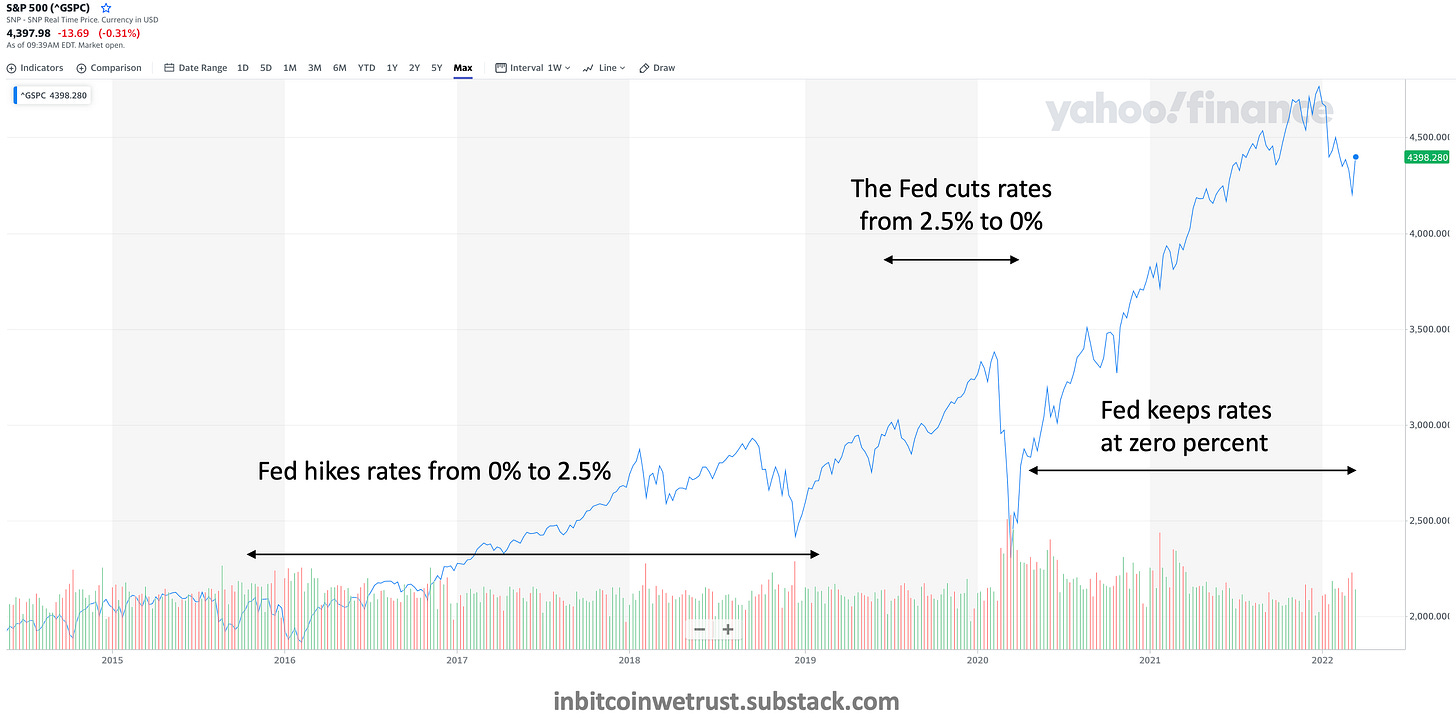

I thought it would be interesting to go further and look at this in terms of gold and the S&P 500. In November 2015, when the Fed was announcing its rate hike cycle, the S&P 500 was just around 2,000 points :

We can then see that the S&P 500 did quite well by taking almost 50% to almost reach 3,000 points over the second half of 2018. A crash then occurred before the rally restarted until approaching 3,500 points as the COVID-19 pandemic hit the world. Meanwhile, the Fed lowered rates from 2.5% to 0%.

Eventually, the S&P 500 soared, as did Bitcoin, as the Fed kept rates at zero from April 2020 to March 2022. But here again, it is more the injections of liquidity in unlimited quantities on the financial markets that have played this role of an incredible booster.

So we have to look at the whole issue and look at the different levers of the Fed in its monetary policy.

Gold price evolution when the Fed raises rates

As far as the ounce of gold is concerned, we can see that its price has not particularly benefited from the increase in the Fed's key interest rates from 0% to 2.5% as can be envisaged for the Bitcoin and the S&P 500:

The price of an ounce of gold was already rising sharply when the Fed began lowering policy rates in July 2019. The price of an ounce of gold swelled before it exceeded $2,000 in the summer of 2020. The price of Bitcoin was skating between $9K and $10K at that time.

Gold then lost interest for investors, and it was then that Bitcoin experienced a phenomenal rise along with the S&P 500 and the entire U.S. stock market. The price of gold returned to $2,000 briefly in the first few days after the Ukraine-Russia war but has since stabilized. We'll see if this causes the same rise in the price of Bitcoin as after the summer of 2020.

Again, there are many more events to consider than simply looking at Fed rates to predict what lies ahead for the price of gold.

Final Thoughts

As you know, I don't have a crystal ball. So I can't give you any guarantees about the price of Bitcoin. In fact, no one can. Anyone who tells you otherwise is a liar. The guarantees that Bitcoin gives you are related to its protocol, and those are incredible in a world as uncertain as ours.

We will see what happens in the coming weeks and months as the Fed continues its cycle of interest rate hikes. In my opinion, there is no need to panic, as this will not have a direct negative impact on the price of Bitcoin. But that is just my opinion. The past has taught us that there are other, more important factors at play that influence the price of Bitcoin.

Twitter

In Bitcoin We Trust

Comment & Earn!

Share your thoughts and opinions on the topics covered within this blog in the comments below for your chance to win yourself an NFT. Click here for more information on our engagement rewards.

I have been hoping that we would see more investors turn to btc in times of uncertainty as they have always done with gold. I think we will see more and more of this as more of the mainstream investors wrap their head around and get more comfortable with cryptocurrencies.

Thanks for this excellent article, we can only wait to see the behavior of Bitcoin.