AotC - 2021 Summary / EoY Special!

This is it…

The post you’ve all been waiting for.

The post where I thresh out exactly how “worth it” this newsletter is…

The post where I outline the potential-gain my recommendations could have provided you, if heeded.

This is how it will go:

All my previous setups will be reviewed with “before & after” charts. The before chart will always be the original image I posted within a 2021 AotC episode, and of course I’ll provide the corresponding episode link to said episode along with. Full transparency.

Before we get started, let’s re-visit my 4 top picks for 2021 from last year’s Christmas Episode. Do any of you recall what I outlined as my top four? Here they were: WAX, IOTX, SOL, and the LTC/BTC ratio. Lets see where those calls would have landed you, had you bought them when I released my Christmas Episode last year (Dec 21st, 2020) and sat on them until today (Dec 31st, 2021):

(1) WAXPUSD: 914% ($0.0442 → $0.449)

(2) IOTXUSD: 1,553% ($0.00735 → $0.1216)

(3) SOLUSD: 10,836% ($1.57 → $172)

(4) LTCBTC ratio: -33% (0.0047 → 0.00314)

Now that I’ve likely piqued your interest, let’s dig in some of my other 2021 calls & their accuracy:

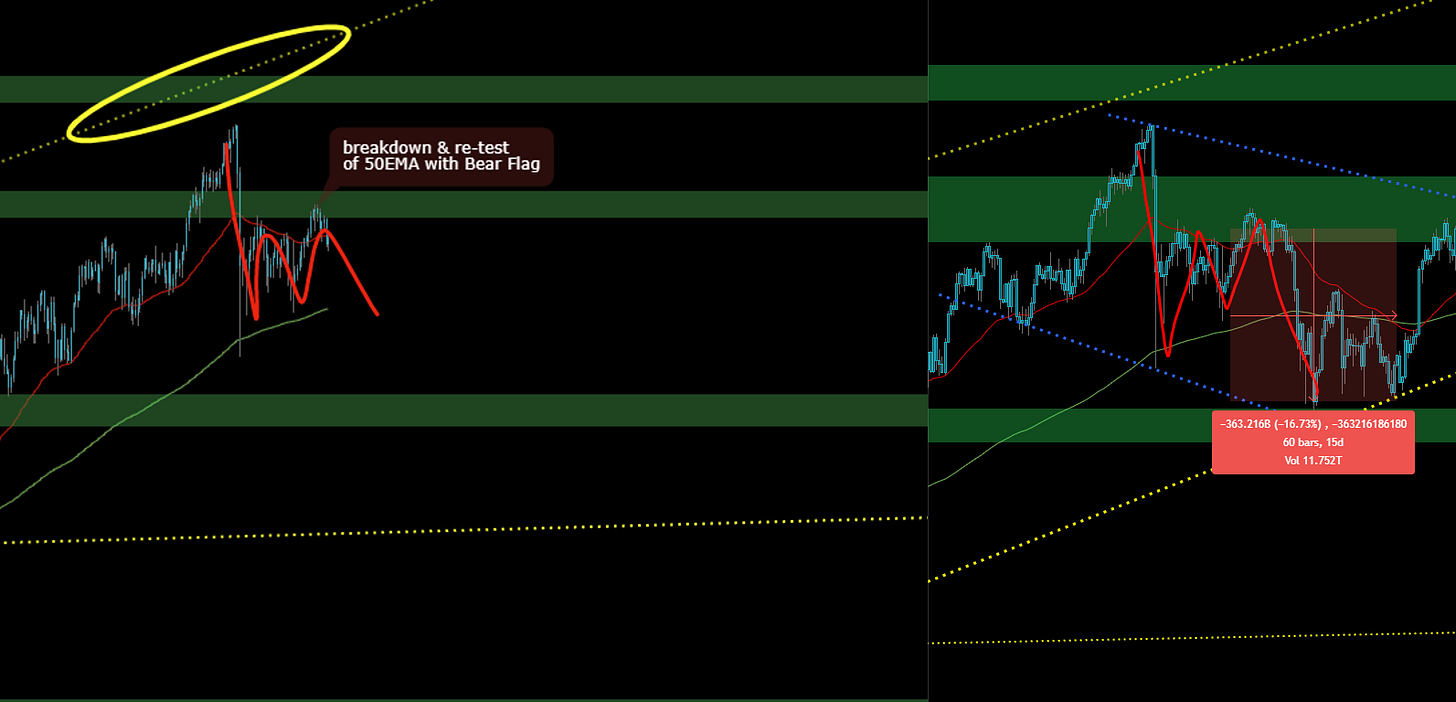

Total Market Cap

Throughout the course of 2021, I started to utilize Total Market Cap more and more in my crypto analysis. I feel it gives a great overview of the market sentiment all on one chart. I used it comparatively, for analysis of sentiment, as well as confluence for positions on other charts; I also ended up doing some TA on Total MC itself, and had some pretty solid calls. Here they were:

I said we’d see a significant catalyst & rejection from 2.5T area ^

Result? 46% drop. See below ∨

From there, I forecast a Bear Flag and a likely break down, on the 2nd equal high. Result? Another 33% drop. See below ∨

After this flag played out, price trickled down slowly, with little volume. I called a reversal, but was wrong on where it would take off from (I expected a 3rd touch on the lower boundary of a Wedge I was watching, which you can see in my SS below). My next call on a local high was again flawless, however:

Another Bear Flag was pointed out, which evolved into a Bull Flag over a period of almost 40 days, but the flag I pointed out still resulted in another 17% drop:

Lastly, when that Bull Flag broke long, I called a mini Bull Flag for price to re-test resistance-turned-support before the next run up. This too was flawless, and took off EXACTLY where I pointed out that it should. It ran up to the next catalyst I had outlined for all my readers well in advance:

In summary, the strike-rate on calling overall market-sentiment in advance was very good in 2021 AotC episodes.

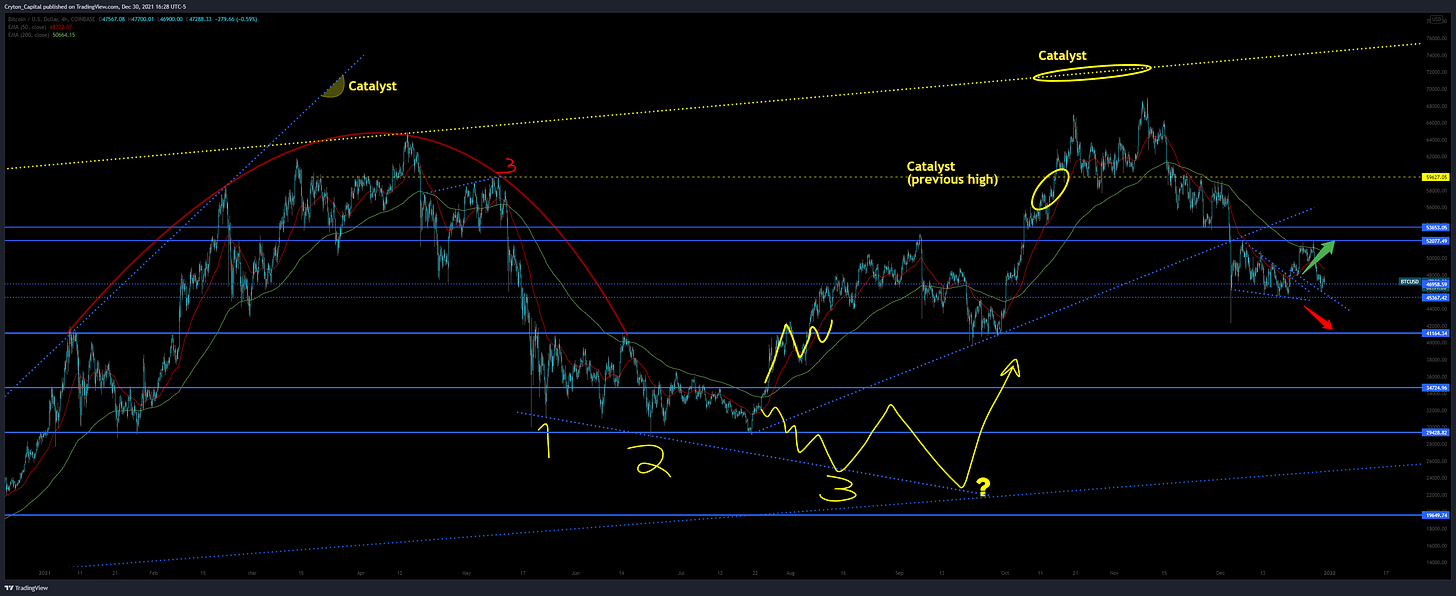

BTCUSD

Unfortunately my BTC calls this year weren’t nearly as good as last year. Here is a one-image summary of all the major turning-points I was watching for, but price seemed to dodge them frequently:

We never got the 3rd touch I was watching for here:

I did call this Rounded-Top formation early, which I said would lead to a mini Bear Market if it completed, which it did, resulting in a 48% drop (5-19-2021 through 7-25-2021). The Flag I had outlined never fully developed and it just broke down early, but the analysis was solid regardless:

My only other good call on BTCUSD this year was when I called this Wedge scenario one-of-two ways. It followed my “if long” theory perfectly:

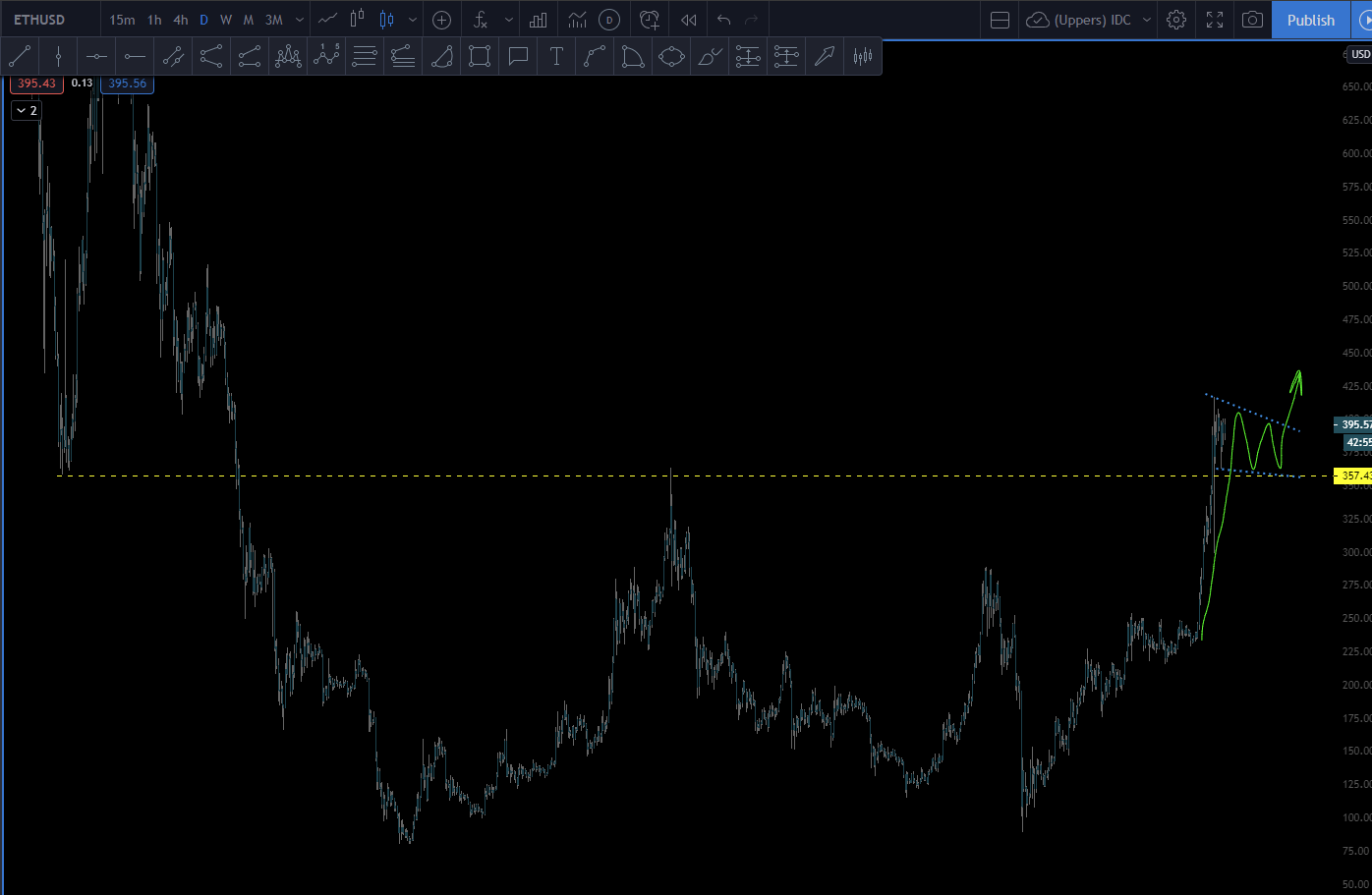

ETHUSD

At the tail end of last year when AotC was still on Voice, I made a legendary ETH call that price would break & re-test previous local high as new support before running up hard. It performed flawlessly.

The call:

The result ∨

From there, I banked on another flag re-testing the previous ATH of $1595 as new support. This too happened, although the flag was sloppy:

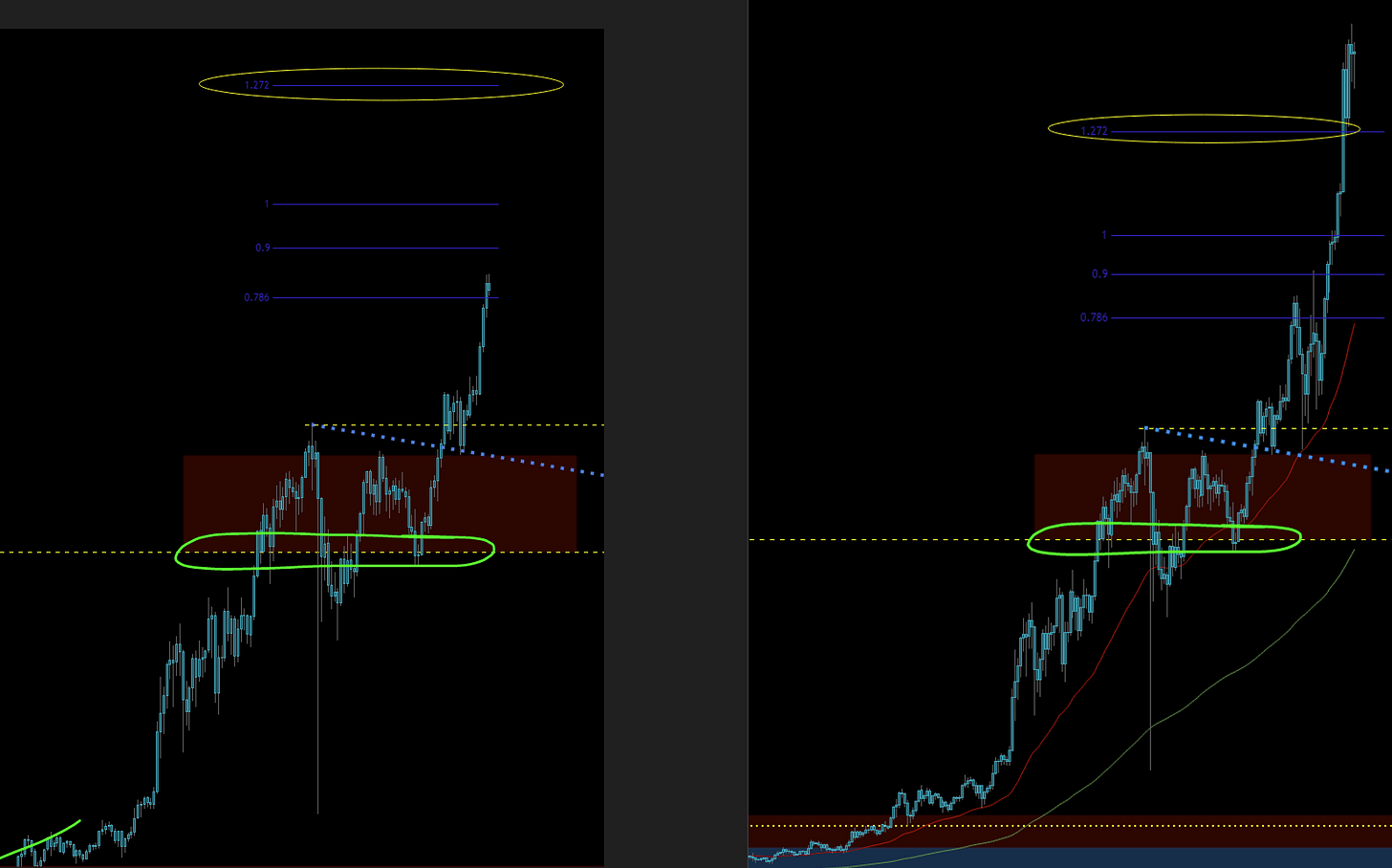

Here, I was betting on 1.272 Fib Extension level being the best spot for profit-taking, and I took my entire position off the table as soon as this was achieved:

I didn’t have too many other predictions on ETH within AotC as I was out of it in my personal portfolio, but did start to make some calls again toward the end of the year. In the end of July, I expected a Bull Flag re-testing EMAs & Support in "Risk Off > Risk On”, but we never fully got it - price banged the EMAs once, then ran hard before getting the chance to touch support:

Next call was a Wedge Break, which was flawless, but it didn’t achieve my target unfortunately, and rapidly returned to the break-point:

Last but not least, another fairly minor call was an Inverse H&S pattern that played out pretty well, but we never fully got the right-shoulder of the pattern, so I never got on-board:

LTCUSD

LTC has plagued me for some time in it’s inability to track according to plan, but I did have some good calls on LTC throughout the year regardless. Here’s the summary:

In April’s episode, I outlined that we would likely get another rejection of what I called a “retaining wall” before moving higher. We got it. And we didn’t just “sorta” get it… it literally couldn’t have followed my line any more closely…

If you think that’s good, check this call in my “Trade setup: LTCUSD Long” special release that I sent out to my readers the second I spotted it:

Unfortunately, after LTC dropped 47% in 24h, it all came crashing down in May’s “Black Wednesday” where I had my first-and-only liquidation of my 9 year trading career.

LUNAUSD

LUNA with it’s elastic supply, is even harder to chart than LTC. It’s constantly taking unexpected twists and turns that catch us TA folks off our guard. I had lots of “nothing burger” calls where predicted setups just fizzled out and would have been break-even or small profit / small loss results.

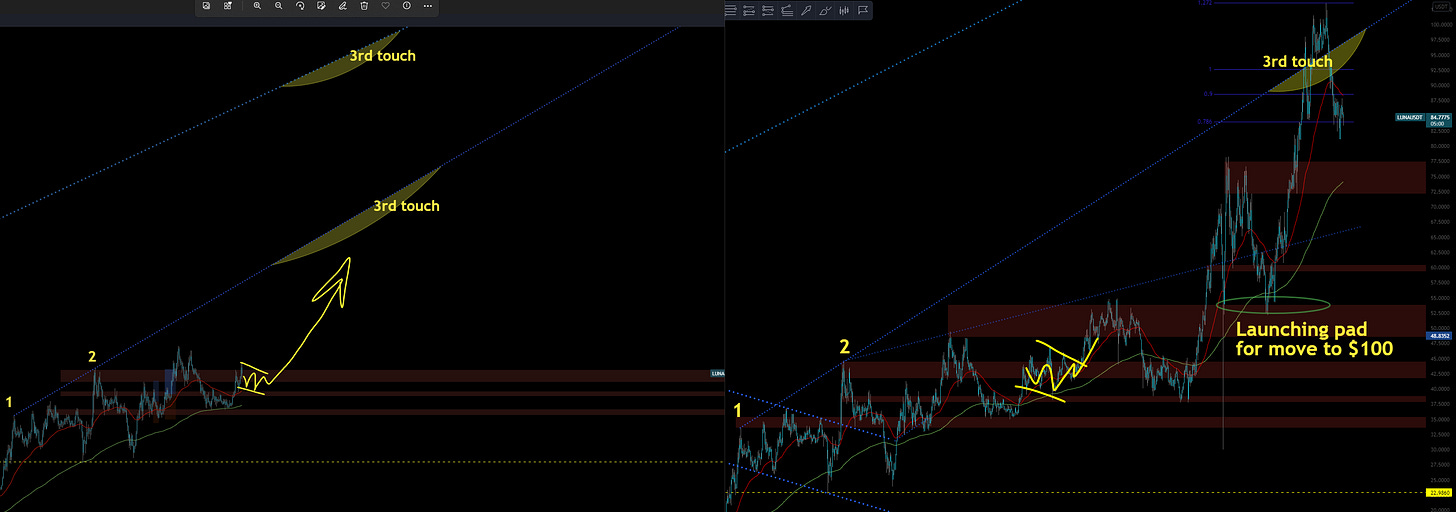

The best call of the year was the move from $40 to $100:

Of course there was 2 months of PA before it actually happened, but I knew $100 would be achieved this cycle no matter what, and it was. Price didn’t stop at my target, and continued up to kiss 1.272 Fib Ext. level, but now has pulled back about 15%.

RUNEUSD

I’ve been a huge believer in RUNE since I first found it, and I’ve been bringing lots of RUNE charts into my AotC episodes since then.

Here are 2021’s calls & predictions:

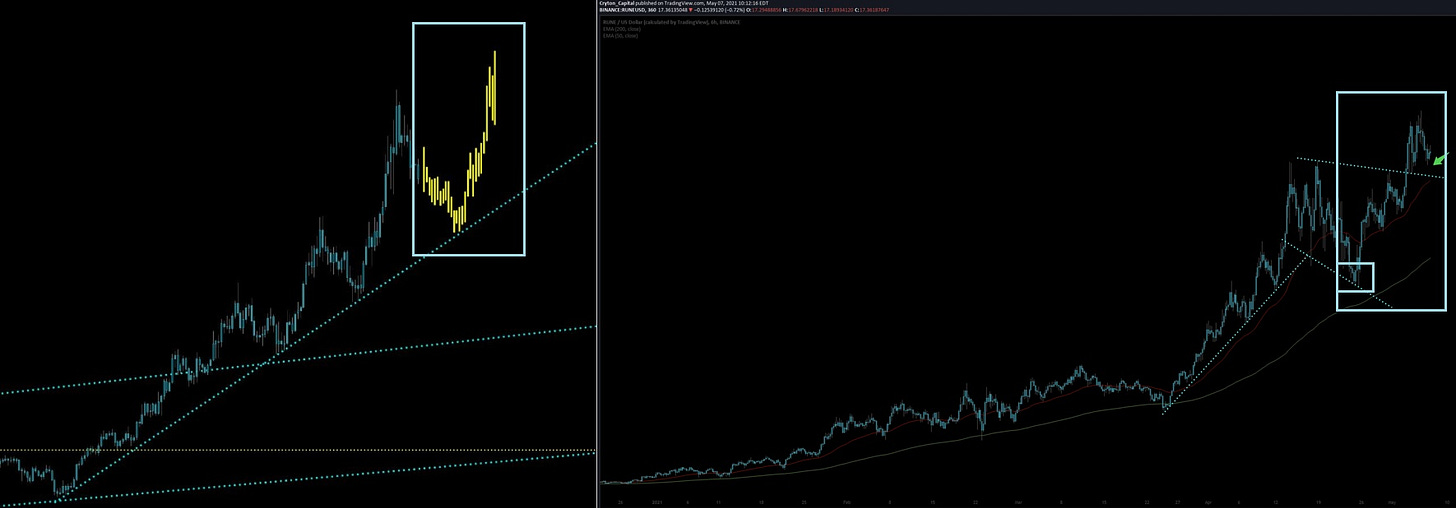

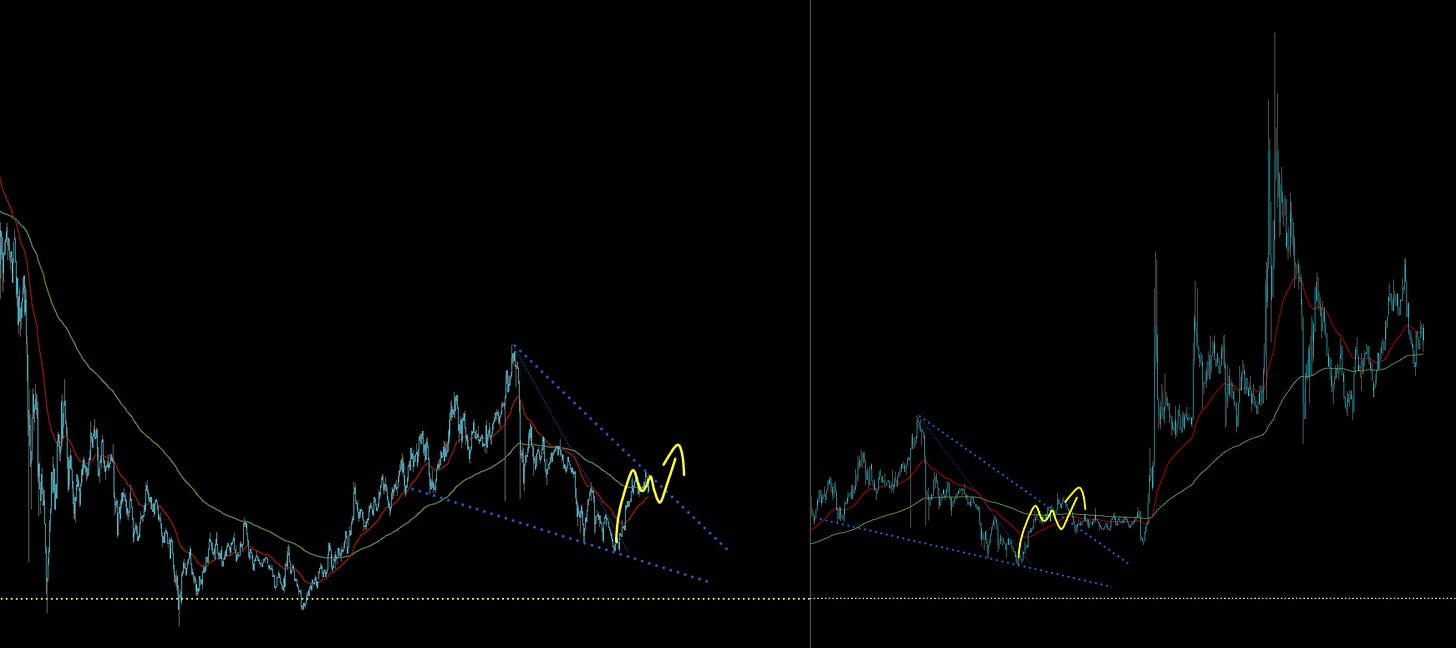

My first call was a re-test of this retaining wall on the way up, which was holding price. It played out as expected, with a brief fake-out break below the retaining wall (USTL) before continuing as outlined. I then removed the USTL completely and just evolved TA structure around the new piece of price action, which came in the form of an Expanding Wedge.

We had some good structure built the remainder of the way up to ATH, but yet again, didn’t anticipate the insane May 19th drop, so we ended up riding most of our position back down. Price action after the drop was unpredictable; a re-test of the underside of EMAs as new resistance post-drop was predictable, but lots of chop and a slow bleed otherwise. AotC did call some structure on the way down that played out quite well, and the clearest example of that is the screenshot above from the July 9th episode. It was a Bear Flag within the Descending Wedge, en-route to the 3rd touch on the bottom-boundary. The break of this Flag resulted in a 49% drop, so selling on first intraday candle-close over the Flag’s containing Phaseline would have saved a bundle. Here is my quote from this episode:

“You always want to approach the market from a place of strength. If you’re not feeling that strength with your current positioning, you need to move into a place of strength as fast as possible by identifying what is making you feel uneasy, and either cutting your loss, getting more cash on the sidelines, or re-distributing into alternative projects to help balance the risk.

Anyway, RUNE just completed a Bear Flag. It’s a full Flag / complete structure, too. Bearish. It looks very likely that we’re going down to the next-lower S/R zone (about $4.70).”

Next, we had another great call on the way back up:

A Bull Flag had completed, re-testing EMAs and an S/R zone as new support. Ended up seeing an 81% rally from this, as price surged to just shy of the 1.272 Fib Ext. take-profit area I’m so fond of. I took half my position off here.

Lastly, we had a final great RUNE call here in October 6th’s episode:

We saw a Descending Wedge with a triple-touch completed structure, then a move up Impulsively, and a re-test of the EMAs. As Bullish as it gets! I called a break of the entire structure, which played out almost flawlessly, except price went back for a quick re-test of a lower S/R slightly below the EMAs before breaking up; a flush of weak hands. We saw a rally of 94% based off this call, and that’s counting from the EMA re-test where my actual call was, not the lowest point (the aforementioned S/R re-test before it ran).

That wraps it up for RUNE!

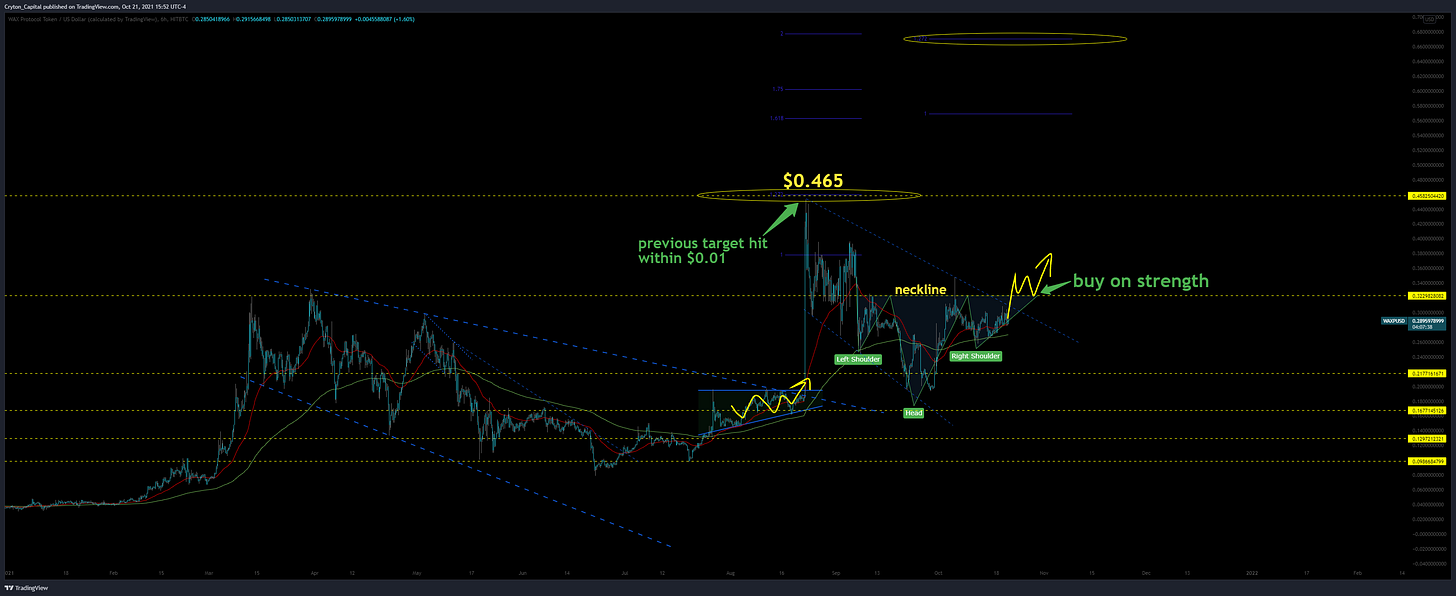

WAXPUSD

AotC had some of the best calls of the year on WAX.

I pointed out a good buy setup on WAX on 1-15-2021 while we were still on the Voice platform!

That resulted in a 600% run up to our take-profit:

From there, I had a bad call expecting a Wedge breakout in May’s episode. I then recommended a buy on strength - a break-and-retest of the upper boundary, which we never got either.

Regardless, I redeemed myself by calling a PERFECT break in August:

Not only did I call the breakout perfectly, I called the profit target perfectly.

As price then consolidated before I called, once more, ANOTHER perfect breakout:

The post:

The result, and as much of a summary as I could fit on one chart:

MATICUSD

We’ve been tracking MATIC here on AotC since it was $0.15, but haven’t had too many calls this year where I distinctly recommended a buy or a sell.

In my June episode, I said “This chart has yet to ‘return to the market mean’, …. I think this could pull back fairly heavily when the other flags market-wide break short causing more blood and fear. I would sell this and look to see how it moves in the coming week or two.” The result? 58% drop beyond where it already was:

Next up, we approached another fork in the road and price took the low road once more. Instead of going up for the pattern completion (3rd-touch on the upper boundary of the Flag), it just formed a mini intraday Double-top and dropped from there instead. Either way, I pointed my followers toward a line in the sand that hopefully helped them pick their position:

Another solid call was the inverse Head & Shoulders we got over the summer. I called for a re-test of the neckline before the move up but price chose to bounce from the 50EMA instead, and run from there. Either way, the call was good:

Lastly, in Escalator to the Moon, I placed 1 final trade on MATIC based on yet another Inverse Head & Shoulders pattern. It dipped one last time before ripping for the rest of the year:

IOTXUSD

We were tracking IOTX for some time in 2020 as it was one of my main calls for 2021 (I laid out 4 calls in my Christmas Special episode in 2020, as mentioned at the start of this episode). We were buying basically every re-test of a key support zone I had outlined on my IOTXUSD charts last Fall, and that worked brilliantly. Throughout 2021, I only made a few moves on this pair; here they are in a summary image:

Breakout was early (never got the 3rd touch on the red S/R zone that I expected, but we were frequently buying retests of that zone anyway, so it didn’t really matter), then we moved into the first flag. It broke as expected, ran long to first target, then started forming a Rising Wedge. I was buying every re-test of the lower boundary of the Wedge as it formed, then I weathered the dip from 4/8 through 4/26, and we finally moved to 2nd target which was clearly laid out for my followers (3rd touch, which you all likely know is my go-to PT by now).

My last buy of the year was here, June 24th; it turned out to be slightly early but resulted in additional massive gains regardless. Gains far beyond the 1,500% mentioned in my intro paragraph, as we were now compounding the gain from my first sale. We were tracking this trade very carefully:

(1) Trade taken here

(2) New price structure formed here

(3) Next entry opportunity , if first was missed

(4) Clean Impulse directly thereafter - 1st & 2nd trade in profit now

(5) Ultimate result

I sold most off on that 4th touch, but then we got not only a 4th touch (which is rare), but also a 5th touch on the same structure! IOTX has had a wild year, to put it mildly, and remains a project on my radar for 2022!

SHIBUSD

SHIB was another excellent call, and a tremendous windfall for anyone who bought in 2021. I only mentioned SHIB once this year, and it was in my August episode:

Took some time for that trade to work out, but did it ever! I took profits at previous ATH for about 5x:

SOLUSD

What results from this pair - another of my EoY 2020 picks for 2021!

Other than just holding, we started tracking SOL for active trading opportunities around July. We were looking at a Wedge formation then, and I was merely stating that we were going to bounce off either the lower boundary or the upper, and that we’d plan for the next trade accordingly. We got a bounce off the upper, a break of the upper boundary, a re-test of the EMAs post-break, and took it from there as a position:

I said the following about this SOL position, before it was even live:

“Solana…. What a legend. Look at the strength this coin has shown all through the last 60-90 day pullback. Incredible! Unfortunately, that means there hasn’t been much opportunity to buy ‘at value’, or what we perceive to be value anyway. Here I’m looking for a buy on first re-test of the EMAs and this nice SR at $37.13. As usual, if this goes to $150 ea, we’d have seen this area as value regardless…”

And so it did…

Oh, you thought that was it for SOL? Sorry, no. We actually took 3 trades beyond the first:

Summary:

We don’t miss here on AotC!

CROUSD

I only touched on CRO once this year - I recommended buying the first re-test of the 200EMA after a nice break of a fairly obvious S/R line at $0.139:

We didn’t get that re-test for about 10 days after I said to keep an eye out for it, but if anyone was patient and waited for the call to become reality, then bought, this would have been the result (to previous high, not to mention where it’s at now).

GRTUSD

As we come to a close, another great call this year was on GRT. I tossed in some arrows as to what I expected price to do next and voila: it couldn’t have followed them any more accurately!

Unfortunately I didn’t capitalize on these GRT trades as I was caught up in other positions and didn’t have enough free capital. They were tremendous calls though, and congrats to anyone who took them!

BATUSD

I only spoke on BAT twice in 2021. The first time was when we were still on the Voice platform, and was to point out that we were stuck in a range. The 2nd was to point out an excellent Wedge I saw taking shape that I wanted to make sure my followers were able to take advantage of. And here was the would-have-been trade + the result:

I did not personally capitalize on this one either, but wanted to make it known as I saw it unfold.

SPELLUSD

Last but definitely not least, SPELL! I called SPELL back on Aug 26th, at $0.00155 and had enough conviction to buy into it with 30% of my portfolio. Here is an excerpt from my August episode:

I then shilled it once more at $0.002, citing it as “still a good buy”:

And lastly, I shilled a massive Wedge breakout as yet another good opportunity to buy:

The results of all 3?

I even called the exact form an Inverse H&S would take, as it was still forming the head!

Summary:

So there you have it. I’m not sure what else I could say to convince you: this newsletter, for free, is pretty damn good…

Whether you follow me to get confirmation for your own bias, to assist in drumming up new trade ideas, to copy-trade (please don’t), or to find out about new promising cryptos, I’m here to assist…

In 2022, I hope to further my product by providing some explanations for my methods, new narratives on crypto you may not have heard of yet, some TA lessons, and of course… some new killer calls & early trades!

Lets get it! 2022, we’re ready for you…

Disclaimer:

Cryton Capital is not a registered investment advisor, legal advisor, tax advisor, or broker/dealer. All investment / financial opinions expressed in any-and-all posts on this page, including screenshots & captions, are from the personal research and experience of the owner, and are intended to be interpreted as educational material only. Although best efforts are made to ensure that all financial charts and commentary are as up-to-date as possible, there may be times where price moves beyond key levels before the chart can be posted. Alas, this is part of the fast-paced financial sector and cannot be avoided. Also, occasionally unintended errors and/or misprints may occur.

Follow Me.

Learn how to earn…

Become part of our community.

Follow our socials.

Subscribe to our podcast.

Subscribe to this publication.

It’s free (for now)

Thanks for it all mate. Really enjoyed your articles all year and made a few great calls per your advice. Cheers!

Plenty of good information in this article...... Thanks!

I can't wait to see what happens over the next 6 to 12 month in crypto and will be keeping a close eye on all your articles going forward.

My tip for 2022 is Chintai (Chex).......Happy New Year!!