Is Occam.fi A Good Launchpad To Get In Now?

There are a few different ways in which you can make an early entry into Cardano projects. Some Cardano projects have already launched or are currently in the process of launching. Most of these projects are still off the radar (particularly outside the Cardano Community). These projects still have a low market cap and lots of room to grow. You can get into these projects using 3 methods:

1. Purchase ERC-20 versions of the Tokens already launched from Uniswap (eg, ADAX, CARDWALLET)

2. Participate in Initial Stake Pool Offerings (eg, MELD, RAY, etc), and,

3. Purchase through Launchpads (This has a high entry price considering the number of tokens you need to stake, but also gives you better results as you can get the tokens at IDO Prices)

There are currently 2 prominent Launchpads in Cardano, namely, Cardstarter and Occam.fi. Both Cardstarter and Occam.fi have been doing relatively well. Good projects are launching on both of them, for example, World Mobile in Cardstarter and Ledgity in Occam.fi. I was looking for a strategy to get into any one of them when my eyes caught sight of very interesting news.

“Occam.fi became the first launchpad where the core Cardano foundational teams (IOG, Emurgo and C Fund) has invested”

Partnership with official Cardano Entities: What does it mean?

1. Occam.fi will be very well networked and would have access to very good early-stage projects

2. Occam.fi will remain committed to Cardano. It can position itself as a major incubator of Cardano projects

3. Cardano entities will provide the technical support to Occam.fi and its projects for easy onboarding and also continuous support

4. OCC Stakers will have the assurance that all the projects launched in the Occam.fi IDO platform has gone through a strong vetting process.

Now that I know that the partnership with official Cardano entities is hugely beneficial, I wanted to do a quick competitive analysis with its competitor, Cardstarter

Competitive Analysis

· Minimum entry point

To be eligible to participate in the pool of any launchpad, you will need to stake the tokens of the launchpad.

The lowest Tier in Occam.fi is “Mont Blanc”. You need 150 OCC to be eligible. Considering today’s price of approximately $10 per OCC, you will need $1500 to be eligible and have a 5-20% chance.

Compare the same with Cardstarter. You need 100 CARDS to be eligible. Considering today’s price of approximately $30 per CARDS, you will need $3000 to have a 10% chance of allocation.

· Guaranteed allocation

Guaranteed allocation means a higher amount of staking.

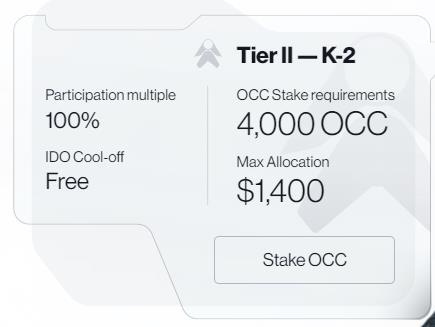

In the case of OCC, you get a guaranteed allocation at Tier 2 (K2). You will need 4000 OCC, approximately $40000

In the case of CARDS, you get a guaranteed allocation at Tier “Jacks”. You will need 1500CARDS, approximately $45000

· Previous performance

I wanted to check the previous performance of Occam.fi projects. I picked up 2 projects Cardwallet and Ledgity. Cardwallet is approximately at an 8x and Ledgity is at 7x.

In Cardstarter, I found Charlie3. It is at 54x as of today. Spores Network is at a 6x.

In average returns, I believe both projects are at par.

The Occam.fi product

The Occam Association, a Switzerland-based entity manages the Occam.fi ecosystem. The platform plans to become a DAO once more adoption comes in. The UX looks good but confusing to navigate and still has some way to go.

At the core, Occam.fi will remain a launchpad, however, in addition to the launchpad, it will have other products. The ecosystem will comprise of

· Launchpad

· Ethereum–Cardano Bridge

· Decentralized Exchange

· Liquidity Mining Pools

Let's take a detailed look at the launchpad

· Tiers: Ocaam.fi has 5 tiers as mentioned below. Getting into Elbrus or Fuji gives you a reasonable chance of allocation. There is a cool-off period after participation in an IDO (This feature is paused as of now).

· KYC: Unfortunately, yes. You will need to do KYC and whitelist your address.

· Projects: Occam.fi has brought in lots of good projects. The parameters of the selection process include

o Impact of the project

o The uniqueness of the product

o End-user use case

o Clarity regarding the project’s vision

· Reward: Rewards are something unique to Occam.fi. Users get different types of rewards

o Cast-out fee redistribution: In case of somebody unstakes, Occam.fi charges a 4% fee in OCC. This is redistributed between the other stakers

o CED rewards: The IDOs have a CED rewards pool. These tokens are freely airdropped to the stakers (minimum 150 OCC) in the OccamRazer staking smart contract.

o Rebates: Participants in an IDO gets rebate rewards in the form of OCC.

Considering the strong Partnership with Cardano entities, the low entry point, the modest return potential, and the Rewards feature, Occam.fi looks like a very good option to get into right now.

Follow me

Learn how to earn…

Become part of our community.

Follow our socials.

Subscribe to our podcast.

Subscribe to this publication.

It’s free (for now)

I prefer to buy Launchpads at ido price.

Looking at the history of Occam.fi projects, it seems that they have been successful.

DAOs are in high demand and can be successful.

The fact that they bring many options for rewards makes this business attractive.

Thanks for the article.

Initial analysis for occam.fi is positive. It looks beautiful and highly functional.

Cooperation with Cardano can bring the situation to different places.

Already the launchpad craze begins. It could be the new trend. If he leads these, we can see very different things.

Thanks for the article and information.