The trading card industry is dead but NBA Top Shot aims to be the future of trading cards by combining non-fungible tokens and highlight reels. The combination of the transaction history along with immutable code seems built for a sports memorabilia industry that has been plagued with fraud for years. There are plenty of articles and videos explaining this notion and hyping the future of a billion-dollar industry, however, there seems to be an inherent issue that could sideline the industry before it even reaches its full potential.

I haven’t collected trading cards in years but I was a 90s kid caught in the baseball card industry boom. I remember buying monthly magazines to check the worth of my cards. I had cigar boxes filled with valuable cards in plastic cases to protect them from becoming damaged. I used to think I’d be a millionaire by the time I was 30 because of that collection (which is why when my brother used a hole puncher on my 1994 Topps Mike Piazza All-Star Rookie card to get back at me for something, I cried) only to watch the value of it decrease to a point where I wondered if the space they took up was even worth the nostalgia. So why aren’t I jumping in with both feet into this burgeoning market? They haven't learned anything from the past.

Now That The Tears Have Dried

I love basketball. I have season tickets to the Sixers and it is the only sport I can still sit and watch from beginning to end. I listen to podcasts about basketball history and I read articles celebrating the cultural impact the game is having in bringing the experience of Black America to the mainstream. I watch games with my one-year-old and she experiences my emotions that are tied to every shift in momentum and acrobatic dunk. However, when I heard about NBA Top Shot I reacted as many of the NBA reporters I follow on Twitter did, “Ok?”.

I’ve had multiple discussions with my basketball friends and colleagues who are also believers in the endless potential of the NFT world. They too seem to have a similar reaction when discussing these digital moments:

“Can’t I just watch these on YouTube?”

“I’m not going anywhere near that!”

Their hesitancy matches my own. Not because I don’t see the potential value and not because I see the inherent risk but for other reasons. How much overlap can there be between the NFT world and the basketball world? Is it possible I am the only one? Probably not considering many of the Nifty Gateway drops around sports are always in high demand. But maybe some of that price is inflated in hopes that once this reaches the mainstream newcomers will flock to familiar images and communities. Maybe I am wrong. How are these items selling out in minutes? How are they selling exclusive ones for $3000-$75,000? Am I missing something?

While problems around this new market exist the biggest issue does not even seem on anyone’s radar and it relates to Ken Griffey, Jr.

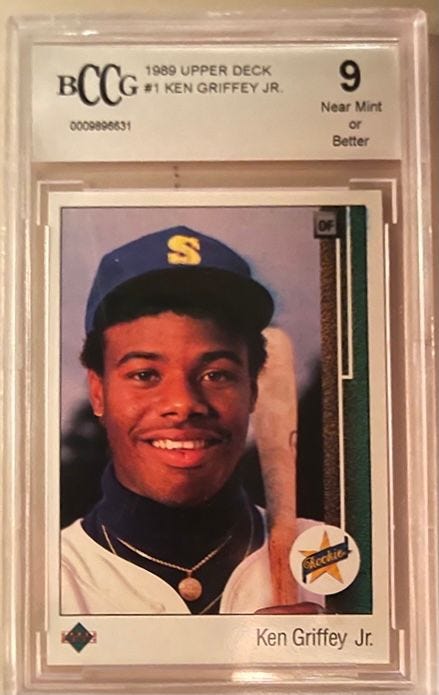

When you collect baseball cards people deep into the rabbit hole recognize the value in cards just by the names; some so unattainable you can only dream of ever owning one of them: T206 Honus Wagner, 1952 Topps Mickey Mantle, 1954 Bowman Ted Williams, etc. The card for my generation: 1989 Upper Deck Ken Griffey Jr. Rookie Card.

The Wagner, Mantle, and Williams cards all have a common reason for their value: scarcity. Honus Wagner requested his card be destroyed because he didn't want his image used for promoting tobacco to children. Mantle’s rookie card was a high number in the set so there were fewer produced but it’s also thought that due to printing errors many were discarded and tossed into the ocean. Ted Williams’ card was destroyed because he had an exclusive contract with Topps, so when Bowman created their version many of them had to be destroyed for legal reasons. Many of the cards between 1900-1970 remain valuable due to the limited availability. During that time many of the kids growing up really only bought baseball cards for the gum and threw the cards away (or as my dad even admitted he probably kept some of those cards...in the spokes of his bike). It’s not a novel idea: scarcity increases the value of an item. But, at the peak of the baseball card collection boom, this lesson seemed to be lost on those looking to break into the bull market. Enter the rookie card of a future hall-of-famer, on a brand new glossy-print baseball card, #1 in a brand new set from a company looking to make a name for themself.

At one point the 1989 Upper Deck Ken Griffey Jr. rookie card was worth $100 in the mid-90s. Today it’s worth about a third of that due to the market itself drying up on baseball cards but even more so due to a bigger issue: mass production. Documentaries and articles investigated whether Upper Deck indeed printed literal sheets of the card because they were so valuable and desired thus flooding the market with this one card. Ken Griffey Jr. even admits to owning a few hundred of them. The excitement and greed of Upper Deck led to a seemingly endless supply of the Ken Griffey Jr. rookie card and cut the value of it in half before the bottom dropped out. You can still buy one for $35 on eBay but I imagine it is only for nostalgic purposes and not as an investment (I am guilty of buying it for that purpose...for my brother).

Even Patty Mills Doesn't Want Patty Mills

NFTs seem to have solved the issue of fraud and duplications being produced but what about mass production? NBA Top Shot drops occur every few weeks where buyers have a chance to obtain cards for their collection. There are currently hundreds of thousands of these "common pack" moments for sale on the secondary market from $4-$400. Worse yet, it appears these common moments will continue to be minted through various editions, thus killing the motivation and interest to buy anything but the rarest of the rare moments. Eventually, buying a pack of these moments will feel like more and more of a gamble that will not pay off. So if one of the goals of NFTs is an investment strategy as it has been in the past with other forms of trading cards and now cryptocurrency, won’t they risk running into the same issue Upper Deck had with the Griffey rookie card?

They have attempted to protect against this by incentivizing collecting some of these common moments to unlock a special edition moment. Other companies have used similar strategies such as Nifty Gateway did with the Justin Riordan Nifty “The Presentations”. Buyers bought three of these cheaper drawings to unlock a rare drawing. Top Shot has implemented this same concept which in theory could be great in the future but the rewards right now are just not there.

To move up the Top Shot food chain to the “limited edition” moments fans can collect nine of some specific common moments of which there are 299 of each (a Patty Mills steal, a Delon Wright layup, a Bol Bol dunk, a Shabazz Napier jump shot, a Jamychel Green dunk, an Ivac Zubac dunk, etc.) and then receive an even rarer moment. That moment? A Larry Nance Jr. dunk.

Now, if you don’t recognize these names don’t worry, that’s kind of the point. These are not top-tier players or superstars. Even if you are familiar with basketball these names may not even resonate with you because these are role players, bench players, veterans playing for the league minimum chasing a championship ring, and over-performing players on bad teams. There are some better moments to collect and trade up for but most so far are similar in their mediocrity. All these limited edition and gold moments have the feel of a special edition DVD in the $5 bin at Circuit City, only these are being listed on the secondary market between $200-$700. I like Patty Mills but I don’t think even he is paying $300 for his moment. And what about the other common moments that aren’t necessary to collect and obtain a rarer moment? Why should I spend money on a sports highlight that I can watch on Youtube that is completely devoid of value because of its unlimited availability?

Right now, it does not seem that the NBA and trading card industry have learned anything from the past. They are bringing a broken business model from the 1990s to an industry on the cusp of revitalization. The secondary marketplace does not feel like it is filled with basketball heads or crypto-enthusiasts but rather 1980s salesmen who think that no matter the cost people will show up to buy this product because it is there. If there is a bubble in the NFT industry I would put money on it being this and that's a shame. With such a glaring design flaw and a broken business model built in what could be the solution? Burn ‘em.

The Cleansing Power of Fire

One of the reasons even common baseball cards from the 50s-60s era are valuable is because mothers across the country threw out cards their children had sitting in shoe boxes. Burning a NFT to obtain another is already being used. One project coming to the Wax blockchain involves a card game of Street Fighter by implementing burning in the game itself. Regarding an art piece from a Canadian non-profit, a Reddit commenter had a brilliant idea to create multiple unique items for those purchasing it. Nifty Gateway plans on implementing burning a previous drop by Mad Dog Jones for his upcoming one this week. Do I know how any of this works? Absolutely not, but I do know that the process creates a limited supply and thus increases the intrinsic value.

The point is, for the NBA Top Shots project to be successful it needs to begin to understand their market. They need to adapt and become creative rather than bring in archaic ideas to new technology. They will not survive if they continue down this path of mass production and overpriced mediocrity and will only have themselves to blame. While I’d be happy to see a capitalist institution crumble and fail in a community I am passionate about I will still be saddened to watch the potential of this idea wither and die.

So, NBA Top Shots, please hire me. I have good ideas to help save you before you crash and burn and they all begin with Ken Griffey Jr.

Learn how to earn…

Become part of our community.

Follow our socials.

Subscribe to our podcast.

Subscribe to this publication.

It’s free (for now)

Thanks you for article , very informative . today MLB launched on wax and sold out within half n hour . believe NFTs are taking hold

A few days ago a mlb.topps account was created on the WAX blockchain. Maybe soon enough we'll see MLB NFTs