Who Else Wants to DCA With Bitcoin Like Michael J. Saylor? Here Are the 4 Essential Rules To Follow

The secret is simply to understand the why of Bitcoin.

At the beginning of 2022, following the announcement of yet another BTC purchase by Michael J. Saylor via MicroStrategy, I wondered how many BTC purchases Microstrategy had made as part of the company's cash reserve allocation strategy.

I had asked a few questions on Twitter and Reddit to see if anyone had a complete listing, but no one had such a ready-made listing available. So I had temporarily given up the idea of having this complete listing available.

And then, on February 1, 2022, Michael J. Saylor announced a new purchase of BTC via a detailed tweet as he has become accustomed to doing since August 2020:

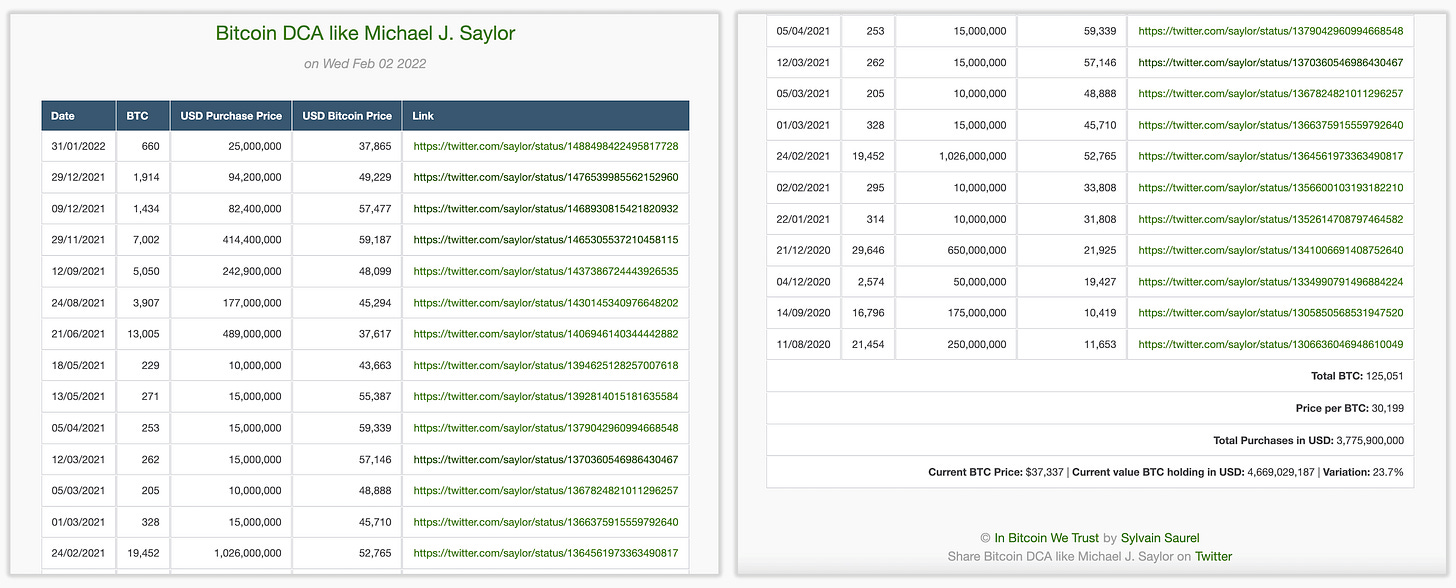

So I motivated myself to make this complete listing of all BTC purchases made by Michael J. Saylor since August 2020. To do so, I used the various tweets published by Michael J. Saylor to announce the BTC purchases made by MicroStrategy.

After finalizing this listing, I thought it would be more convenient for everyone to have a web page available to view all Michael J. Saylor's BTC purchases. The “Bitcoin DCA like Michael J. Saylor” page was born today from this idea. It can be accessed here:

https://www.bitcoinpriceinwords.com/bitcoindcalikesaylor.htm

I will update the page as future purchases of BTC are made by Michael J. Saylor through MicroStrategy. This web page provides you with details of the number of BTC held by MicroStrategy in real-time, but also what this represents in fiat currency, as well as the variation from the purchase price paid by MicroStrategy:

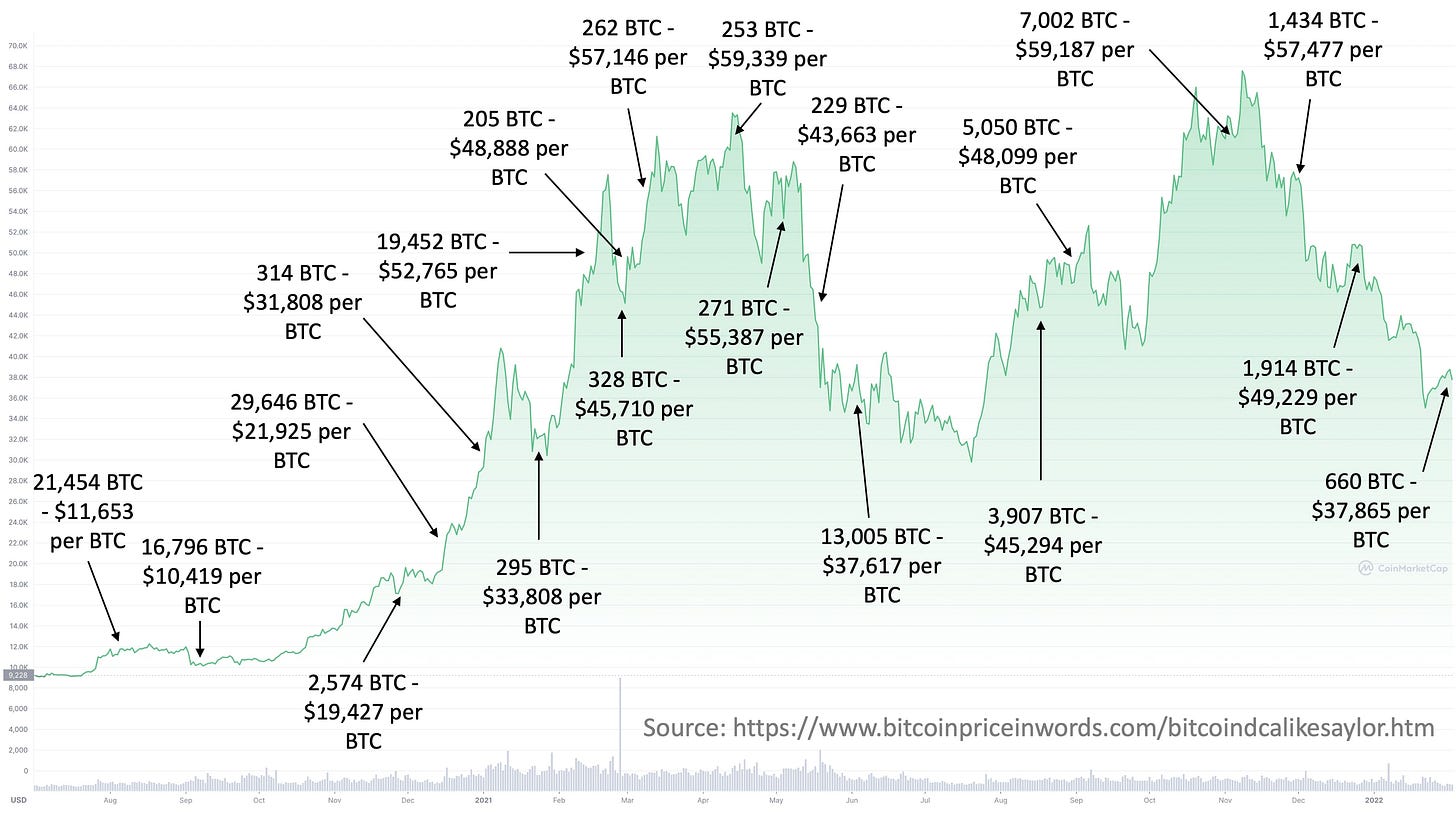

By further analyzing this listing of BTC purchases made by MicroStrategy, I then made the following illustration:

This gives you a better look at how Michael J. Saylor applies the Bitcoin DCA strategy with MicroStrategy. From this, I have retained 4 main rules that you can apply yourself if you have chosen a DCA buying strategy with Bitcoin.

1. DCA purchase no matter what

After embracing the Bitcoin revolution, Michael J. Saylor was quick to say that he had no intention of selling the BTC units purchased by MicroStrategy. His strategy has always been long-term oriented. He immediately redefined his time horizon to take full advantage of the Bitcoin revolution.

Once you make that choice, you can make DCA purchases no matter what. For example, Michael J. Saylor buys Bitcoin with MicroStrategy without even considering the short-term price. That's how he was able to buy BTC several times at the ATH level, just as he did in subsequent dips.

He is convinced of the inevitable success of Bitcoin in the future, and so he sees no reason not to buy Bitcoin as soon as MicroStrategy has some cash to protect from inflation. He doesn't fall into the trap of procrastination like some who always wait for the price of Bitcoin to fall lower before buying.

2. Take advantage of dips to accumulate more BTC

When the price of Bitcoin corrects or crashes, as it has since the November 2021 ATH, Michael J. Saylor does not panic. He explains that his strategy with Bitcoin does not depend on its short-term price, but rather on the guarantees that the Bitcoin protocol offers to its users.

Michael J. Saylor sees every dip as an opportunity to accumulate more BTC. The BTC purchases he was able to make in June 2021 or January 2022 fit perfectly into this view. He can buy more BTC than expected during these dip periods to take advantage.

However, Michael J. Saylor never makes the mistake of trying to time the market. He buys when he thinks the dip warrants a larger purchase, but if the price of Bitcoin continues to fall, it doesn't affect his view.

3. Don't worry about the price of Bitcoin after a purchase

Michael J. Saylor buys Bitcoin without thinking about what will happen next in the short term. Thus, he never worries about the price of Bitcoin after a DCA purchase. The price may go down or up, Michael J. Saylor continues to stay the course with his long-term vision. He knows that Bitcoin's goals are long-term.

Whether he bought Bitcoin at $38K or $35K won't make much difference in 10 or 15 years. Many think this is wrong, but given the phenomenal upside potential of Bitcoin's price for the future, it will make little difference in reality. You'll have just a little more or a little less, but not in a way that will change your life as much as if you hadn't taken the Bitcoin opportunity.

4. Taking the long view allows you to implement a DCA strategy effectively

A DCA buying strategy with Bitcoin is most effective when you can take a long-term view, beyond 10 years. This will allow you to HODL Bitcoin no matter what for at least two full Bitcoin market cycles. This is what gives Michael J. Saylor such confidence. Indeed, even if the price of Bitcoin falls after a MicroStrategy purchase, he is confident that its price will rise again afterward.

It's just a matter of time and patience. With Bitcoin, patience is always rewarded. It's up to you to be as patient as Michael J. Saylor to take full advantage of Bitcoin in the future.

Final Thoughts

Michael J. Saylor's strength of conviction with the Bitcoin revolution is remarkable. He understood the why of Bitcoin and decided to go all-in on Bitcoin. We will see in the future if his strategy was the right one, but what is certain is that one can only respect a man of conviction who translates all his words into action. Because Michael J. Saylor doesn't just talk a good game about Bitcoin on TV or the Internet, he does what he says.

An example for all those who believe in Bitcoin and have long understood that the DCA strategy is the best way to get through this monetary revolution in the most serene way possible.

Twitter

In Bitcoin We Trust

Comment & Earn!

Share your thoughts and opinions on the topics covered within this blog in the comments below for your chance to win yourself an NFT. Click here for more information on our engagement rewards.

In fact, buying bitcoin is a little different from buying other coins. It has a different metallicity. At least I think so. I don't look at the amount or price when buying bitcoin. 0.000087 btc. It doesn't matter because I bought it. I'm comfortable now. Because I feel really good. It's like a sign that I'm on the right track.

Thanks for the nice article.

BTC Maxi’s like Michael Saylor definitely show one way to less stressfully invest in crypto by just purchasing on a regular basis regardless of the price. If you don’t want to worry about watching trend lines and reading charts then this is one way to do it. I like some of the variations on this where you buy more heavily on the dips or wait for certain percentage drops before DCAing.