Did you hear about bitcoin’s two-day death cross?

It’s when one of bitcoin’s short-term moving averages crosses below a long-term moving average on a price chart. That’s happened twice before, and it will happen again within the next few days (possibly before you read this article).

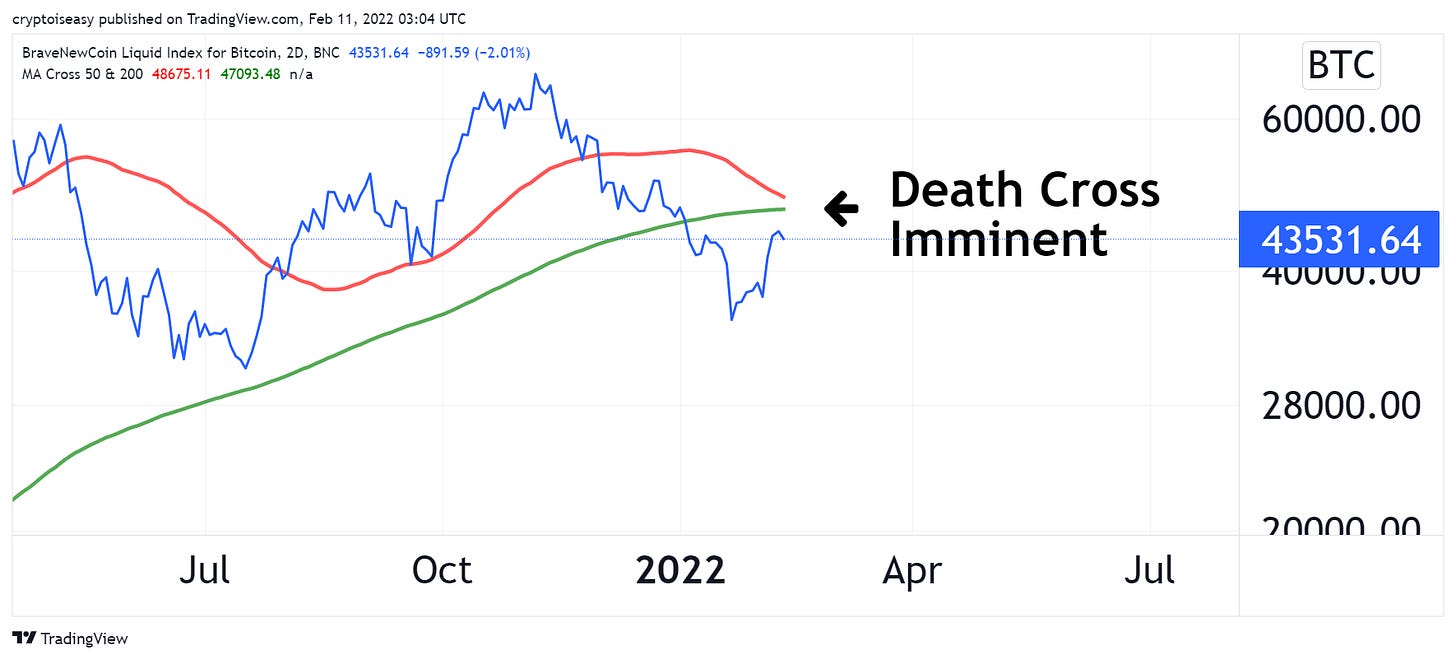

Look at this chart, which shows the two lines they’re worried about:

Traders say a death cross is really bad. Expect the price to go lower, maybe much lower.

While death, crosses, and lower prices may seem scary, a two-day death cross has confirmed the generational bottom twice.

That’s right, two of the four times bitcoin’s price had a death cross, it never went lower.

The other two times?

Its price went lower. I marked all four death crosses with arrows on this chart:

Fifth time’s a charm?

We’ve only had four two-day death crosses, so we don’t have much data to look at. As such, take it with a grain of salt.

Twice, a two-day death cross confirmed a bear market. Twice, it confirmed a bull market.

History would tell you it’s a 50/50 proposition. Could go up, could go down.

In other words, it’s irrelevant.

There are plenty of reasons to think bitcoin’s price will go up or down. A two-day death cross is not one of them.

Three-day death cross is even worse

Do you know what comes after a two-day death cross?

No, and neither do I.

That said, bitcoin’s price has made two death crosses on the three-day chart. Both of those death crosses came just before the end of a bear market.

Will we get a three day death cross?

We shall see.

Let’s not get ahead of ourselves. Unless the market nose-dives, a three-day death cross will come in late May at the earliest—if it comes at all.

And a four-day death cross?

One saw bitcoin’s price go lower for six months, the other saw bitcoin’s price go higher forever.

Maybe you’re reading more into the death cross than you need to?

Mark Helfman publishes the Crypto is Easy newsletter. He is also the author of three books and a top bitcoin writer on Medium and Hacker Noon. Learn more about him in his bio.

Follow Me on Twitter.

Learn how to earn…

Become part of our community.

Follow our socials.

Subscribe to our podcast.

Subscribe to this publication.

It’s free (for now)

Some technical analysis. I like the math part. Mathematics tells the truth, but the ratio gives 50% or 33%...

We'll never find 100% of them. there is even a 0.1% chance. That's why we need to take the right amount of care. It's neither too important nor too insignificant to be ignored. The golden ratio should be found. You have to look and get an idea.

Thanks for the nice article.

This doesn't scare me at all since we've been chased by bears last 4 months. My guess is that it will go up or stay in this area for a while