Staking has been a very popular crypto investment strategy for long-term crypto holders. It allows them to earn passive income. In many cases, staking has some technical knowledge barriers to enter. New users usually prefer to use the exchange staking services (eg, Binance Earn). As they become more advanced, they prefer to stake independently, holding their keys. The below parameters need to be taken care of while choosing a staking node:

The node has been consistently getting rewards

It has a strong infrastructure setup. It should not have a previous history of slashing.

It is verified with the project

The commission is good. It helps the nodes to survive. However, it also should not be greedy. There needs to be a fine balance.

Running a node involves the complexities of handling hardware and codes. Are there any nodes that run professionally? Can users have their peace of mind by staking with them? Here are 3 staking service providers that you can check.

Stake. fish

Stake. fish has set up robust validator nodes secured by state-of-the-art security standards. These nodes are globally distributed and run 24 x 7. They have a strong support team, spread across the globe, and also available 24 x7.

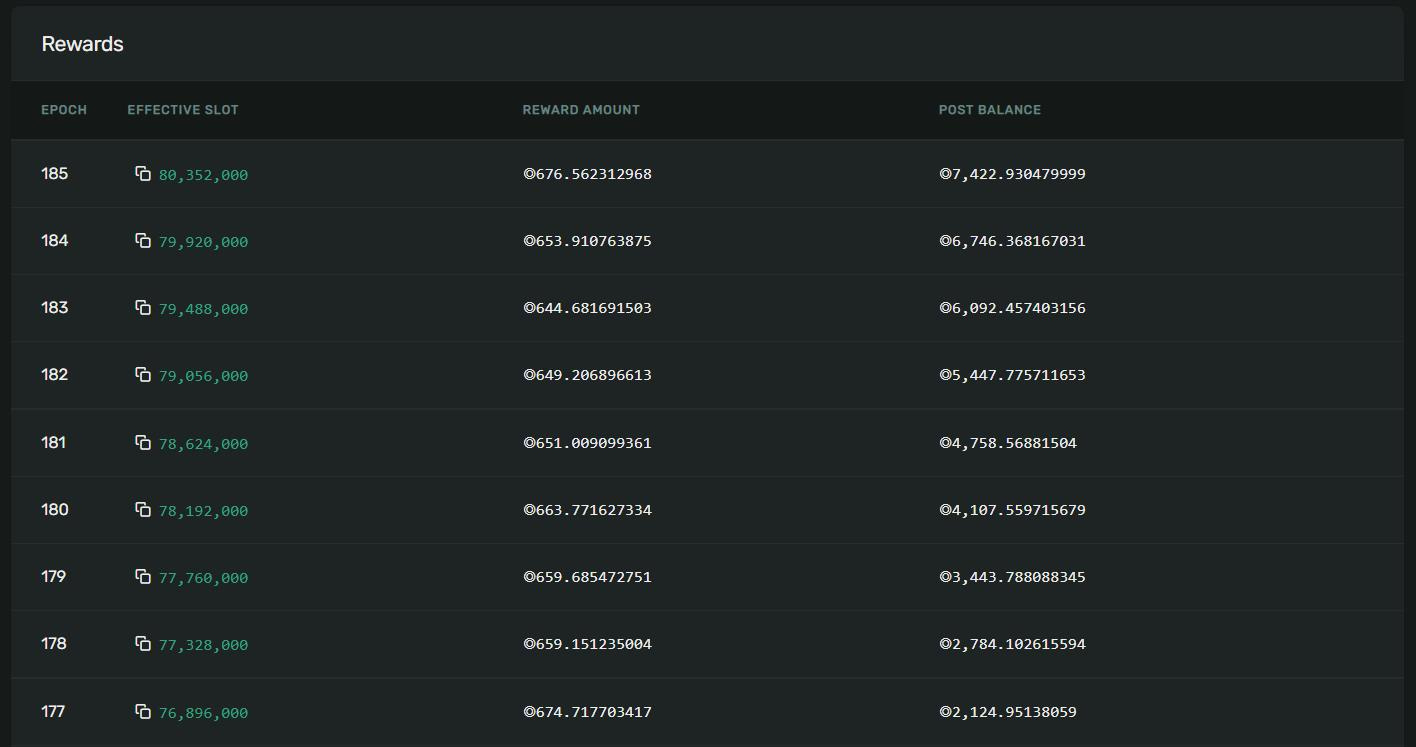

I tested out their nodes in few different networks to see their performance. Their track record with Polkadot looks consistent, with no downtime.

With Cardano, they had some hiccups in few epochs. But overall, they have performed well.

Stake.fish provides the below staking options and reward %ges.

· Ethereum – 1% - 20%

· Polkadot – 0% - 20%

· Cosmos – 7% to 20%

· Tezos - 6% - 10%

· Cardano – 3% - 12%

· Solana – 10% - 20%

· Polygon – 9% to 20%

· Kusama – 0% to 20%

· The Graph – 3% to 5%

· Near Protocol – 5% - 20%

· Flow – 6% to 13%

· Kava – 7% to 13%

· Band Protocol – 7% to 20%

· Edgeware – 0% to 20%

· Oasis Labs – 2% to 20%

· IRIS Network – 7% to 20%

· Casper Labs – 10% - 20%

· xDai – 12% - 18%

· Persistence – 44% - 88%

· Sentinel – 50% - 80%

Staking Facilities

Operational since 2017, Staking Facilities primarily focusses on the institutional investors (though normal users can also participate). Their Tier 3+ data centers are hosted in the heart of Europe and run 24 x7.

They provide custom reward reports, individually adjustable staking agreements as well as a customized fee structure for institutional users. Their website consists of comprehensive risk guidelines and FAQs for each staking activity. They have also created easy-to-refer tutorials to make onboarding easy.

I checked out the performance of their Polkadot Validator. Their rewards performance has been consistent, fluctuating within a small range but have never been zero.

Their performance in Solana has also been consistent in every block.

The below are the staking options and the rewards.

· Ethereum 2.0 – 7.58%

· Solana – 11.4%

· Polkadot – 13.9%

· Cosmos – 9.99%

· Tezos – 6.10%

· Kusama – 15%

· Edgeware – 18.8%

· Skale – 8.25%

Staking Facilities will soon start to provide staking services for Dfinity, The Graph, etc.

Ankr

Ankr has built a reputation by being one of the first service providers who managed to remove the barriers of ETH 2.0 staking. It has built an innovative platform, called Stkr for the same.

Access ETH 2.0 staking using any ETH amount (even below 32 ETH)

Receive liquid aETH in a 1:1 ratio.

Ankr is also one of the largest validators of the Binance Chain.

My recent experience in using Ankr as a validator in Binance Chain has been mixed. The Validator was penalized for a short period; however, it was able to reinstate itself back. Ankr is currently ranked 3rd in the Binance Validator leaderboard.

Apart from staking, it also provides a marketplace where individuals can run their shared nodes, by subscribing to a monthly payment option.

All the above nodes have shown consistent performances. They might not provide you the highest staking rewards but will give you consistency, which in the long run will add up to the best possible outcome.

Follow me

Learn how to earn…

Become part of our community.

Follow our socials.

Subscribe to our podcast.

Subscribe to this publication.

It’s free (for now)

I wish more people would write comprehensive pieces about staking. Loanscan.io just gives the rates and locations but that's not enough. Everything is so scattered and well...decentralized.

The Polygon staking is the most promising I feel.

I like the premise of staking, I think it’s going to develop way more in the next months.