AotC - And Now, Back to Our Regularly Scheduled Programming

Welcome back!

Not much has changed since last we spoke. We’re almost out of the dip we were in when I published The Pause before the Storm, and many of the charts have tracked perfectly with what I laid out in that episode.

Like last year, I plan to do a massive once-annual Christmas Special this year as well, which will outline our results for 2021 to see how my calls stacked up against what actually happened! What better way to judge if this newsletter is worth it, right?! So you all can look forward to that within Dec.!

Lets jump in:

Total Market Cap - 6H - click to view:

Thesis has played out exactly as I said it would in Episode 29. Price still within the flag, and breaking long from it any day now. Thesis invalidated on a break-and-close below the yellow boundary line + below the green support area. This is unlikely. If we do get a close below these 2 levels, I will be selling 100% of my stack to stablecoins.

BTCUSD - 6H - click to view:

Again, basically directly on point with what I pointed out in Ep. 29. Bull Flag still forming, and looks like we’re getting a mini inverse-H&S pattern within the bottom of the flag, which makes it twice as primed for a turnaround. Nice rejection of S/R as well, at the base of the flag!

ETHUSD - 6H - click to view:

On ETH, we have a beautiful clean Impulse long post-rejection of this extremely strong red S/R zone ($3950-4225). What follows an Impulse? A corrective cool-down / pullback / consolidation period; whatever you want to call it. It’s usually in the form of a Bull Flag that pulls back opposite of the Impulse that just occurred. Where do these typically happen? At local highs. We’re about to be there, at $4865, and I think price will form a mini Bull Flag just under this high, before breaking up through and into Price Discovery. We may then get a brief re-test of that S/R as new support, but I don’t expect more than a single wick…

Alt Index - 6H - click to view:

Still playing out exactly as in The Pause before the Storm. Thesis remains unchanged.

RUNEUSD - 6H - click to view:

I’ve doctored this chart up quite a bit since my last episode, but again, basically nothing has changed since Ep 29. I added in some new red S/R zones to make them clearer than a bunch of static lines. Just pure S/R lines are tempting because they look so clean, but they tend to be more confusing to people who aren’t as familiar with TA that think they’re 100% static. Not the case. Think of them more as little trampolines that absorb the shock of price colliding with them, and, depending on the volume and beliefs the market participants that pushed price there to begin with hold, the zone may rocket price away from it or absorb the shock more deeply. So ALL “static” Support/Resistance levels, even those posted by the pros with 300k+ followers on CT, should be viewed as the red “zones” you’ll typically see on my charts, more than lines.

Back to RUNE, I’m still long, still buying more when I can at these prices, and the next major catalyst for me on this chart is previous high. Each red zone, when reached, will probably slow price and form a mini-flag below (or within) each, but I don’t see anything that will majorly halt price before $20 is re-achieved.

LUNAUSD - 6H - click to view:

LUNA has seen a strong run up (a clear high-volume Impulse), even throughout the last 72hr where other coins have continued to stagnate. Lets test your memory from above: What follows an Impulse? A corrective cool-down / pullback / consolidation. Usually in the form of a Bull Flag, and it usually pulls back opposite to the direction of the Impulse that just occurred. Where do these typically happen? At local highs, or in this case, re-testing recent highs as new support. So, in summary, I expect a flag here re-testing this previous (local) high as new support, then a run up to the 3rd-touch area on the trendline depicted in the SS above. Remember: 3rd touch of any trendline will likely see the strongest rejection, as it’s the first touch that 100% confirms the trendline’s placement.

SPELLUSD - 4H - click to view:

On SPELL, I’m thinking we’ll see a large inverse H&S pattern here. I’m looking for a break above the containing trendline, then a re-test of $0.015 for the final shoulder / completed pattern before the real move up. Let’s see how this plays out….

Reader Request - BNBUSD - 1D - click to view:

BNB playing out exactly as predicted in my Nov 16th episode. Nothing more to add to this except that it’s becoming more clear to me that we’ll likely see a re-test of the 200EMA before the break above ATH. This would line up perfectly with the 3rd touch on the bottom-boundary of the Flag it’s in.

Reader Request - AVAXUSD - 1D - click to view:

As with BNB, I think we’ll see a re-test of EMAs on this one before a continued move up. A bounce from the 50 may be just what we need to springboard up to the 3rd touch on the USTL (upward-sloping trendline) pictured above. Next target should be about $160; of course, depending on how much more consolidation occurs before we move higher, we may intersect with that 3rd touch higher or lower on the USTL, thus resulting in a higher or lower next-target.

Reader Request - FTMUSD - 1D - click to view:

Unfortunately, and strangely enough, FTM doesn’t look tremendous here. Looks like we just got the right-shoulder in a fairly clear H&S pattern, and a break below the neckline would confirm this. Let’s see how this plays out - this pattern may fail if the rest of the market picks up again, because FTM is certainly undervalued even here, in my opinion. Keep this H&S in mind when you do your own analysis, and see if the pattern starts looking a bit wonky. I’d say the H&S is invalidated on a break-and-close back above the high that was just formed by the right-shoulder, & the 50EMA.

Reader Request - CUBEUSD - 1D - click to view:

As with AVAX and BNB, I think we’ll see a bounce from the EMA here, as I’ve outlined in yellow. That would be the final touch on the bottom boundary to complete the Wedge pattern & make it official, and if it bounces (which it likely will), that would be a great value-buy. That being said, I don’t know anything about CUBE. DYOR. Obviously this has had a massive run up so far, so taking a bit of profit anywhere in here within the first major piece of structure that’s formed since the Impulse would be advised.

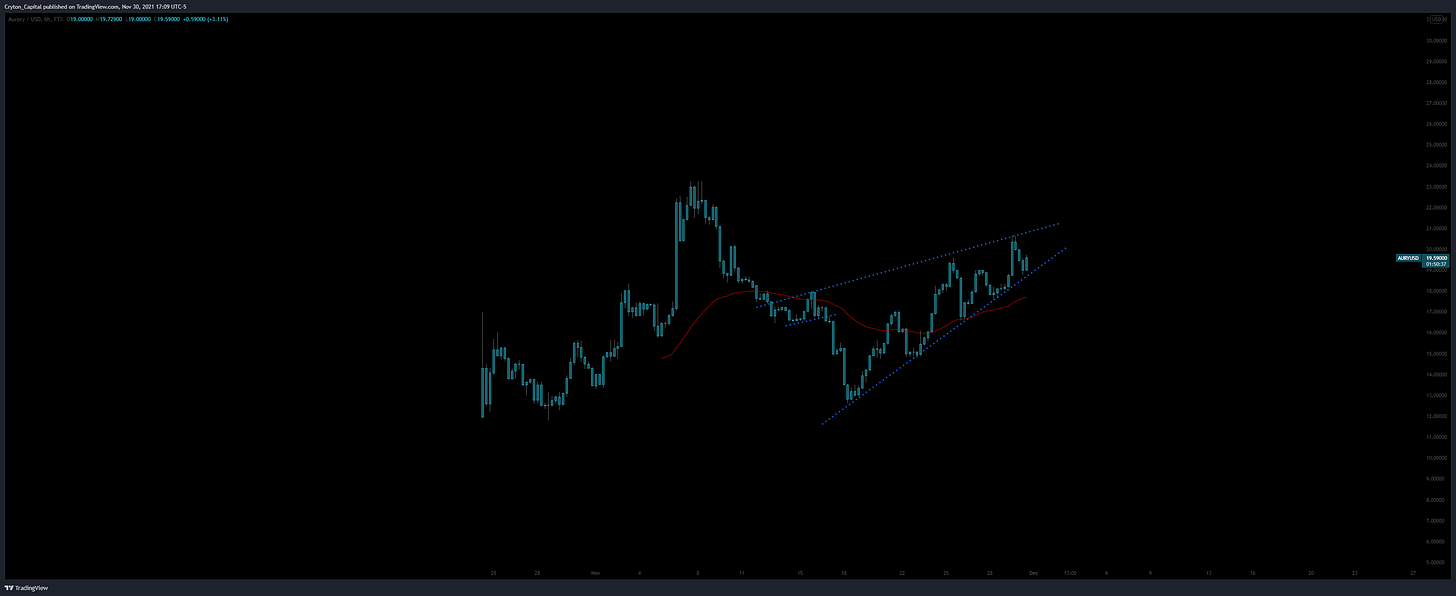

Reader Request - AURYUSD - 6H - click to view:

Not a tremendous look on this chart - we’re in an Ascending Wedge, which tend to break short. It doesn’t look like AURY has really moved a ton and it seems like a fairly new coin, so you can just choose to HODL, but I’d personally be taking full profits (if you’re in any yet) upon a re-test of the upper boundary of the Wedge. A re-test in that area will very likely perfectly intersect with the previous ATH, which will surely be rejected. The rejection may be strong enough to force price down out of the Wedge, and like I said, Ascending Wedges tend to break short, so this thesis is in line. You can then use your profits to re-buy on strength, which would be a breakout + re-test of that ATH as new support.

Reader Request - VRAUSD - 6H - click to view:

This too has played out exactly as I said it would in Episode 29. See my chart from that episode below, and compare it with the above (current) chart. Nice value area here, with this re-test & double-bottom, rejecting previous high as new support. This is what you should look for when I mention “buying strength” on the AURY chart.

Reader Request - CEEKUSD - 4H - click to view:

This is a weird chart that I can’t really do anything with, sorry. Each one of these swings are 70-80%. I’m talking each candle… I can’t help with that TA-wise, lol. Certainly looks interesting though!

Reader Request - US Dollar Index - 1D - click to view:

On the US Dollar Index, it looks like we’re in a massive Expanding Wedge here. The median line of the Wedge, which so happens to be a nice little S/R line, has just been broken with volume. I expect a re-test of this line, then a run up to the 3rd touch on the upper boundary of the Expanding Wedge. This 3rd touch should reject even more violently than the first two. The pattern will then be considered complete.

Summary:

Not much has changed since my last episode. Which is probably a good thing considering the Holiday Season should be our focus right now! More time with friends & family is the goal we’re typically after with the money we hope to gain from the markets, but don’t forget you can have that now, too :}

We’ll keep an eye on the market, and I’ll be TAking Requests next week for the final episode of the year, which will probably be released around the 15th!

Then, to close the year out, I plan to do the big ole’ Christmas Special between Christmas and New Years, which will be a massive “year in review”-type episode!!

Until next time!

CC

Disclaimer:

Cryton Capital is not a registered investment advisor, legal advisor, tax advisor, or broker/dealer. All investment / financial opinions expressed in any-and-all posts on this page, including screenshots & captions, are from the personal research and experience of the owner, and are intended to be interpreted as educational material only. Although best efforts are made to ensure that all financial charts and commentary are as up-to-date as possible, there may be times where price moves beyond key levels before the chart can be posted. Alas, this is part of the fast-paced financial sector and cannot be avoided. Also, occasionally unintended errors and/or misprints may occur.

Follow Me.

Learn how to earn…

Become part of our community.

Follow our socials.

Subscribe to our podcast.

Subscribe to this publication.

It’s free (for now)

Great stuff mate. And yes, these are truly worthwhile. Keep em coming please!!

Thanks Chris! Great episode as always