AotC - Supercycle Confirmed!

Welcome back!

Another great week in the market! This pullback is temporary, minor, and was predictable. If you don’t think so, did you happen to see my previous episode?

My Total MC chart from last episode:

Total MC now:

Exactly as predicted. Bounce from higher timeframe Structure. Where will it go from here? Depends… Recall my lesson on Impulsive vs. Corrective? Taking that into account, we reached HTF Structure boundary how? Impulsively. Next, price consolidates. We have to wait for additional structure here, but it’s looking good and I don’t foresee any issues with this truly turning into a supercycle.

Now that that’s locked in, lets get to it!

BTCUSD 6H - click to view

Where is BTC going, specifically? We have very strong support here in this red area, so we may continue to move up through what looks to be an Ascending Channel, or we may break through the lower boundary of the channel and re-test this red rectangle area of support. If we do, don’t be alarmed… I can say with high confidence we’ll be bouncing from there…

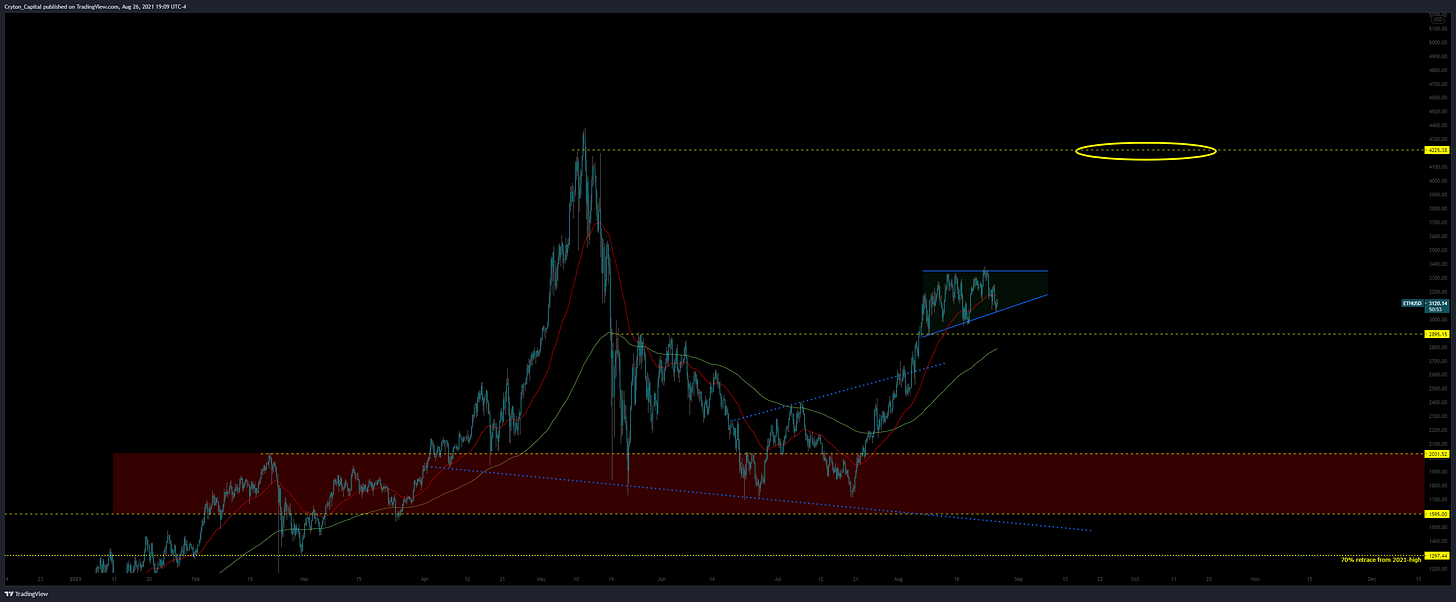

ETHUSD 6H - click to view

In a Wedge here, and price breaks out of the flat side of this pattern with much higher frequency than the angled side, so we’re looking for a re-test of ATH next. There is no resistance before that is re-tested…

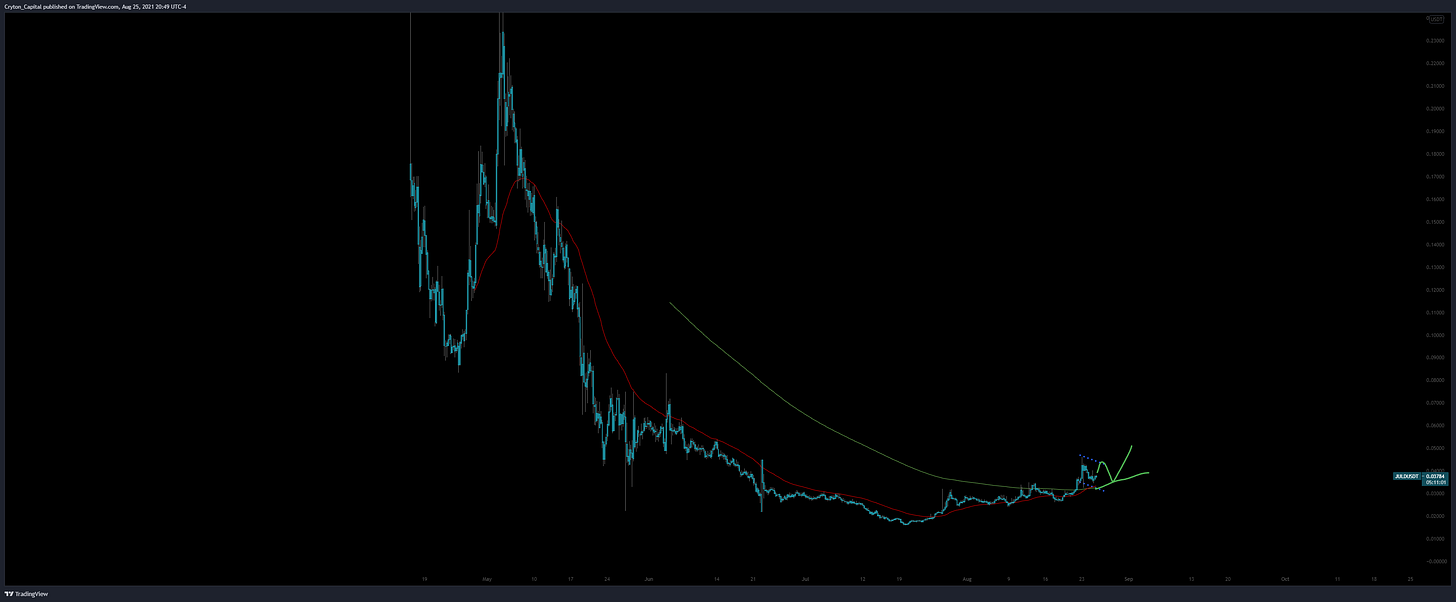

AUDIOUSD 6H - click to view

Audio token as posted in my last episode of AotC:

Audio now:

We broke out in a massive way, right where I said we would, and now we’re in a Bull Pennant. With a beautiful re-test of the 50EMA, this is good for a scale-in on the dip.

RUNEUSD 6H - click to view

RUNE formed an inverse H&S pattern, re-tested the neckline as support, and is now at it’s first re-test of the 50EMA since that pattern completed. This is a buy up until $14.90, which is our next target and potential pullback area.

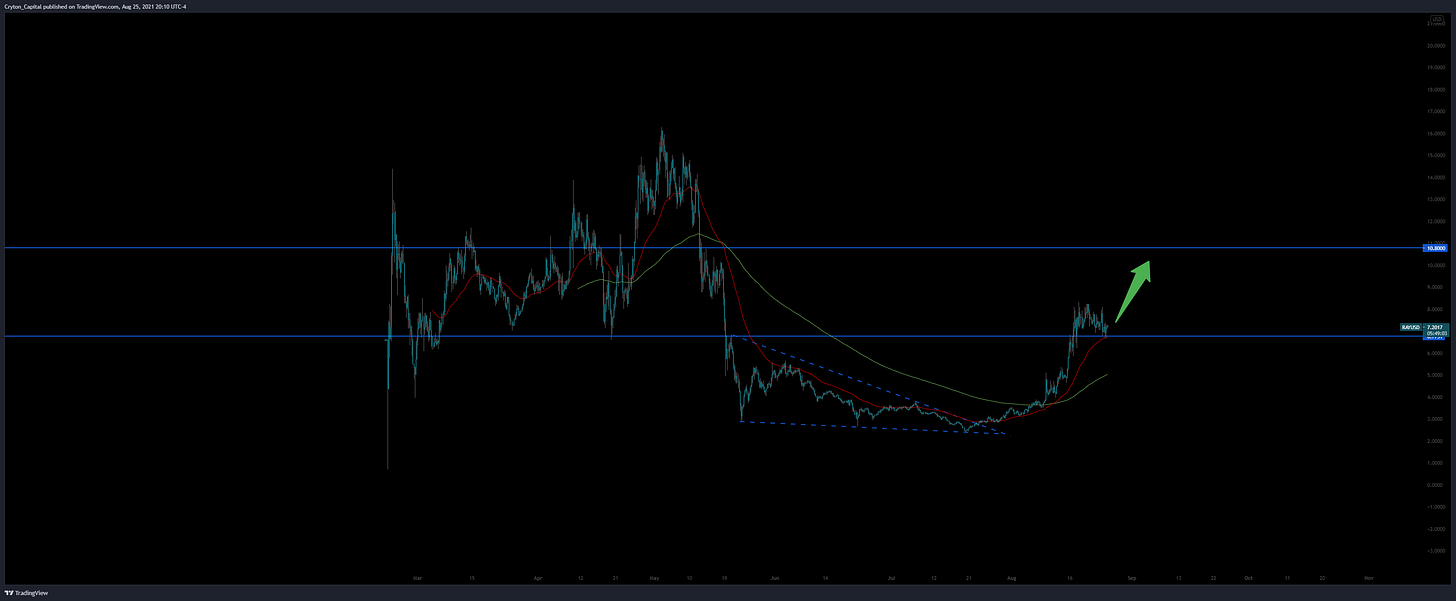

RAYUSD 6H - click to view

RAY is re-testing a beautiful S/R level here, as well as the 50EMA. The pullback is corrective and clean. Therefore the next Impulse should be as well. Next target: $10.80

IOTXUSD 6H - click to view

IOTX absolutely blew up on it’s Coinbase listing. I first pointed this unique project out as a "gem to keep your eyes on and one of my top picks for 2021” in my Christmas episode last year. This year it’s up to around $0.07 from $0.0065 back on 1/1/2020 for a return just north of 1000%. With the Coinbase listing, this project is truly set to be a beast, and I am willing to bet it will reach $1.00 in the next 4 years.

Although we can’t do much TA work where price currently is due to the recent volatility, we’ll continue to track this over time as new structure forms.

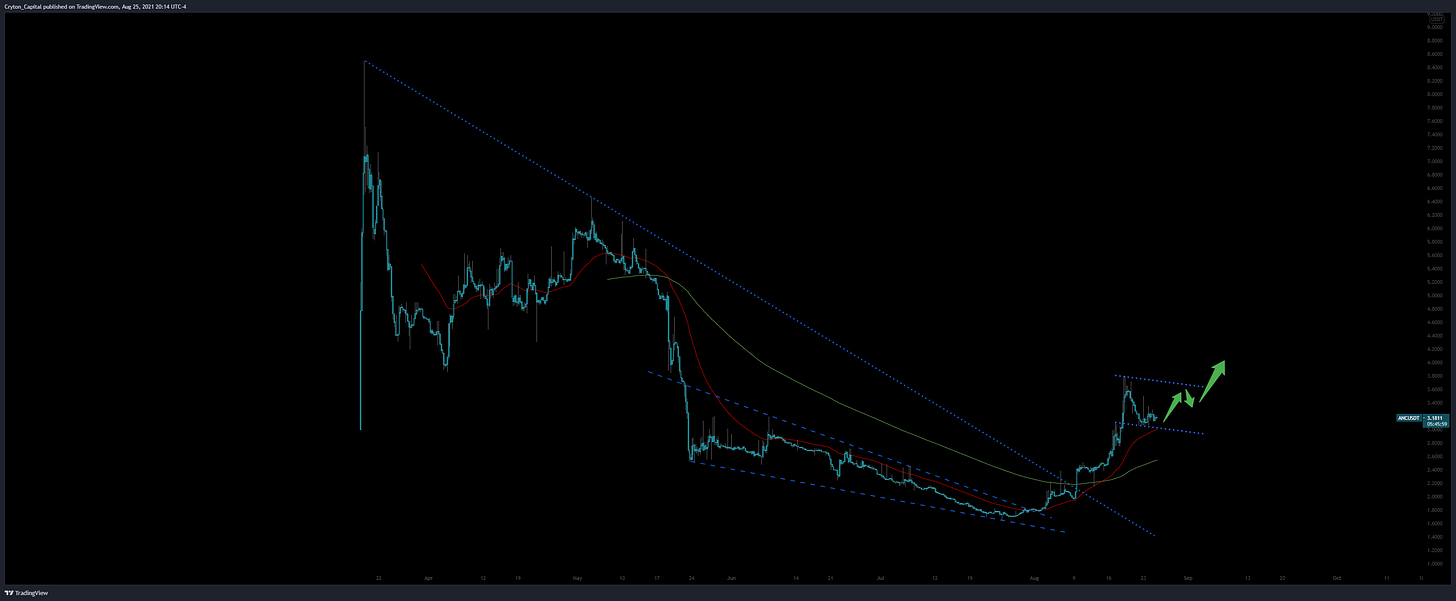

ANCUSD 6H - click to view

Anchor, a LUNA dapp, is looking promising lately. I’ve mentioned this coin a few times, but recently it’s re-piqued my attention with an incoming revised tokenomic model. I will let you do your own research on that, but we could see additional airdrops and rewards for ANC holders. Therefore, I have bought this re-test of the 50, now that it’s broken clean out of it’s Falling Wedge with nice volume.

CROUSD 6H - click to view

CRO has always been a part of my portfolio as I use and enjoy the Crypto.com VISA card and that requires a stake of 10,000 CRO (more, now, I believe. I think I was grandfathered in to the 10k Tier), so I’ve kept good track of the project.

Currently, CRO is headed to re-test an S/R line as well as the 200EMA. This is a positive thing, and will help the likely rally from this area. So in summary, it might drop another $0.015 or so to the $0.14 area, but then I think we’re headed back to $0.20.

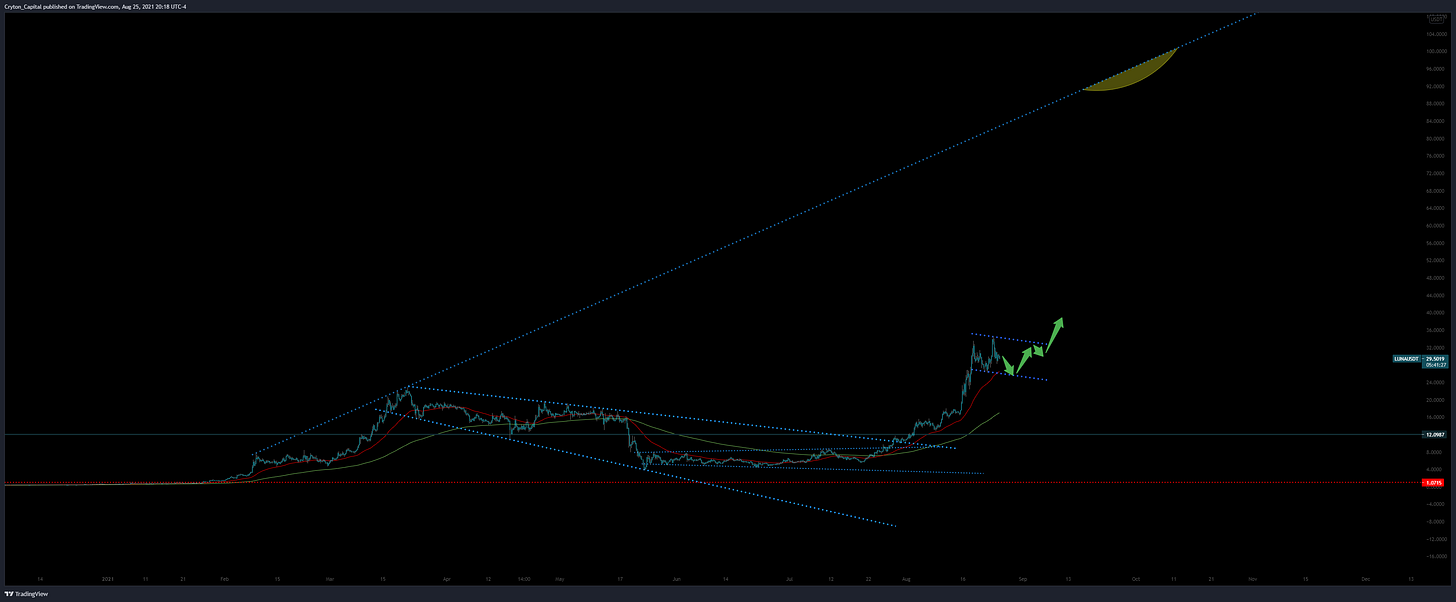

LUNAUSD 6H - click to view

LUNA is looking moonish here, and is re-testing it’s EMAs as well. We’re looking at a Bull Flag, but the pattern is not yet completed. With the incoming network upgrade, I believe LUNA could head to around $92 within the next 90 days. Although this is only about a 3x, it will be well-worth holding LUNA for the airdrops and rewards alone, as there are over 10 projects building on LUNA who are waiting to release after the network upgrade. This will increase UST demand, burn LUNA faster, and cause a springboard for price to run perhaps even past this next re-test area circled above.

WAXPUSD 6H - click to view

WAX as posted in my last episode of AotC:

WAX now:

This tapped my target almost to the cent, when I posted the next probable area for WAX to run to in this episode

As with IOTX, we can’t do much TA work where price currently is due to the recent volatility, we’ll continue to track this over time as new structure forms, but we’re looking promising as WAX is now re-testing it’s previous local high as new support. Also, The WAX Cloud Wallet just recently passed 6 million wallets!

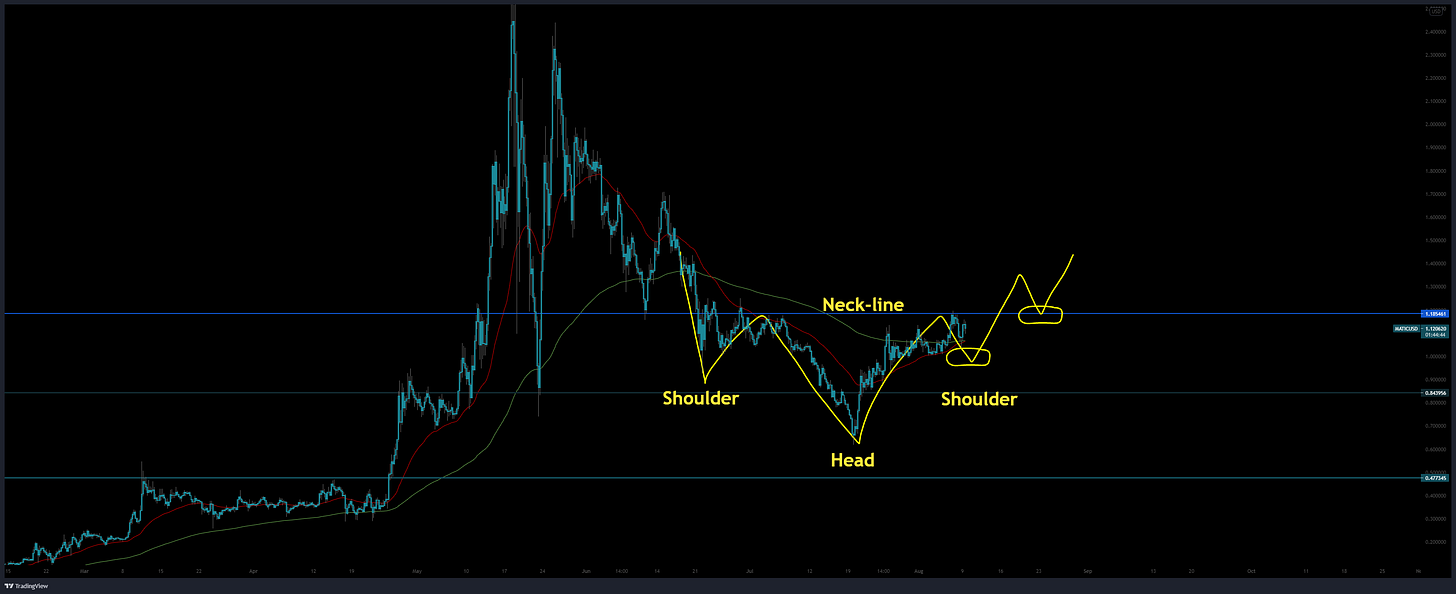

MATICUSD 6H - click to view

MATIC recently completed an inverse H&S pattern that I called above (SS from my last episode), and now looks like this:

Breaking out as expected, I was surprised that we did have a more solid re-test of the neckline on such a beautiful completed pattern breakout, but we may be getting that now. Either way, this is bullish back up to previous highs at anything above $1.15. If we break back below the neckline, I would cut all trades and wait for further confirmation.

SOLUSD 6H - click to view

SOL finished an excellent Falling Wedge and rocketed up to this area, where we’re likely seeing a new Bull Flag form. We’ll wait for completed structure on this one, but this chart is very bullish.

ANKRUSD 6H - click to view

ANKR appears to be in a nice HTF flag, and on the LTF’s we’re now in an Expanding Wedge and will likely break long from this overall structure with high volume, price using the EMAs as a springboard. Of course price will likely ping off of the boundaries of this pattern right up until the end before the big break.

Reader Request - JULDUSD 6H - click to view

Nice break above EMAs. This looks promising now, and I would be buying on the first re-test of the 50EMA, which could come any hour. This is a lovely setup. I would be targeting the $0.075 area for first TP.

Reader Request - ELASD 6H - click to view

ELA is in an Ascending Channel right now, but isn’t showing tremendous volume or any clear / clean impulse on the chart yet. It’s been a corrective & choppy ascent thus far. I would be shying toward more promising opportunities, but this could shape up in the weeks to come.

Reader Request - CAKEUSD 6H - click to view

CAKE is is a really impressive Ascending Channel, but this channel has been going for much longer than ELA’s. I don’t think ELA will replicate this channel, for clarity. CAKE’s tokenomics likely are causing this PA, and I would be HODLing this as long as the lower boundary isn’t breached… It’s quite impressive, and hardly expanding, which is good. But patterns like this can’t last, and it will likely break from it eventually, so keep yourself from getting too euphoric.

Reader Request - REEFUSD 6H - click to view

REEF is in an interesting spot here. It’s re-testing a DSTL, a USTL, EMAs, and an SR level. The PA isn’t super clean, but I would shy on this being more bullish than anything. There is no real current structure that I can work with at this moment except for this X and S/R. There is one thing for sure, $0.04-0.05 held price for a long time previously, so I would be aware of that strong ceiling on this chart.

Reader Request - AVAXBTC 6H - click to view

Nice clean chart here. Ratio pinging between 0.00086 and 0.0012. No telling on if this will continue, but when we get a 2nd touch & a bounce on the top or bottom boundary, I’d be trading this range. Of course swapping on a break of the upper boundary would be an alternative play.

Thank you

I really appreciate all your support, trust, and patience. I look forward to a new week ahead, and I’m beyond glad that the opportunities are still aplenty!

If you all to check out a sneak peak of a new crypto gem I’m slowly averaging into, you can check out SPELL. It’s a DeFi token that powers https://abracadabra.money/ and looks to be a promising yet hidden gem. I will release more on this soon, but you can start looking into it yourself in the meantime.

Disclaimer:

Cryton Capital is not a registered investment advisor, legal advisor, tax advisor, or broker/dealer. All investment / financial opinions expressed in any-and-all posts on this page, including screenshots & captions, are from the personal research and experience of the owner, and are intended to be interpreted as educational material only. Although best efforts are made to ensure that all financial charts and commentary are as up-to-date as possible, there may be times where price moves beyond key levels before the chart can be posted. Alas, this is part of the fast-paced financial sector and cannot be avoided. Also, occasionally unintended errors and/or misprints may occur.

Follow Me.

Learn how to earn…

Become part of our community.

Follow our socials.

Subscribe to our podcast.

Subscribe to this publication.

It’s free (for now)

I agree with you about BTCUSD, maybe a correction may come, but it will not exceed this red wedge.

When we move to ETHUSD, a breakout with an angled break signals that the correction will take place by a small amount.

I think that AUDIOUSD will follow sideways movements.

I like your RUNEUSD chart and I think it will work.

Unfortunately I have no idea for RAYUSD.

IOTXUSD peaked with Coinbase listing and since its price is volatile, it would be better not to comment much.

I would especially like to see IOTXUSD in your next article.

I really like your analysis.

WAXPUSD peaked with the Binance lockdown and I believe it will go more stable now.

Really, your analysis is very successful, I hope you will be much more successful.

I wish everyone a good reading.

The Reef chart is very interesting. But here's what I expect. Behold BTC rises then BnB rises a few altcoins as big as eth. The next day makes 200% of one coin while waiting for the entire market fixed.

I'm waiting for him at the reef.

Frankly, I was expecting Avax. I had it before I ascended. But there is liquidity in futures.

Frankly, my expectation from avax is at least $ 100. He's got a great CEO.

I think it's normal to back down now. Correction and breathing zone now. Monday tuesday, I think he will continue the run.

I have great expectations, especially from the BNB. I expect $ 1,000 by the end of the year.

Many thanks for the beautiful article and analysis.