Written by Mark Helfman

In a recent article, Could Bitcoin’s Bull Market End Next Month?, I projected market expectations for bitcoin’s price into the future and compared the results to historical indicators of market cycle peaks.

Guess what?

If those expectations come true, we will peak next month at approximately $90,000, give or take $10k or so.

Yes, that means the market cycle peak will come next month and possibly not break $100,000.

Mark, you’re nuts. STOCK-to-FLOW says there’s no way that can happen

Yes, Stock-to-Flow predicts bitcoin’s price will reach $82,000 in June and stay above $100,000 from July to eternity.

Look at this chart, courtesy of LookIntoBitcoin:

Do you see the squiggly line at the bottom? That shows you how much bitcoin’s price has strayed from Stock-to-Flow’s predictions over time.

When the line hits the black line, that means its price is aligned with Stock-to-Flow. As the line moves away from the black line, that means bitcoin’s price is deviating from Stock-to-Flow.

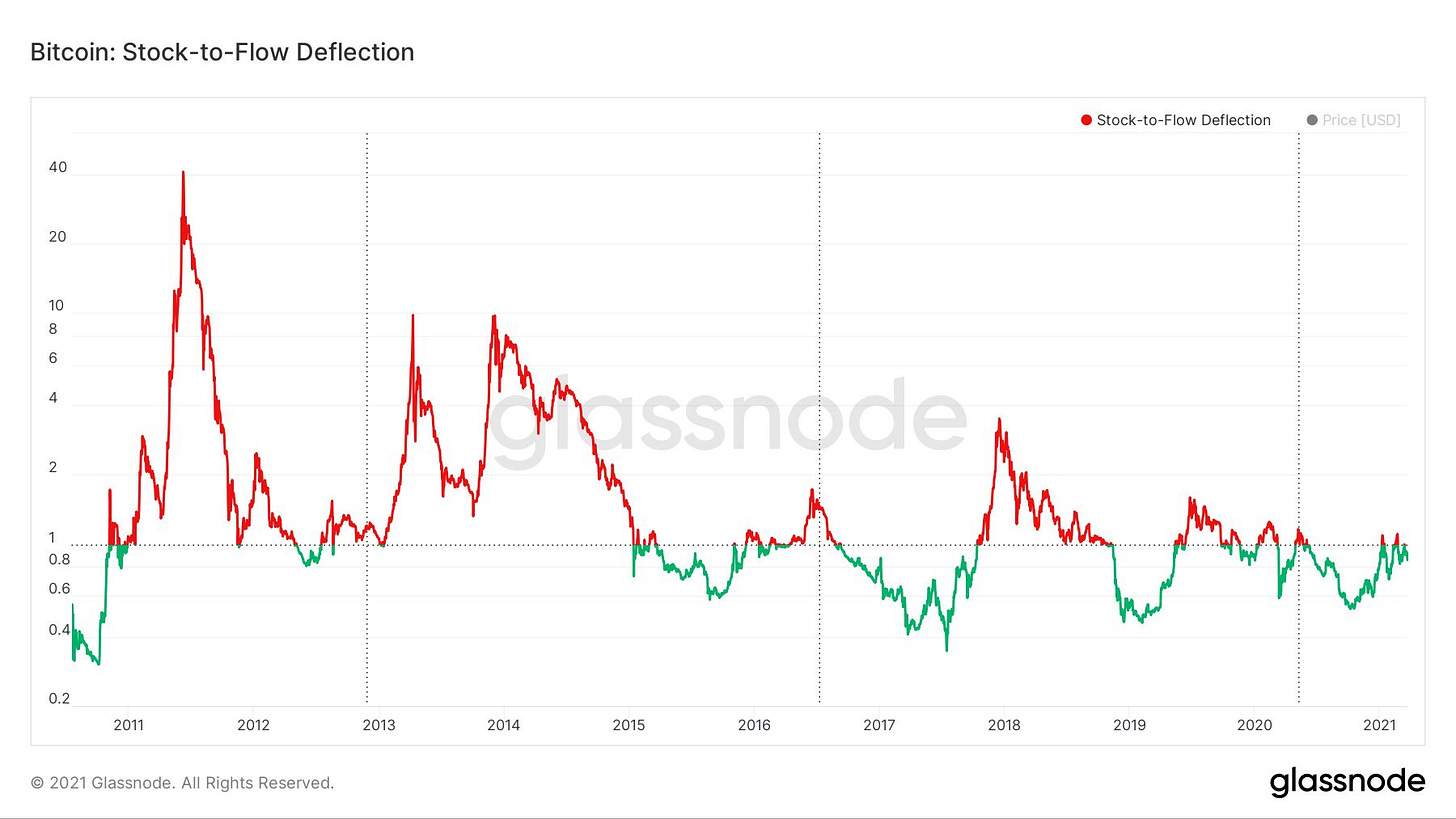

You can see it more clearly on this chart from Glassnode:

Bitcoin’s price has gone 4x higher and 70% lower than Stock-to-Flow for weeks at a time, and sometimes spends months at prices 50% below and 2x higher than the model predicts.

We’ve done it before

There’s no reason we can’t zoom to $90,000, hit a market cycle peak, crash to $30,000, then go up to $100,000 later this year (or even by summer). We’ve seen similar behavior in 2010, 2011, 2012, 2016, 2017, and 2019, though perhaps without the massive euphoria surrounding this latest zoom.

Maybe instead of a bull market that looks like 2016-2017, we get a bull market that’s more like 2013: a market cycle peak in April to cap off a 1.5-year bull run, followed by a massive crash, then a few months of Silicon Valley FOMO that sent prices even higher.

Stock-to-Flow says we can do that.

There’s also no reason bitcoin can’t chill around $40-60k for a few months or crash down to the $20,000s from here. We’ve seen bitcoin make those types of moves in the middle of raging bull markets, all within the range of prices you get with Stock-to-Flow.

Unless Stock-to-Flow is not very good at predicting bitcoin’s price . . .

Mark Helfman publishes the Crypto is Easy newsletter. He is also the author of three books and a top bitcoin writer on Medium and Hacker Noon. Learn more about him in his bio.

Learn how to earn…

Become part of our community.

Follow our socials.

Subscribe to our podcast.

Subscribe to this publication.

It’s free (for now)

This all seems like magic. Anything can and will happen. For me it's best to HODL and not panic

I think there hasn‘t been more differential analytics for an asset than for bitcoin in these past years. Ranging from back to 3k within a couple weeks to crashing 250k within the year cycle.

And they crazy thing is...not one of these is impossible. Like you mentioned we have seen some crazy ups and downs within a very short time and btc is never shy to impress.

I remember the voices after the last run and then hitting 3k bottom again...loud voice about the burst bubble, btc being dead and people loosing their livesavings.

Well its often the same people who don‘t believe and fomo at top only following green candles.

But if you believe and hodl you are good! Leave your wallet, forget about it for a couple years...like you said 1 btc (of a 21m hard cap) is still 1 btc (of a 21m hard cap) in a couple years!

Continue to stack sats! Thats the best advice...