The US Dollar From the Bitcoin Perspective – Buying USD Is Clearly Too Risky Right Now

If you understand Bitcoin, being a HODLer no matter what is the only logical decision.

Written by Sylvain Saurel - In Bitcoin We Trust

I frequently hear opponents of Bitcoin say that the king of digital currency is too risky an investment for the average person. Politicians, central bankers, and economists are all trying to dissuade the general public from discovering the incredible monetary revolution that is Bitcoin.

This is a shame because Bitcoin is something that will change your life for the better forever.

Taking power over the fruits of your labor and ultimately your life is priceless in my eyes. That's what Bitcoin is all about. To prevent people from discovering this fundamental truth about what Bitcoin gives you is therefore something criminal in my eyes.

The big question right now is: Is buying US dollars too risky?

In this article, I decided to take a different approach. Rather than explain to you why Bitcoin is a once-in-a-lifetime opportunity that is essential to seize, I'm going to take the perspective of a Bitcoiner on the U.S. dollar.

The big question I'm going to get you to think about is whether it's too risky to buy the U.S. dollar right now. This question may come as a surprise to those who have not yet understood the reason for Bitcoin and the flaws in the current monetary and financial system.

For others, the answer may seem obvious. Nevertheless, the subject is interesting enough to be discussed in an article.

Distrust of the U.S. dollar continues to grow

The first thing to remember is that the US dollar has been the world's reserve currency for a hundred years now. The recent history of past centuries has shown us that this is generally the average age at which a global reserve currency eventually falters:

On closer inspection, this is something that seems likely to happen to the US dollar shortly.

The distrust of the U.S. dollar has never been greater than it is today. More and more countries want to get rid of the US dollar, which gives America an exorbitant privilege. Russia has succeeded in getting rid of its US dollar reserves after ten years.

China wants to reduce its exposure to the US dollar as well. In short, America's domination of the international monetary system is increasingly disturbing.

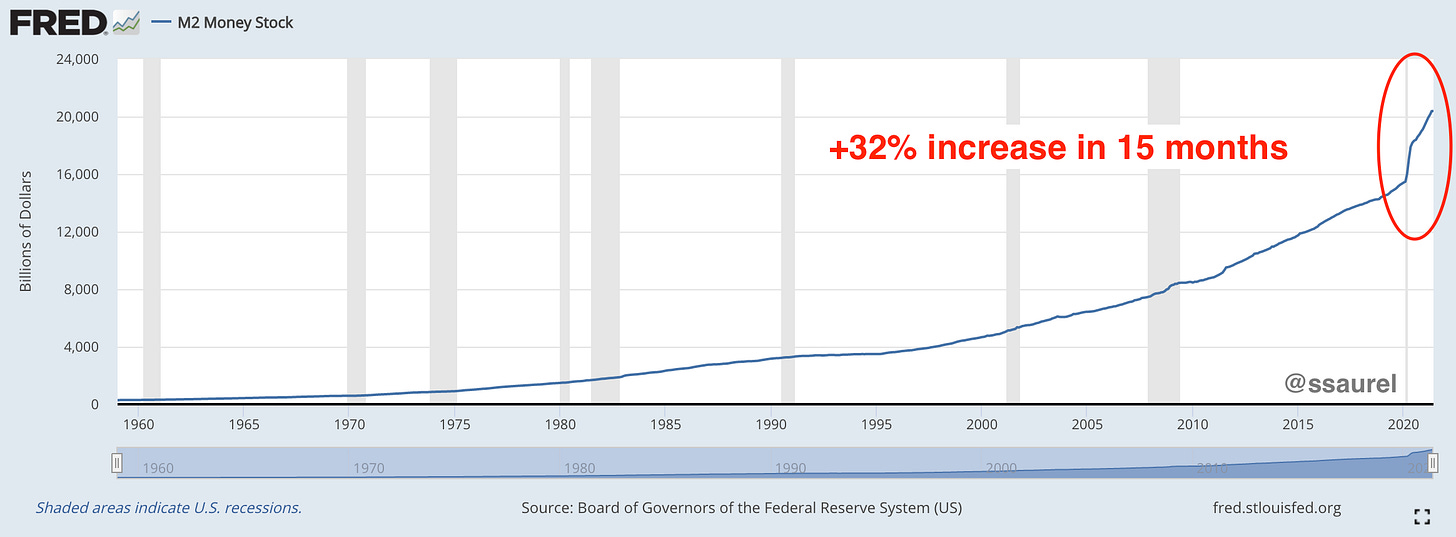

The problem with the U.S. dollar is the use of it by the U.S. government and the Fed. They keep printing it out of thin air. The trend has even accelerated since March 2020 and we are in the middle of great monetary inflation.

The great monetary inflation that we are undergoing exposes the flaws of the current system to the greatest number

More than a third of all US dollars currently in circulation have been printed since March 2020:

Such out-of-thin-air printing of U.S. dollars will obviously have disastrous consequences for hundreds of millions of people.

It will accelerate the devaluation of what they own in U.S. dollars in the years to come. This is all the more disturbing when you realize that the purchasing power of $1,000 in 1971 is not even worth $150 in 2021.

I am starting from the year 1971 here, because it was in August 1971 that Richard Nixon decided to end the Bretton Woods system. On August 15, 1971, Richard Nixon decided to end the convertibility of the U.S. dollar into gold. There were many reasons for this decision, but the consequences for the people were severe.

We then entered the era of financial crises and speculation.

The current system at the heart of which is the American dollar is a failed experiment

Just fifty years later, it is time to open our eyes: the experimentation of the current system is a monumental failure. Buying US dollars with your Bitcoin is therefore a very risky thing to do.

In doing so, you would be deciding to exchange hard money, whose supply is limited to 21 million units no matter what, for weak money, whose supply is unlimited, as the Fed constantly shows us.

With the current system, a minority of people who are not representative of the people can decide to print as much money out of thin air as they deem necessary. The fact that this has disastrous consequences for the majority of people does not change the Fed's monetary policy.

These central bankers know full well what the disastrous consequences of their monetary policies are, but they won't try to get out of them because they are among the great beneficiaries of the injustice of the current system. If you benefit from the injustice of a system, there is little chance that you will make the necessary efforts to change it.

The people, therefore, have no alternative but to take their destiny into their own hands. This is what the Bitcoin system offers.

Buying US dollars with Bitcoin is complete nonsense

To take up an argument used by Bitcoin's opponents, there are far too many scammers in the American dollar system. Every year, hundreds of millions of people are defrauded in US dollars. Moreover, the US dollar is the preferred currency for all those who wish to conduct illegal activities. This has been proven many times before.

Buying US dollars is therefore a very dangerous thing to do.

You could be financing drug dealers, and even promoting wars that America is waging all over the world. Disastrous wars often lead to nothing. The latest example comes from Afghanistan, which has just fallen back into the hands of the Taliban, after America had waged a war there for 20 years, spending more than 2,200 billion dollars.

This money would have been much better used to invest in America's infrastructure which is in a disastrous state.

By buying U.S. dollars, you remain at the mercy of politicians who have driven the U.S. public debt past $28 trillion, or more than 130% of U.S. GDP. And this is not going to stop in the coming months as the $30 trillion mark will soon be passed.

This debt is disastrous for the people and for future generations who will have to pay it back one way or another.

If only this money was used in the interest of the people. But unfortunately, it is not. With the American dollar system, you have to accept that governments and central bankers make bad decisions that keep impoverishing you.

The problem is obviously the total centralization of this system at all levels.

The last example is the private banks that censor your transactions for totally arbitrary reasons. Many people are thus prevented from buying Bitcoin with the fruits of their labor.

Final Thoughts

The answer to all these major problems lies within the Bitcoin system, and decentralization is the key. Bitcoin gives power back to the people and gives you the ability to live your life on your own terms.

By selling your Bitcoin to buy U.S. dollars, you will again be giving up all the freedoms that Bitcoin gives you. This is something clearly unthinkable for all Bitcoiners.

That's why Bitcoiners continue to HODL Bitcoin no matter what. Their goal is more than just to get rich: above all, they want to be able to have the freedom to live as they please. This can only be done outside the dollar system.

Twitter

In Bitcoin We Trust

Learn how to earn…

Become part of our community.

Follow our socials.

Subscribe to our podcast.

Subscribe to this publication.

It’s free (for now)

Hahaha. I like the title of the article, moreover the perspective you are trying to present us. Sadly every single point of this article is true... They are making acts by saying it's greater of the good, but it's just a big nonsense for the people who are below their layer. Most of the politicians and people in charge are focused on filling their pockets (I know there are some who are paying attention to needs of society, however their numbers are less compared to overall). Therefore, it's onto us to be aware the cracks that governments cause, and build what we believe is the future.

Thanks, it was indeed interesting article!

Hahaha I really like the perspective :D They are opposing Bitcoin and crypto as if it is the most dangerous thing in the world. This article is a good answer to them. I felt like I was in a parallel universe :D All of these things you said ironically are really true.

Thanks for this thought-provoking article! :P