VanEck’s Spot-Market Bitcoin ETF Is Rejected – SEC Continues To Act to the Detriment of US Investors

This cannot last forever.

Written by Sylvain Saurel - In Bitcoin We Trust

The SEC had until November 14, 2021, to give its answer on the Bitcoin ETF based on the spot market of VanEck. The answer finally came late last week on Friday, November 12, 2021.

The SEC has rejected the spot market-based ETF that VanEck hoped to launch. As with previous rejections of this type of ETF in the past, the SEC rehashed the same old story: the applicants did not do enough to show that it could prevent fraudulent trading to protect investors.

This decision of the SEC is not a surprise if we remember what Gary Gensler, the chair of the SEC, said in the summer of 2021. Gensler explained that while he was open to the idea of ETFs based on the Bitcoin futures market, he was against those based on the spot market because the lack of regulation in the Bitcoin world was too great a risk in his eyes. He also mentioned the risk of manipulation and fraud in the Bitcoin market.

SEC acts to the detriment of American investors

The rejection of VanEck's ETF is therefore in line with what the SEC has been saying for several years. Those who thought that the arrival of Gary Gensler at the head of the SEC would mark a change of policy in this area must be disappointed. This is to be expected because even though Gary Gensler may be pro-Bitcoin, he is in a system that is against a monetary revolution like Bitcoin.

So he can only do what he is told to do by the Biden administration that put him there. It is as simple as that.

Yet, in recent weeks, there was some hope, and I even thought that the validation of an ETF based on the Bitcoin spot market could mark the takeoff of a new bullish wave for Bitcoin. I was wrong, and for now, Wall Street investors will have to limit themselves to the ETFs validated in October 2021: the ProShares Bitcoin Strategy ETF, which began trading on October 19, and the Valkyrie Bitcoin Strategy ETF, which began trading on October 22.

Under the guise of protecting American Bitcoin investors, the SEC is acting to the detriment of American investors.

Futures market-based ETFs are far more expensive in terms of fees than an ETF based on the Bitcoin spot market. The difference in fees ranges from x2 to x5. So this is something that goes against the interest of American investors. Moreover, many other countries have already approved such ETFs in the past and Gary Gensler's fears seem to be unfounded.

The Canadian example shows that the majority of investors prefer Bitcoin ETFs based on the spot market

Staying in North America, it is interesting to see what is being done in Canada. In this neighboring country of America, there are already several ETFs based on the Bitcoin spot market or cryptocurrencies that are exchangeable on the Toronto Stock Exchange. These ETFs have several billion dollars of assets under management at the time of writing, without any danger to the investors who profit from them.

The largest of these is the Purpose Bitcoin ETF which has bought 2,442 BTC in the last 31 days:

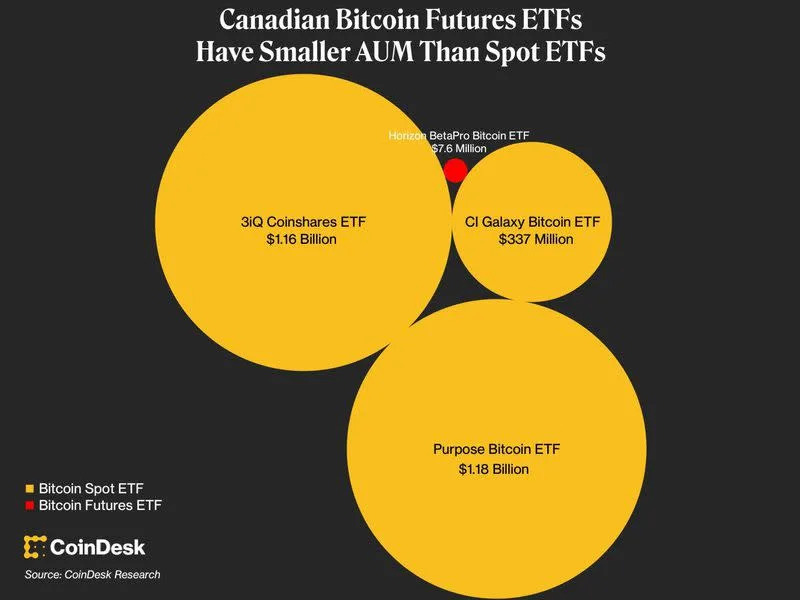

What is interesting about the Canadian example is that the three spot-based Bitcoin ETFs that are tradable on the Toronto Stock Exchange are unanimously favored by investors over the futures-based Bitcoin ETF that is tradable on that exchange.

The futures-based Bitcoin ETF represents only 0.3% of the Bitcoin ETF market in Canada:

This ratio gives you an idea of the billions of dollars that will come into the market the day the SEC validates a Bitcoin ETF based on the spot market. Because it's only a matter of time in my opinion before the SEC finally approves such an ETF.

The political pressure is starting to build with more and more voices in Washington advocating such an opportunity to be offered to American investors when the rest of the world has already been offering it for a long time now.

The SEC will sooner or later have to be less dogmatic and approve Bitcoin ETFs based on the spot market. It's only a matter of time

It's time for the SEC to be less dogmatic to consider the interests of American investors. They want real exposure to Bitcoin. While I don't think it will replace buying Bitcoin directly, these investors would feel more comfortable investing in an ETF that buys Bitcoin for them on the spot market.

Billions of dollars are waiting to flood the market and put pressure on the available Bitcoin supply. The ETF market is now worth over $9.4T worldwide, with an annual growth rate of 26%. It is certain that the day this happens, the price of Bitcoin will be boosted even more.

In the meantime, American investors who do not wish to buy Bitcoin directly will have to wait. Some may find it advantageous to invest in Bitcoin mining companies on the stock market or in a company like MicroStrategy that has chosen Bitcoin to manage its cash reserve.

Finally, it is also worth considering that the approval of the first Bitcoin ETFs based on futures contracts in America could be the beginning of a path leading to the approval of ETFs based on the Bitcoin spot market. It is only a matter of time before the SEC realizes its mistake in this area.

Twitter

In Bitcoin We Trust

Learn how to earn…

Become part of our community.

Follow our socials.

Subscribe to our podcast.

Subscribe to this publication.

It’s free (for now)

Gotta be honest here. In some ways I think Garry Guzzler is right. The BTC market is still too open to manipulation and fraudulent trading behaviours to be ready for a spot-market ETF. It seems clear to me that certain early adopters that accumulated enormous amounts of BTC and certain exchanges that offer leveraged trading continue to manipulate the markets in their favor, whether it be a liquidity hunt for big buyers or simply clearing the order books of over-leveraged greedy traders. The fact that these 2 examples alone can be achieved with ease and efficiency in the BTC market tells me that we are simply not ready for a spot-market ETF and that some form of regulation may be inevitable eventually.

VanEck's investors in the Turkish stock market (BIST) by making manipulation and speculative movements in the past

They were not allowed to enter the crypto world because there was no trust in the company and its owner.

So a decision has been made about trust. VanEck's company is valued today at $13,639,395. maybe

The company may not have given confidence in terms of value...