Game Theory in Action – The Example of Vladimir Putin’s Russia With Bitcoin

Rather than a ban, Putin has approved a roadmap for the regulation of Bitcoin.

The position of most governments around the world regarding Bitcoin and cryptocurrencies has never been crystal clear. Most countries have been wavering between a desire to ban it and a desire for more or less strict regulation. Despite this, most of the major Western powers seem to have realized that Bitcoin is here to stay.

Rather than fighting unnecessarily and justifying the very existence of Bitcoin, it was agreed to think about regulations that would help to make the most of Bitcoin. These regulations will be more or less strict by attacking the exchange platforms and users, but there is no longer any question of a ban.

A utopian ban that China has proclaimed for the umpteenth time in two steps in 2021. First in May 2021 for Bitcoin mining, then in September 2021, for the possession of Bitcoin and cryptocurrencies.

Great geopolitical ally of Xi Jinping's China, Vladimir Putin's Russia has always oscillated between banning Bitcoin and cryptocurrencies, and more or less strict regulation. What has always struck me in the case of Russia is that the positions in the upper echelons of power have always been very divided.

This explains the great confusion that has always reigned in Russia regarding Bitcoin.

Bank of Russia advocates a ban on Bitcoin at all levels

We had a perfect example at the beginning of 2022. On January 20, when Bitcoin was around $43K, the Bank of Russia issued a “Consultation Paper” arguing for a government ban on Bitcoin and cryptocurrencies at all levels: production, trading, and possession by citizens and banks within Russia.

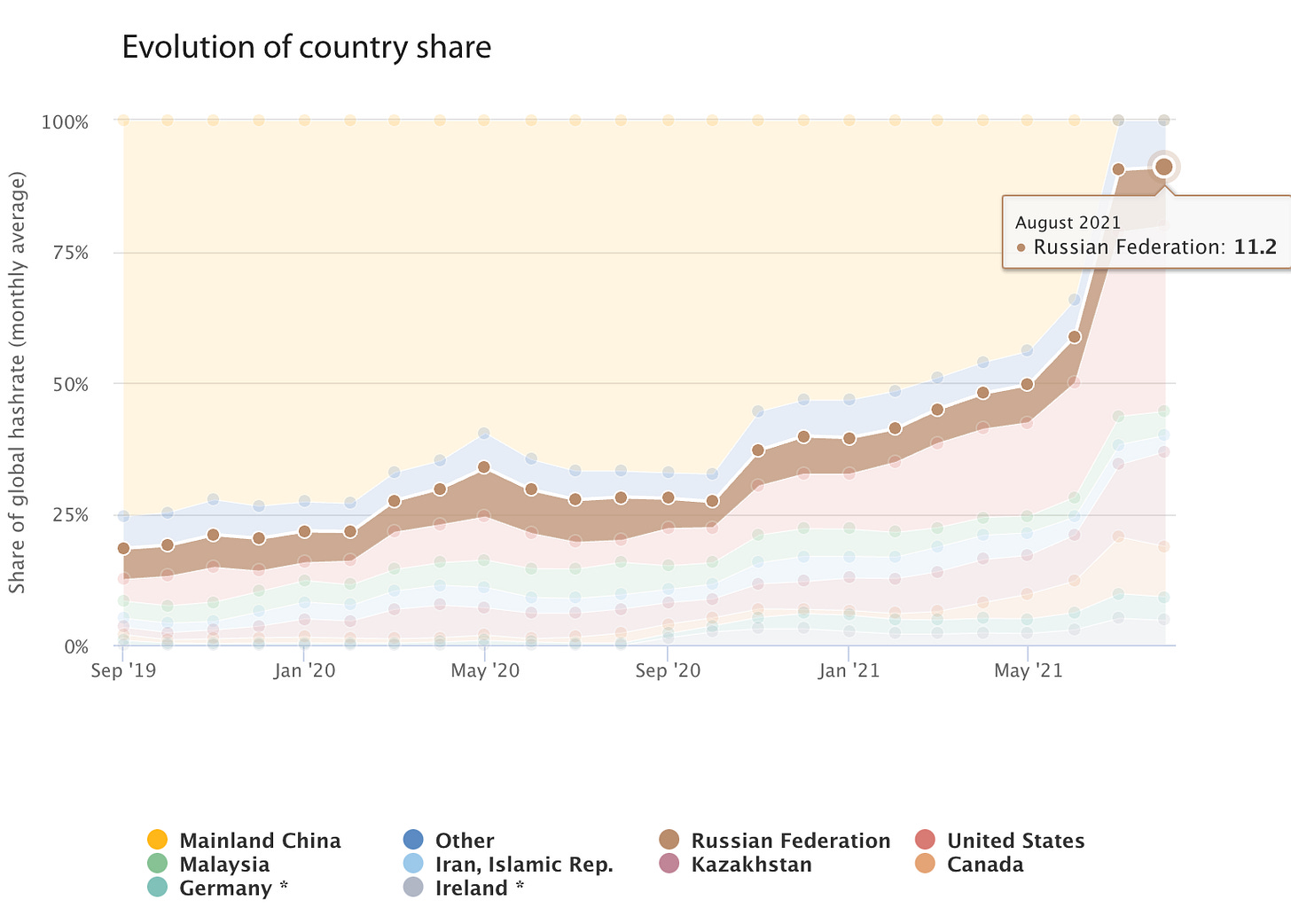

This news had then promoted a fall in the price of Bitcoin, while Russia still accounts for between 10 and 15% of the Bitcoin Hash Rate. Since China has voluntarily left the race for Bitcoin Hash Rate domination, this puts Russia in third place behind America (between 40 and 45% of the Bitcoin Hash Rate) and Kazakhstan (between 20 and 25% of the Bitcoin Hash Rate):

Called “Cryptocurrency risks and possible regulation measures: consultation paper”, the document issued by the Bank of Russia justifies its frontal attack on Bitcoin and cryptocurrencies like this:

“Bitcoin could pose a risk to Russia's financial sovereignty by facilitating capital outflow. This risk is much higher for emerging markets, including Russia.”

This statement by the Bank of Russia is deliberately catastrophic. Of course, economic sanctions by America and the European Union have caused capital outflows that weigh on the ruble.

However, Bitcoin should be seen more as a solution than a problem. Capital outflows are motivated primarily by the desire to protect one's purchasing power. Bitcoin offers a very convincing alternative to buying US dollars or Euros.

For these purchases to be even more relevant, these Bitcoin units would have to be issued by Russian mining companies. Buying BTC issued by foreign companies would be another capital outflow. And this is where Russia has a significant asset to offer.

Vladimir Putin would lean towards regulation rather than banning given Russia's advantages in Bitcoin mining

Russia can offer ultra-competitive electricity costs. It is no coincidence that thousands of mining machines have migrated from China to Russia after Xi Jinping imposed a ban in May 2021. While China's attitude has been to ban Bitcoin before now questioning the wisdom of this decision, the head of the financial policy department of Russia's Ministry of Finance has advocated a more sensible approach:

“Russia should regulate Bitcoin and cryptocurrencies, not ban them. Banning Bitcoin purchases and mining would undermine the industry's technological development. We need to let these technologies develop. The Ministry of Finance has prepared a series of proposals and is waiting for the government to evaluate them.”

Here we can see a disagreement between the Bank of Russia, which is the equivalent of the American Federal Reserve, and the Ministry of Finance. It is therefore up to the Kremlin to make the final decision. As always, I dare say.

And this is where things get interesting. In October 2021, Vladimir Putin gave an interview to CNBC in which he explained that “Bitcoin and cryptocurrencies have the right to exist and can be used as a means of payment”. In recent days, Vladimir Putin responded to the controversy caused by the Bank of Russia report by saying this:

“Russia has advantages in Bitcoin mining.”

Game theory is at work here. Russia has no interest in letting America take the lead in Bitcoin Mining alone

This is where the game theory that all Bitcoiners have been talking about for years comes into play. Putin can see that America is going to dominate this sector, which looks strategic for the future. As the third-largest country in the Bitcoin network's Hash Rate, Russia has some serious assets to bring to bear if it wants to compete with America. Why not take advantage of this?

Taking advantage of Russia's strengths to mine Bitcoin would be all the more welcome for Vladimir Putin's country as in the context of tensions around Ukraine, America and the European Union could impose even stronger sanctions on Russia. These sanctions could go as far as removing Russia from the SWIFT global interbank payment network.

Nearly 500 Russian banks and financial institutions would be deprived of access to this global network, which is a monopoly in the field.

This is when Bitcoin could be a significant alternative to circumvent these sanctions, as Iran has been doing for several years or as other countries are forced to do to resist American imperialism. Please note that I am not defending Putin's attitude on the Ukrainian issue. I'm simply giving you the arguments that lead Putin to consider Bitcoin and cryptocurrencies again.

As you can see, the reasons do exist. So, when will Russian oil or gas be denominated in Bitcoin? It's probably not going to happen tomorrow, but it could happen much faster than we could have imagined if tensions between Russia and America were to go up another notch in the coming months and years.

The latest news from the Kremlin tells us that the Russian government has decided to follow the recommendations of the Ministry of Finance. This means that Vladimir Putin has approved a roadmap for the regulation of Bitcoin and cryptocurrencies, rather than a ban that would have more negative than positive effects for Russia in the long run.

Pragmatism seems once again to prevail, as always with Bitcoin. Be careful, though, because we are not immune to a new turn of events. Russia has accustomed us to this for years with Bitcoin and cryptocurrencies.

More on this in the next episode.

Twitter

In Bitcoin We Trust

Comment & Earn!

Share your thoughts and opinions on the topics covered within this blog in the comments below for your chance to win yourself an NFT. Click here for more information on our engagement rewards.

I wonder how much underground mining is still taking place in China?

The same principle applies to them, in that they have no interest letting America or Russia become dominate.

Good read. Thanks once again. Russia mining bitcoin and being the third largest bitcoin mining country says that bitcoin is not going anywhere. All of this information is both informative and an eye opener. It's just a matter of time before bitcoin is at its ath again and beyond. For Russia to ban bitcoin and crypto would be a big mistake. With the exchanges delisting China, I'm sure a few of us out there thought that bitcoin would just go up from there, but I was wrong in my thinking. Seems that bitcoin is here to stay for good, and what a good thing that is. It is definitely refreshing to not read about China dumping bitcoin every month. To me they were just playing games with people's investments, and I for one am glad to not see this happening. I'm just going to keep on buying bitcoin and holding on for the future of my children, and loved ones. After all the future is coming at an alarming rate, and it's not slowing down. Once we get 50% of Americans on board, boom 💥 I can't wait to see where my investment lands in the next 5 years. I'm no fortune teller in any sense but I do know one thing and that is bitcoin is here, and it is here to stay.

Thank You for an amazing article. Keep up the great work. Writer has become fast my favorite place to read the articles on crypto. And will continue that way for a very, very long time to come. Peace to all