Welcome back!

This market is testing the best traders, yet the best investors are unphased. Being a trader doesn’t mean you always need to trade. Being an investor doesn’t always mean you need to sit on your hands and wait for half your life for boring returns. Learn to fluidly slip between roles in the market, as the market flips through it’s cycles & seasons.

Lets jump in:

Total MC - 4H - click to view

Current Total Crypto Market-Cap chart isn’t looking great… We just broke below a key S/R (Support / Resistance) level, and have just re-tested the bottom of it. It could also be argued that we have even broken short from the mini-flag that formed to re-test that S/R… Now it looks like we may have a day or two before we face one final confluence factor: a retest of the 50EMA. Once that occurs, I see this falling even harder. Total MC falling = money being withdrawn from the crypto space and removed from the ecosystem.

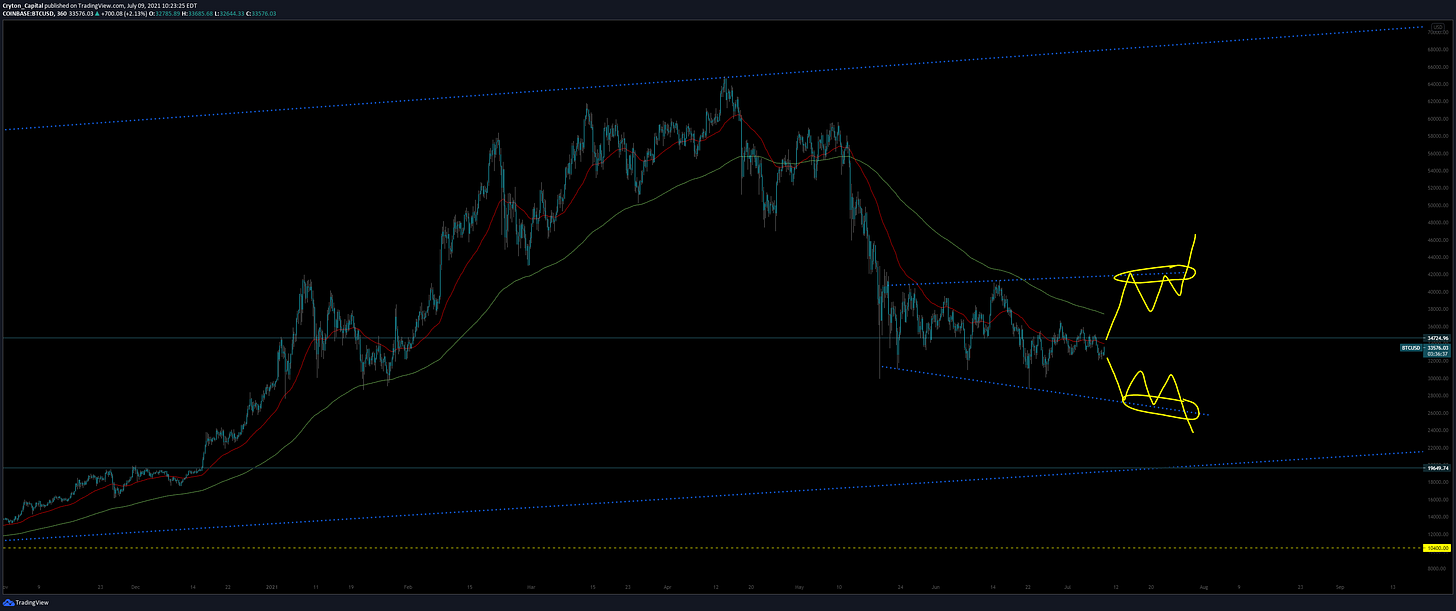

BTCUSD - 6H - click to view

I see the following two options… Right now, we’re in a Bear Flag. It’s an incomplete structure, as we only have 2 touches on each flag boundary. I believe we’ll get one more touch before this structure breaks, and I tend to believe it’ll be a retest of the upper boundary rather than the lower one (just based on how price has formed within). If we reach the upper boundary impulsively, THEN correct within the overall structure’s boundary forming a mini-flag, we might break long from there. However, if we chop up slowly / correctively, then impulse short, and correct along the inside of the lower boundary, we’ll very likely break short from there. In summary, whichever boundary gets retested correctively: plan for price to move out of the opposite side of the flag. Alternatively, whichever boundary gets retested impulsively: plan for price to move out of that side of the flag. In the meantime: patience!

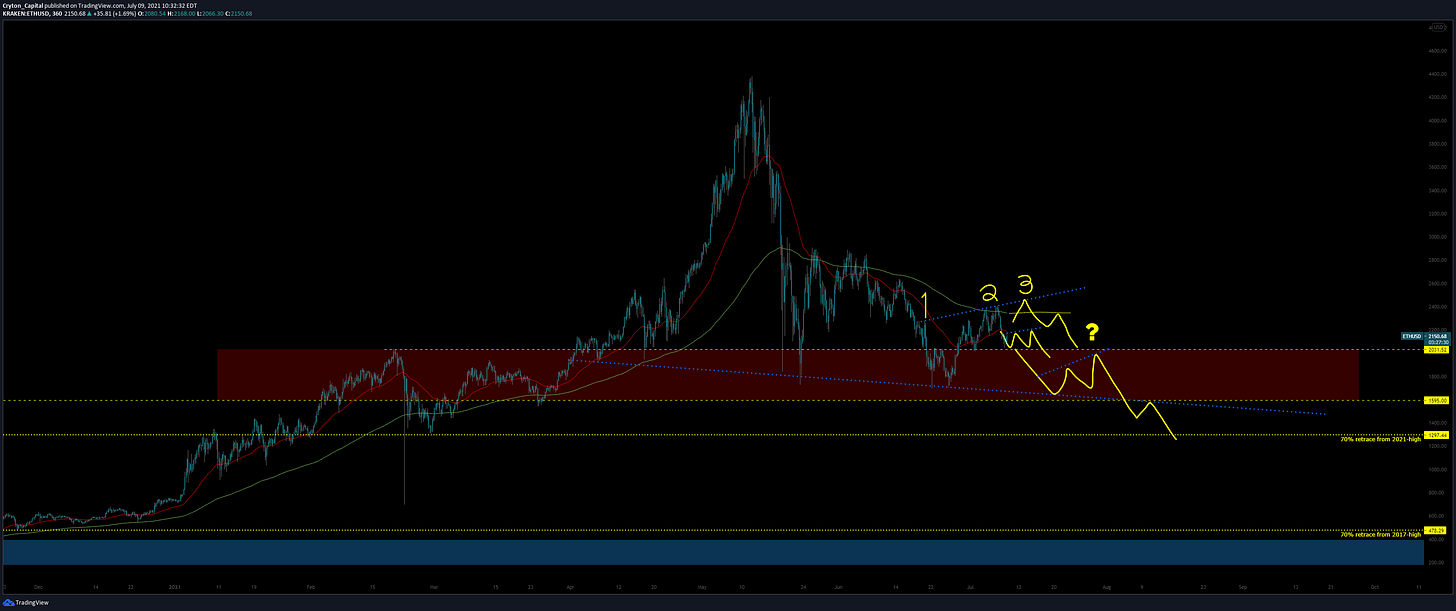

ETHUSD - 6H - click to view

We have further incomplete structures forming on many other pairs, such as ETHUSD above. We could do many things here, so we will just have to wait and see. Price may go back to the upper boundary and re-test it a 3rd time (again, 3rd re-test is always the most powerful); alternatively, we may just re-test the 50 with a mini-flag and drop from there. If we impulse down into the red zone after the 50 is re-tested, then correct along the inside of the lower-boundary, we could break short from this zone and do a full 70% re-test, as is common at the depths of bear markets. That would put price around $1290, which I could certainly see without even a stretch.

The bull case? A break long, cleanly, up through the 200EMA, and correctively re-test of the top-side of it as new support.

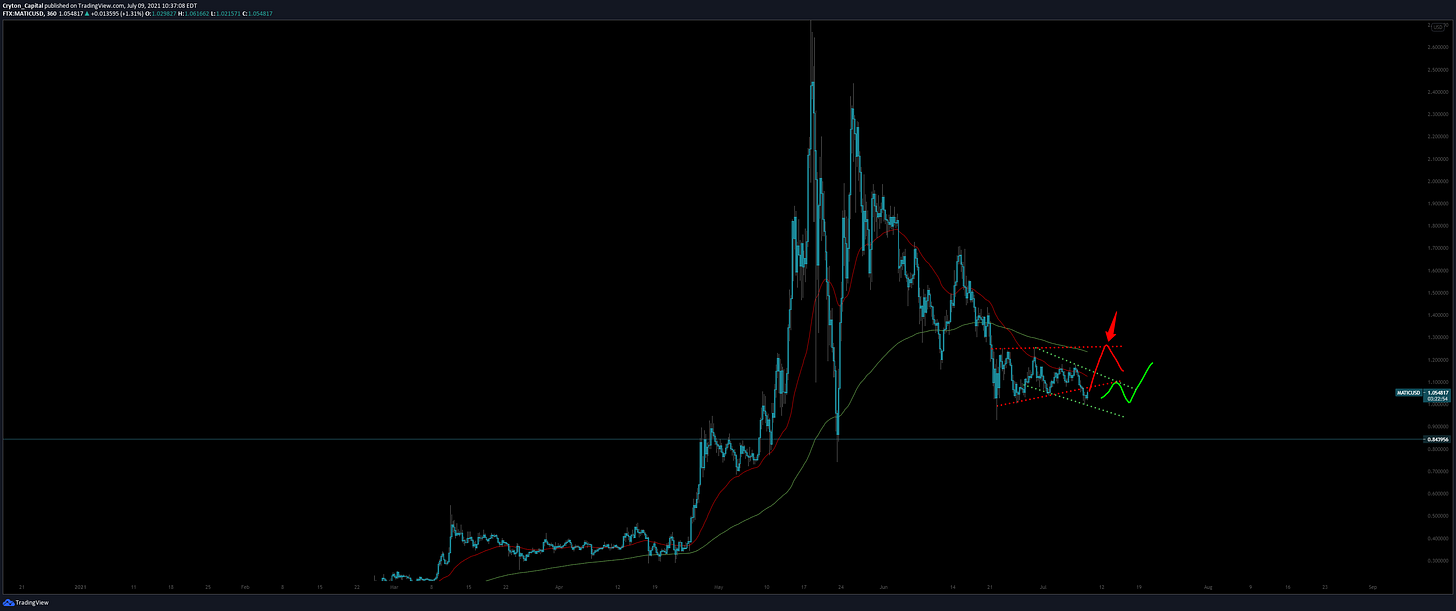

MATICUSD - 6H - click to view

Here I see two options as well. Again, patience is necessary while we let these new structures complete, to give us a better picture. In red, this could be a Bear Flag that just broke short. Alternatively, we may have just made the 2nd touch of a Bull Flag (outlined in green), which would have us moving up. As with ETHUSD, a clean break up through the 200, then a re-test of it as new support would help confirm this.

RUNEUSD - 6H - click to view

RUNE, my favorite altcoin, is looking quite bearish. “Marrying our bags” does us no good. If it’s looking bad, I’ll sell ranges and flags on my favorite coins just as I do on the charts of the projects I don’t really care about. I’m a trader, and that means keeping a cool head, and regardless of the bullishness of a project, if it’s not showing strength, that’s a call to exit (or at least move to Spot). If you’re uncomfortable, it’s looking bearish, yet you truly believe in the project, at least sell half and get some $$ on the side, ready to buy lower. That will help you be prepared for either outcome, and ease your discomfort.

You always want to approach the market from a place of strength. If you’re not feeling that strength with your current positioning, you need to move into a place of strength as fast as possible by identifying what is making you feel uneasy, and either cutting your loss, getting more cash on the sidelines, or re-distributing into alternative projects to help balance the risk.

Anyway, RUNE just completed a Bear Flag. It’s a full Flag / complete structure, too. Bearish. It looks very likely that we’re going down to the next-lower S/R zone (about $4.70).

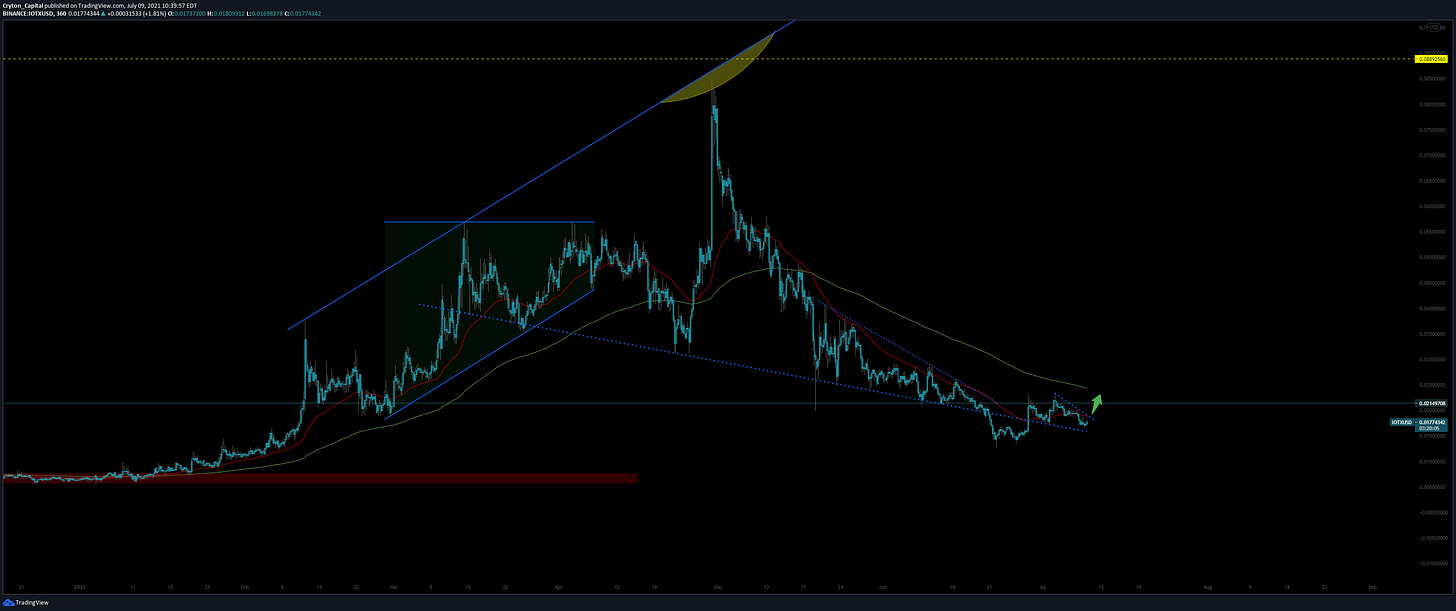

IOTXUSD - 6H - click to view

IOTX is actually looking decent here. It just Impulsively broke back up into previous structure (so the break down was false / a fake out), and now we’re forming a mini-flag. It looks like it wants to push higher up to the 200EMA. Might be a nice little trade, at least 1:1, with a Stop below recent local low.

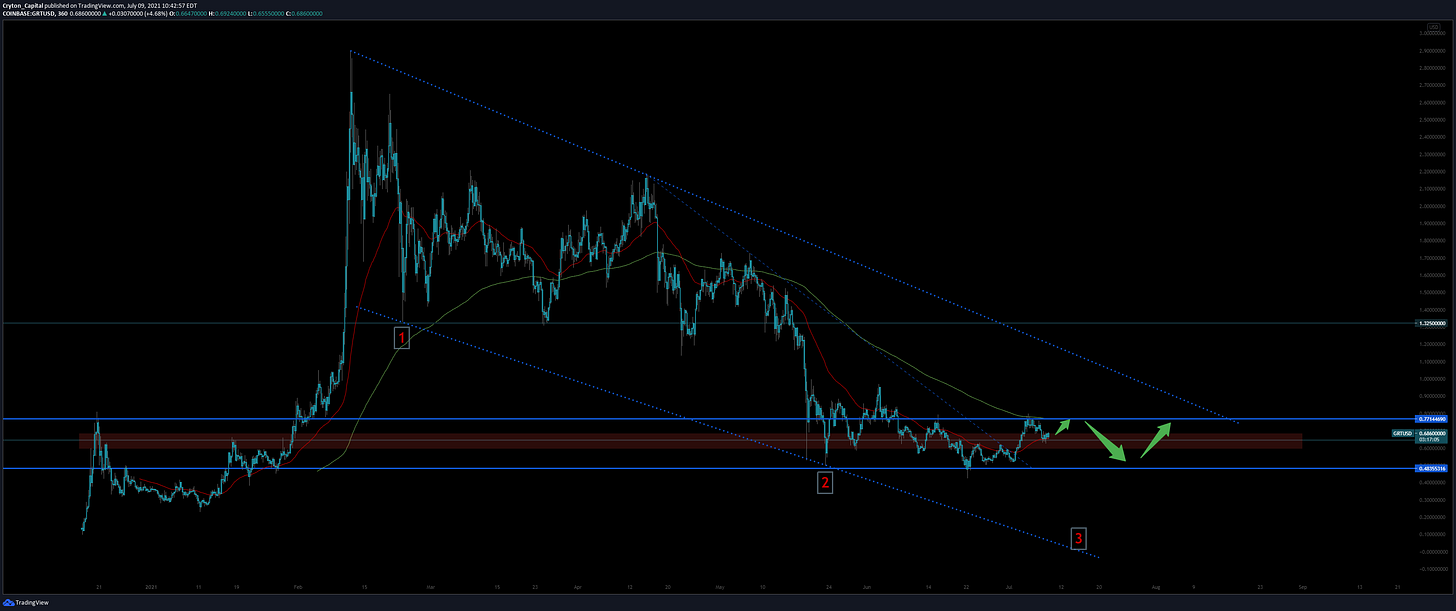

GRTUSD - 6H - click to view

We’re range-bound on this one. Could bounce in here for quite a while. Overall, we’re in a large flag, but unless you want to trade this boundary-to-boundary, not much opportunity to be had here until we show better strength. Too choppy for my blood, and I’ve exited GRT fully for now, at the top of this range. Still one of my favorite projects, simply based on what they’re doing, but the token doesn’t reflect that… yet…

Reader Request - ADAUSD - 6H - click to view

ADA is showing surprising strength. This project’s following has never ceased to amaze me. I’ve been trading since 2013 and have never once traded or owned ADA, but that is not to say that it is bad. I just have never been able to quantify exactly what they’re doing, or why someone else couldn’t do it better… (and faster, as it’s one of the OG crypto projects, and still doesn’t seem to have much going on in the way of chain activity or DAPPs). Meanwhile, stuff like MATIC spins up and has projects migrating over to it left and right… Makes you wonder what is really going on behind the scenes of ADA. No one can say, though, that the owners of ADA aren’t resilient or passionate, that’s for certain.

Anyway, we’ve bullishly moved back up through the S/R drawn from 2017’s high, and are now re-testing it. We’re not in any form of structure here, or at least not one that’s clearly identifiable, so I won’t be able to give any advice on this one, but it’s showing more strength than dozens of other promising projects, and the last impulsive move is to the upside, so that is also positive. We’ll re-visit ADA after it has developed in this area for another week or so. Traditionally, projects that show strength in the midst of an overall Bear Market do return to the mean eventually, so just be cautious.

Reader Request - ETHBTC - 6H - click to view

ETH looks like it will be moving heavily against BTC soon. We just broke long from a decently respected S/R line (certainly not the strongest one, but it’s there), and the break itself was very impulsive. Now we’re re-testing the top of it correctively, as new support (bullish). This also corresponds with the 200EMA, so that’s another confluence factor for the trade as well. I would be migrating from BTC to ETH in preparation for the break of this flag in the coming weeks. It’s one of the clearest Bull Flags in the landscape right now.

Reader Request - VRAUSDT - 1D - click to view

VRA is a reader-requested coin (full name Verasity), and it looks to have had an incredible run up during the 2020/2021 bull mkt. It’s now in a bit of an unknown space, as we’re looking at a Death Cross of EMAs on the 1D chart. I’ve circled in yellow the various structures in play here. We had one very minor correction on the way up, but the one that’s forming currently at similar levels is looks like it will be much larger overall. We’re in a mini-flag now, suppressed under EMAs and the $0.013 level, but I think this flag will evolve to be larger, helping to complete the overarching flag (largest yellow circle). Current price doesn’t look great, and we could bleed off from here, but my gut tells me this might be a fake-out. Patience and a frequent eye on this one will tell us more soon. Pretty clean PA (price action) for a lowcap alt - thanks for bringing it to my attention.

Reader Request - XLMUSD - 1D - click to view

XLM is another OG crypto project. It’s been around for ages, has ties to IBM, is in competition with XRP (but more reputable, in my opinion), and has experienced some massive adoption and growth this cycle. As with VRA above, we’ve just broken short, are being suppressed by EMAs, just had a Death Cross, and look to be forming a Bear Flag under the key S/R of $0.33. Might see some more blood on this one, but we’ll keep an eye on the re-test of the EMAs and the underside of this S/R, which is likely coming soon. If the pullback is corrective, that is bearish. If you’re still unclear as to the difference, this very chart (XLMUSD) holds a great example in it’s trip up to recent high:

See how the runs up are very fluid, strong, and high-volume? Then the pullbacks are choppy, slow, and don’t lose as much ground vs. what was gained in the impulse? That is what I mean when I say Impulse vs. Correction.

Reader Request - JULUSD - 4H - click to view

Here is another reader request named JulSwap. Currently -96% from ATH, and looks to be bottomed out. It’s been bleeding for weeks and weeks now, and seems fully decelerated. An entry here might be a position of strength, but just know it’s a Risk Entry (no confirmation or reversal signal yet). HODLing this through the next cycle would take some serious patience, but could pay off in a major way depending on the project’s progression. I don’t know anything about the project, but the metrics look good to me on first glance. Might be a diamond in the rough!

So the summary for this week’s AotC is once more: patience. There are too many missing pieces from these charts. Too many incomplete structures. Since my Pain Abounds episode on June 4th, the market has done nothing but bleed out and lose value. Although I didn’t call the top, I’ve been very cautious since that episode on June 4th, mostly sitting on the sidelines, and it’s paid off in saving me much money. It’s fine to put making money in the back seat once in a while, as retaining what you’ve made is always priority #1, and that can require one’s full attention at times! Again, being a trader doesn’t mean you always need to trade. Being an investor doesn’t always mean you need to sit on your hands and wait for half your life for boring returns. Learn to fluidly slip between roles in the market, as the market flips between it’s cycles & seasons. This is the season of learning, building better awareness, staying on the side of caution, and only risking a little on the far-and-few-between higher probability plays if you so wish. Or, alternatively, just take some time off and recoup! We’ve been through a lot, and recharging is just as important as pouring in the energy when it’s required; without one, there is no other!

Until next time,

Cryton Capital

Disclaimer:

Cryton Capital is not a registered investment advisor, legal advisor, tax advisor, or broker/dealer. All investment / financial opinions expressed in any-and-all posts on this page, including screenshots & captions, are from the personal research and experience of the owner, and are intended to be interpreted as educational material only. Although best efforts are made to ensure that all financial charts and commentary are as up-to-date as possible, there may be times where price moves beyond key levels before the chart can be posted. Alas, this is part of the fast-paced financial sector and cannot be avoided. Also, occasionally unintended errors and/or misprints may occur.

Learn how to earn…

Become part of our community.

Follow our socials.

Subscribe to our podcast.

Subscribe to this publication.

It’s free (for now)

I like all of the reviews you brought this week. Much thanks for considering to examine VRA (I was the one who requested that :p).

I haven't been on the technical side of the market, but I want to make a fresh start and learn if I can even on a beginner level, do you have any suggestions about this? I also wonder how do you search or decide on choosing the coins you trade, if you could explain briefly.

I'm already excited for the next week, thanks Chris!

I always have faith in Bitcoin. But we can take our precautions for short-terms. Thank you for these graphic illustrations and comments.