The First Bitcoin ETF in the U.S. Is Here – Don’t Be So Optimistic, It Is Not Based on the Spot Market

The November 14 verdict for Van Eck's spot market-based Bitcoin ETF will be more important.

Written by Sylvain Saurel - In Bitcoin We Trust

After years of waiting and negative responses from the SEC, the first Bitcoin ETF is expected to begin trading on October 19, 2021. This news has been expected by the entire Bitcoin market for months. The narrative around the arrival of this Bitcoin ETF in America has completely overshadowed all of the bad economics that have been building up for weeks.

The potential real estate crisis in China with the Evergrande case already seems behind us, while the problem is far from being solved.

For Bitcoin, this already seems far away as its price has risen from $43K on October 1st to over $62K in the last few hours. Bitcoin has also just achieved the highest weekly close in its history.

The first Bitcoin ETF accepted in America is futures-based

Everything seems to be going well for the king of digital currencies. Uptober is indeed predicting an exceptional Q4 2021, especially since the current macro-economic conditions favor such a scenario for Bitcoin.

The first ETF to be accepted by the SEC in America is that of ProShares. It is named “ProShare Bitcoin Strategy ETF”. It will give investors exposure to future Bitcoin contracts under the ticker BITO.

You read the subtlety right here. This Bitcoin ETF will not be directly linked to the spot market, but rather to future Bitcoin contracts. That's a notable difference, which is why you shouldn't be so sanguine about this first Bitcoin ETF in America.

The first thing to understand is that the Bitcoin ETF landscape in America currently falls into two categories:

“Physically” backed Bitcoin ETFs that give direct exposure to Bitcoin, seeking to replicate the price of Bitcoin. These ETFs will therefore physically hold Bitcoin.

Futures-based ETFs. These are Bitcoin ETFs based on other Bitcoin investment vehicles, including CME BTC futures. These ETFs will not hold Bitcoin directly. They will invest in other investment vehicles that do.

A Bitcoin ETF based on the spot market would be much more interesting for investors and the market in general

If you look closely at the differences between these two alternatives, it is clear that futures-based ETFs will be more expensive and less efficient than those based on the spot market with direct exposure to Bitcoin. This is due to their complex structure requiring more maintenance.

However, the SEC, through Gary Gensler, had once again reiterated in the summer of 2021 that it favored futures-based ETFs over spot-based ETFs because of the greater protections that this would supposedly provide to investors:

“Given these important protections, I look forward to the staff’s review of such filings, particularly if those are limited to these CME-traded Bitcoin futures.”

— Gary Gensler

Gary Gensler's message was clear: a future-based ETF application had a much better chance of being approved by the SEC in Q4 2021 than an ETF based directly on the spot market.

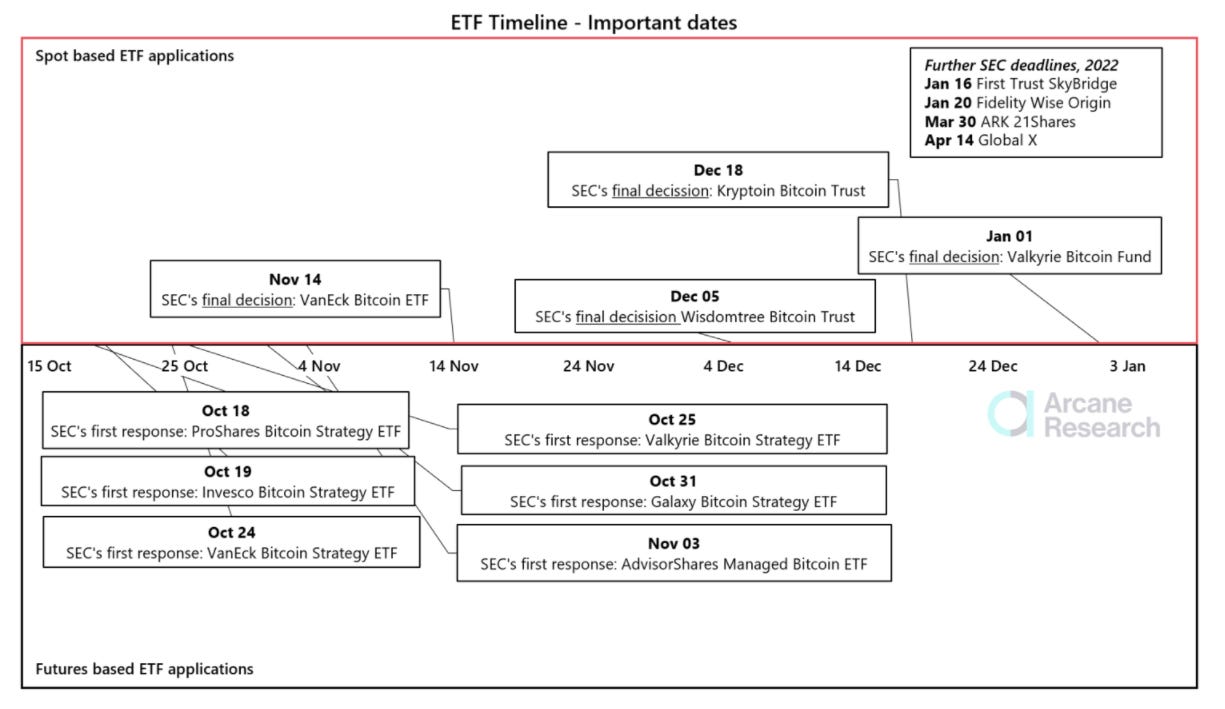

In the coming days and weeks, the SEC will give a response to the Bitcoin ETF applications made over the past few months:

As you can see, 6 futures-based ETFs are awaiting approval from the SEC, while four spot-based ETFs are awaiting feedback from the SEC by the end of 2021.

ProShares is getting the first positive response, but returns on ETF applications from other players like Invesco, VanEck, and Valkyrie are expected by the end of October 2021.

While these futures-based ETFs will allow more American investors to gain exposure to Bitcoin, they will also allow traders and other financial professionals to better manipulate the market to their advantage by leveraging the Bitcoin futures market to the spot market.

So from that point of view, it's not such good news.

The short-term impact of these ETFs will be extremely bullish for the price of Bitcoin in the spot market

The first real deadline we have to wait for before we can get excited is November 14, 2021. That's when VanEck will receive the final verdict on its spot-based Bitcoin ETF. An approval from the SEC would propel Bitcoin towards $100K by the end of the year.

A rejection of VanEck's Bitcoin ETF would not necessarily mean that others awaiting approval in December 2021 or January 2022 would be rejected. It would, however, chill investors who are euphoric about the current narrative around a U.S. Bitcoin ETF based on the spot market.

The SEC could justify its rejection of a spot-based Bitcoin ETF by arguing that the legal framework around Bitcoin and crypto-currencies is still too unclear and does not protect investors enough, as this seems to be Gary Gensler's leitmotif in recent weeks.

We'll see in the coming days and weeks what impact the entry of this (or these) first Bitcoin ETF(s) will have on the Bitcoin spot price. We can already imagine that in the short term the buying pressure on the CME will be more constant. This should lead to an increase in open interest with more cash coming into the market and thus ultimately buying pressure on the spot market.

The approval of a Bitcoin ETF based on the spot market would have a more direct effect on the demand for Bitcoin, which would absorb the available supply and thus rapidly increase the price of Bitcoin initially. The lower fees could attract many more investors than a future-based ETF.

In the longer term, these ETFs would simply be an additional investment vehicle for traders seeking exposure to Bitcoin without buying it directly. Once the market has absorbed the entry of these new players, they would have less impact on its price.

However, the price of Bitcoin would then be well above $100K or even $200K at that point.

Final Thoughts

From a more personal point of view, if these ETFs giving exposure to Bitcoin tempt you, know that nothing will ever be worth buying a Bitcoin directly if you can do it. The whole point of Bitcoin is to give you power over your money. To do this, you must have the private keys associated with your Bitcoin.

You must not let traditional financial players come in and steal this incredible revolution from you by trying to centralize a system that is all about decentralization.

Keep this in mind before making any investment decisions.

Twitter

In Bitcoin We Trust

Learn how to earn…

Become part of our community.

Follow our socials.

Subscribe to our podcast.

Subscribe to this publication.

It’s free (for now)

People who believe in Bitcoin have won again. As always, they will win again.

I'm not standing in this market for the purpose of making dollars. I want more coin tokens. We can see an increase in the price when some things are going well.

More time will show us a lot. I'm just waiting.

Thanks for the article.

Have a nice day.

The world should now design itself according to Bitcoin and be open to innovation, these steps are pleasing and promising.