Some people keep talking about a bitcoin bear market.

I don’t.

Not just because the definitions of “bear market” change from person to person and depend on arbitrary charting patterns and semantic contortions, but also because we have not seen a market cycle peak.

At least, not a peak that matched any peak we’ve ever seen.

You can cherry-pick signals that we see at previous peaks, but those signals also appear during smaller boom/bust cycles between the peaks. Show me a signal we see only at market cycle peaks and never at any other time, and then we can talk about bear markets.

Since we didn’t have a peak, we’re not in a bear market.

At least, not yet

With that said, I wouldn’t get too complacent. Some people say the bottom’s in and prices can only go up from here.

Let’s not get ahead of ourselves. This market went up very high, very fast. It’ll take a while for the dust to settle.

The $288,000 question: at what price will that dust settle?

My answer?

I don’t know and it doesn’t matter. Opportunity and price are two different things. I’d rather talk about opportunity. Price can do whatever it wants.

But, since it’s probably on your mind, I can assure you that as long as bitcoin’s price stays above $29,000 we will not have to worry about a bear market.

Why is $29,000 so important?

It’s not $29,000 specifically, just that general price area, for two reasons.

Strong hands at $29k

On-chain analysis shows strong hands have acquired a lot of bitcoin near and below the $29,000 price, based on the movements of bitcoins at that price and the behaviors of the wallets that moved them.

That’s not my analysis, it comes from other sources and it’s too complicated for me to explain but it seems valid. Bad form for an opinion piece, I know, but hopefully you’ll take me at my word.

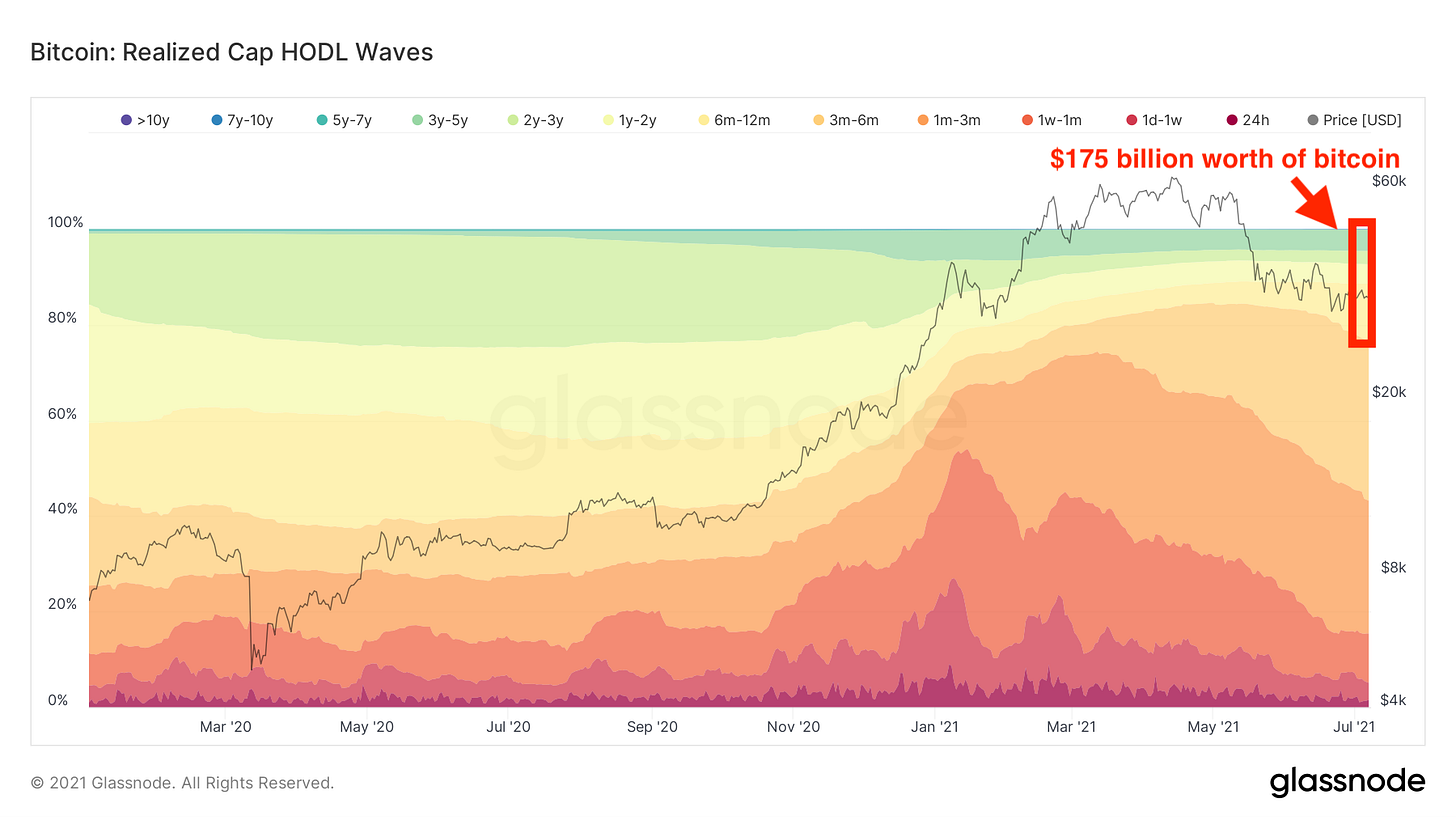

Simply put, a lot of whales, OGs, and accumulation wallets bought from September to December but not from January to April. Those wallets started buying bitcoin again in May. As shown on this chart:

These behaviors suggest a lot of bitcoin sits in strong hands—people who sat on 2-3x gains, *mostly* didn’t sell (or sold only a bit), waited for the market to cool off, and then bought more.

Perhaps they follow my plan for bitcoin’s bull market?

Or maybe not.

The more important question is how much did they buy?

It’s hard to say and depends on extrapolation skills that I don’t have. Looking at Realized Cap HODL waves, their collective bitcoins probably total at least $175 billion.

On top of that, probably at least $210 billion sits in the hands of people who bought in January/March but never sold.

Those numbers keep growing. We’re seeing massive accumulation. That should result in a strong floor for prices.

If bitcoin’s price drops below $29,000, it needs to bounce back up ASAP. Otherwise, that suggests these strong hands and new buyers can either no longer support the market or they’ve given up.

Bull markets respect the fibs

While the 55% drop from $65,000 to $29,000 freaked a lot of people out, that drop aligns with the .618 Fibonacci retracement level—the same level we see bitcoin’s price fall to during bull market consolidations, but never after the market cycle peaks.

What’s a Fibonacci retracement level?

It’s the ratio of a price’s move up to its move down. With “fib levels” we can see the size of a crash in proportion to the rise that came before it. As a result, the fibs allow us to more accurately compare one move to another over different times and market conditions.

Excluding the black swan event of March 2020, bull market consolidations always start with drops to the .618 level. Look at all the times that happened in bitcoin’s history dating back to 2011.

Bear markets start with drops below the .618 level, excluding the black swan event of March 2020. We saw those in 2011, twice in 2013, and at the end of 2017.

Each of those times, bitcoin’s price didn’t just drop way below the .618 fib level. It did this quickly:

Within 7 weeks after the December 2017 peak.

Within 3 weeks after the December 2013 peak.

Within 1 week after the April 2013 peak.

Within 1 week or 9 weeks after the June 2011 peak, depending on whose pricing data you believe.

We’re almost three months removed from April’s all-time high of $65,000, yet we’re still above the .618 level.

Does that mean we can expect the price to drop below the .618 to match previous market cycle peaks?

Sure. That’s a realistic possibility. If that happens, I will have to concede the point.

Until that happens, it’s hard to conclude this most recent crash is exceptional. Proportionally, it’s normal. What goes up must come down.

That doesn’t mean supercycle

As long as bitcoin’s price stays above $29,000, we will not have a bear market.

If history is our guide, we will most likely spend another 3-5 months going sideways before starting to trend up again. That would match the lengths of our previous bull market consolidations and even the more extreme “false peak” bear market of mid-2013, which some people consider part of a bull market that ended later that year.

Those consolidations are shaded in this chart.

As anybody who’s read Confessions of a Cryptocurrency Millionaire can tell you, those times are stressful, challenging, and seem to last forever.

Fortunately, they all happen within a larger bull market that eventually rewards everybody who has the patience and persistence to stay the course.

Any price between $14,000 and $120,000 would fit within a realistic range of prices based on bitcoin’s history. Various data models give a range of $9,600 (CME gaps) to $288,000 (S2Fx).

Don’t assume the bottom’s in and “only up” applies, but let’s not psych ourselves out. Bitcoin doesn’t always have to be in a supercycle or a bear market.

Sometimes, it can just go up, down, or sideways.

Is that so bad?

Mark Helfman publishes the Crypto is Easy newsletter. He is also the author of three books and a top bitcoin writer on Medium and Hacker Noon. Learn more about him in his bio.

Follow Me on Twitter.

Learn how to earn…

Become part of our community.

Follow our socials.

Subscribe to our podcast.

Subscribe to this publication.

It’s free (for now)

Bear market bull market is chewing gum in people's mouths. Even when Bitcoin is 60k, the bear market is coming down 2%, bitcoin crashed. News was coming out. At first I was afraid of them, and now I know.

Some people's duty is to spread fear. Only fear inoculates people. He always sets the worst-case scenario. You shouldn't listen to these people. We have to learn for ourselves and do our own analysis.

Fibonacci is very important. Who is Fibonacci for the first time at the age of 10? What's the pattern he found? I was amazed when I found out. It's also a very important indicator when analyzing. He can't always show the truth, of course. But it gives you an important idea. And real math.

Thanks for the nice post.

The language of article is very clear and entertaining to read. I like mathematical explanations, .618 Fib factor got me there. I hope that cycle won't happen this time, and we will see the ascending trend.

There is something noticeable: we always tend to categorize things, it's not just about Bitcoin. We always think that they will follow a pattern, and things will be defined accordingly, but we ignore the spontanous moves.

Definition of bear market depends on people. I wasn't active in crypto world during 2018, but I think bear comes out of fear, and they feed on fear. What I see last 3 months was nothing but fear of people. Moreover, the volume of market is great compared to 2018, maybe that's why the price couldn't be that volatile.

Thanks you for this nice article. : )